As we cruise into the last two weeks of the year, it is instructive to note the sea change in the municipal-bond market in 2014. The beginning of 2014 saw long tax-free bonds of the highest grade at over 4% and many bonds in the AA and A category at well over 5%. As we finish the year, the AAA scale for 30-year paper is at a 2.90, and most AA and A-rated longer-term bonds are in the mid to high 3% levels.

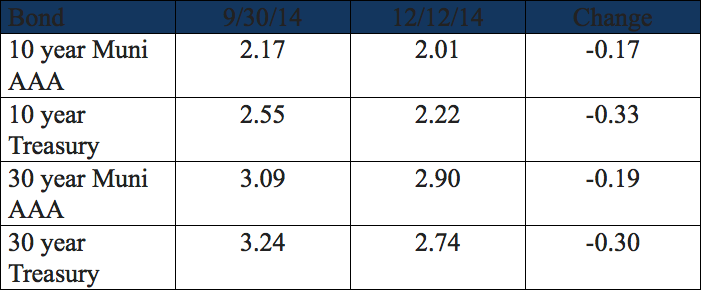

The fourth quarter of 2014 has seen a lowering of yield in sympathy with the drop in US Treasury yields. But munis have not kept up with the drop in Treasuries.

The main reason that municipals did not keep up was the big boost in issuance we have seen this quarter. We wrote about this a few weeks ago.

Below is a chart showing the Bond Buyer 30-day Visible Supply – a measure of the municipal bond calendar going out 30 days. The beginning of 2014 saw muted supply, since issuers with flexibility were not issuing bonds with bond yields near 5%. As the year went on and yields came down, there was clearly more volatility in the supply of bonds but also a steadily rising quantity of bonds, with the end of the year seeing huge numbers of bonds issued for refunding purposes. At the end of the first quarter of 2014, issuance was running roughly 33% behind issuance for the first quarter of 2013 (a factor helping to drive down muni yields), but by the end of the year we will be 2-3% ahead of last year’s issuance. And as we previously wrote (see above link), this has made longer munis very attractive again in our opinion.

Source: Bloomberg

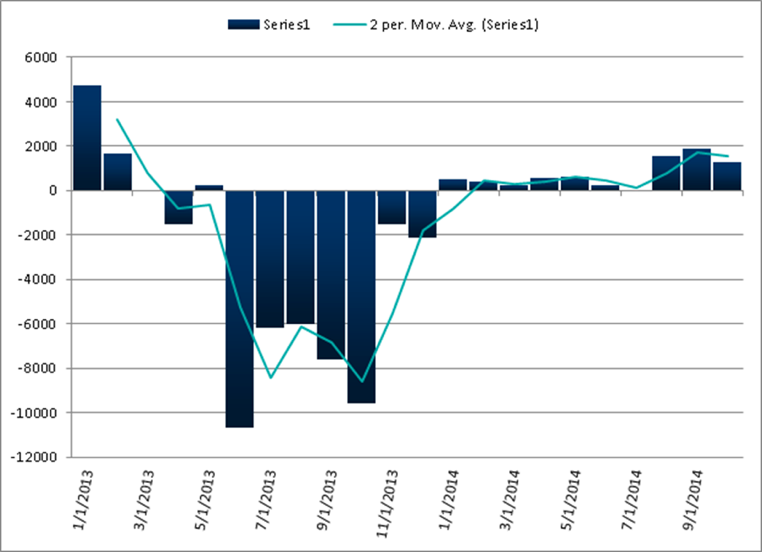

A resumption of bond fund flows this year has also aided the muni market. As you can see in the charts below, the massive outflows witnessed in 2013 because of the “taper tantrum” and the retail selling of bond funds were not reversed, but the slow and steady inflows of 2014 have helped.

Municipal Bond Fund Flow

Source: Lipper

Municipal credit continued to improve in 2014. Apart from the well-known problems in Puerto Rico and Detroit (which exited bankruptcy this fall), the overall story on municipal credit is quite good, with overall receipts rising and property tax receipts in particular continuing to rise as the real estate market has continued to rebound from the depths it experienced during the Great Recession. Overall, municipalities added net new hires in 2013, and this continued in 2014.

We also feel that retail investors finally recognized the impact of the higher marginal tax rates that went into effect at the beginning of 2013. The top marginal rate for federal tax purposes went from 35% to 39.6%. On top of that was the Obamacare tax of 3.8% that applies to interest income on families earning $250k or more. That means that the top rate is now 43.4%, versus 35% at the end of 2012. It also means that at the highest marginal rate, the taxable equivalent yield for a 4% tax-free yield, went from 6.15% to 7.06%.

We believe most investors did not realize the impact of the new marginal rates until this year. One reason for their lagging response was the bond fund meltdown’s dominating the headlines of summer 2013. But people generally do not adjust to changes in taxation until two or three quarters after those changes take effect. Certainly, as people began to prepare their 2013 taxes last March and April, the full impact of these higher taxes became clear, and the demand for tax-free bonds began to increase.

So as we close 2014, the longer end of the tax-free bond market offers considerable value vis-à-vis US Treasuries. We believe the current supply glut offers some opportunity, and higher-coupon cushion bonds offer value relative to their duration. We believe that – short of an economic slump – municipalities should continue to improve credit-wise and longer-dated munis should return to closer to 100% ratios or lower later in 2015 as the Federal Reserve’s tapering is concluded and as some normalcy returns to the Fed’s interest-rate cycle.

John Mousseau, CFA, Executive Vice President & Director of Fixed Income.