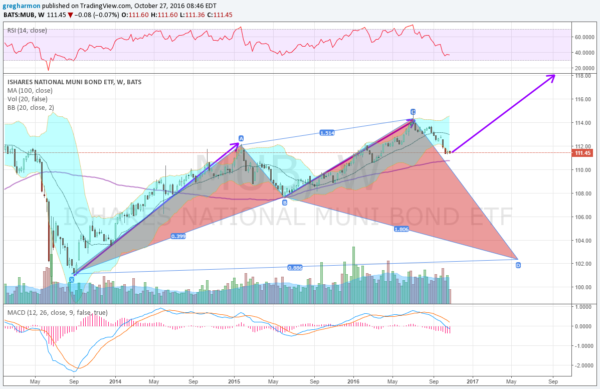

Municipal Bonds (via iShares National AMT-Free Muni Bond (NYSE:MUB)) have tended to follow the same path as other debt instruments. When the Treasury and Taxable debt world start to break down though the call to keep municipal bonds for tax purposes strengthens. Can they really be a good investment all of the time? Maybe. But without regard to the tax implications, the prices of municipal bonds are sitting at a critical juncture. The chart below explains.

After a strong run higher from mid 2013 until the end of 2014 they started to fall back. But it was a short lived decline and in May 2015 they started back higher again. That run ended with a Shooting Star reversal candle the Fourth of July week in 2016. It has been falling since then. Will the fall continue or is it over and a new run higher about to begin?

There are 3 things to watch in the chart that can help determine this and where municipals might end up. First is the 100 week SMA. This moving average sitting just below halted the last decline at the lower Bollinger Band®. With price at the Bollinger Band now watch to see if the 100 week SMA holds as support.

Next is the RSI. It has been falling and is now technically into bearish territory. Continuation would suggest more downside, but with it at a lower low and price at a higher low, there is a Positive RSI Reversal setting up. If confirmed this would suggest new highs to come and a target of 118. Next is the Shark harmonic pattern in play. It will not be confirmed until a move under 107, a long way off, but would then give a target to the Potential Reversal Zone (PRZ) at 102.40.