Investing.com’s stocks of the week

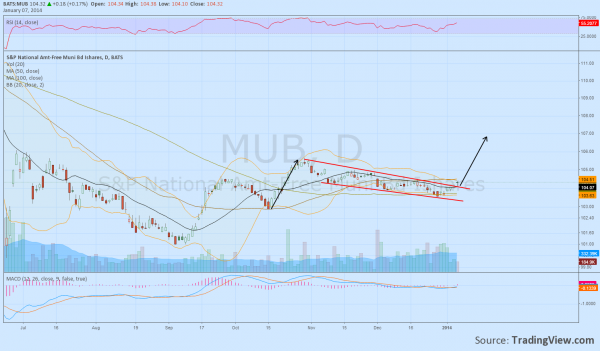

The last time we looked at the Municipal bond market was back in June, and it played well for a bounce off the lows. But since then it has moved sideways in a tightening consolidation. The last 2 months have played out a falling wedge until Monday. That is when it popped above the wedge and over the 20 day SMA. If it closes above it Tuesday it will be the first time that it has closed over the 20 SMA for two days in a row since November 7th. The Measured Move higher suggests a target of about 107 to the upside in short order. But the Bollinger bands are not opening so a failure and move back into the wedge is not out of the question. If I were to play this I might buy with a stop just under the wedge, about 104.

Assuming an entry near the close at 104.32 that risks 32 cents. A looser position might use a stop under the wedge at 103.50 and I could accept that but would be more inclined to use the lower stop when the price is at the bottom of the wedge, not the top. 32 cents allows for a rather large position on a 100,000 account where you allow your loss to reach 1% or even 2% of your portfolio. More than you will be given in margin. Let your diversification rules dictate your size in this one. But don’t let that allow you to cheat on the stop by making it lower. The level is the level and below it you are wrong and need to get out. No holding and hoping in my world.