Murphy Oil Corporation (NYSE:MUR) delivered fourth-quarter 2017 earnings of 8 cents per share, surpassing the Zacks Consensus Estimate of 2 cents. Further, the figurewas significantly better than the year-ago quarter’s loss of 16 cents.

On a GAAP basis, net loss per share was $1.66, much wider than the loss of 37 cents a year ago.

Revenues

In the quarter under review, Murphy Oil’s revenues came in at $541.6 million, missing the Zacks Consensus Estimate of $573 million by 5.5%. Moreover, revenues increased 7.1% on a year-over-year basis.

Quarterly Highlights

Murphy Oil produced 168,339 barrels of oil equivalent per day (BOE/d) in the fourth quarter, compared with 167,719 BOE/d in the prior year. It sold 164,201 BOE/d during the fourth quarter compared with 168,679 BOE/d in the prior-year quarter.

The company continued to emphasize cost control during 2017, achieving a full year lease operating expense (excluding synthetic oil operations) of $7.89 per BOE flat with 2016. In addition, full year 2017 selling and general expenses were $223 million, a 16% reduction from the level in 2016.

With continued emphasis oncost control during 2017, the company achieved competitive EBITDAX per barrel of oil equivalent over $22 in the fourth quarter. Further,it generated free cash flow from offshore assets near $120 million in the fourth quarter and over $500 million for 2017.

Murphy Oil increased onshore production by 16% quarter over quarter, excluding asset sales, driven by increased Kaybob Duvernay production of 31%, quarter over quarter.

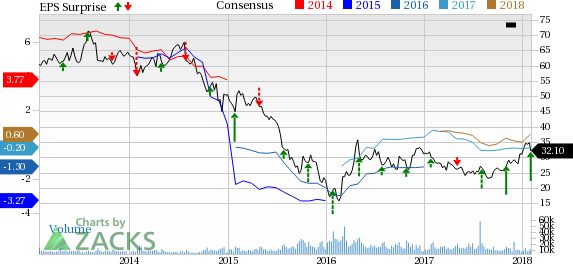

Murphy Oil Corporation Price, Consensus and EPS Surprise

Financial Condition

Murphy Oil had cash and cash equivalents of $965 million as of Dec 31, 2017, compared with $872.8 million as of Dec 31, 2016.

Long-term debt was $2,906.5 million as of Dec 31, 2017, compared with $2,422.8 million as of Dec 31, 2016.

Net cash from operating activities in the fourth quarter was $310.1 million, lower than $320.4 million in the year-ago quarter.

In the reported quarter, the company’s total capital expenditure was $274 million compared with $176.1 million in the year-ago quarter.

Guidance

Murphy Oil expects net production for first-quarter 2018 in the range of 164-168 thousand barrels of oil equivalent per day (Mboepd) with full-year 2018 production to be in the range of 166-170 Mboepd. The company estimates total exploration expenses of $30 million in first-quarter 2018.

The company expects full year 2018 capital expenditure budget of $1,056 million.

Upcoming Releases

Anadarko Petroleum Corporation (NYSE:APC) is scheduled to report fourth-quarter 2017 on Feb 6. The Zacks Consensus Estimate for the quarter is pegged at a cent per share.

TotalFinaElf, S.A. (NYSE:TOT) is scheduled to report fourth-quarter 2017 on Feb 8. The Zacks Consensus Estimate for the quarter is pegged at $1.06 per share.

Occidental Petroleum Corporation (NYSE:OXY) is scheduled to report fourth-quarter 2017 on Feb 13. The Zacks Consensus Estimate for the quarter is pegged at 38 cents.

Zacks Rank

Murphy Oil currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

TotalFinaElf, S.A. (TOT): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

Murphy Oil Corporation (MUR): Free Stock Analysis Report

Original post

Zacks Investment Research