A Market in Transition?

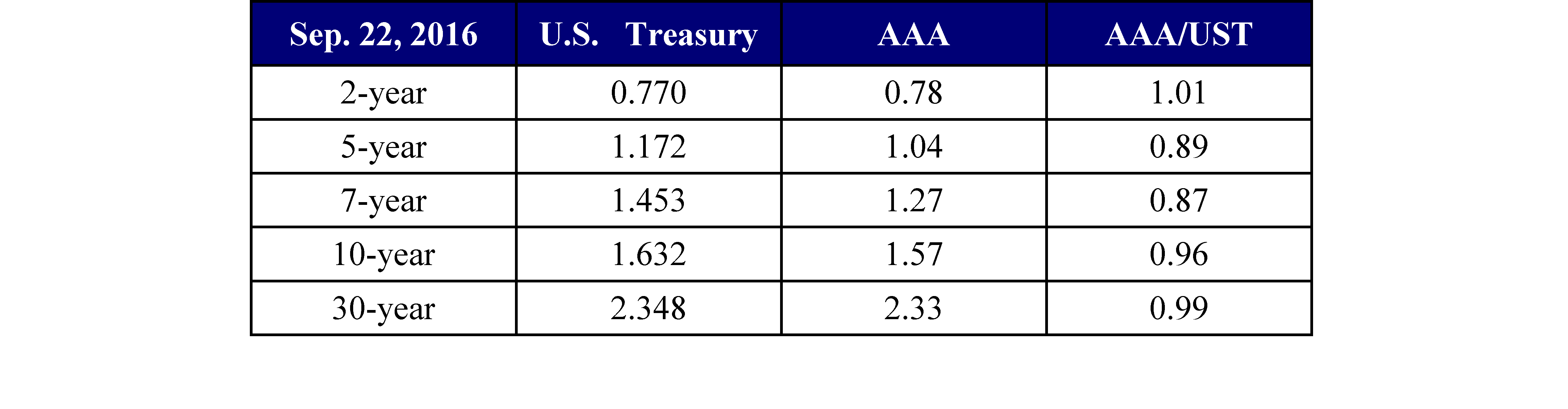

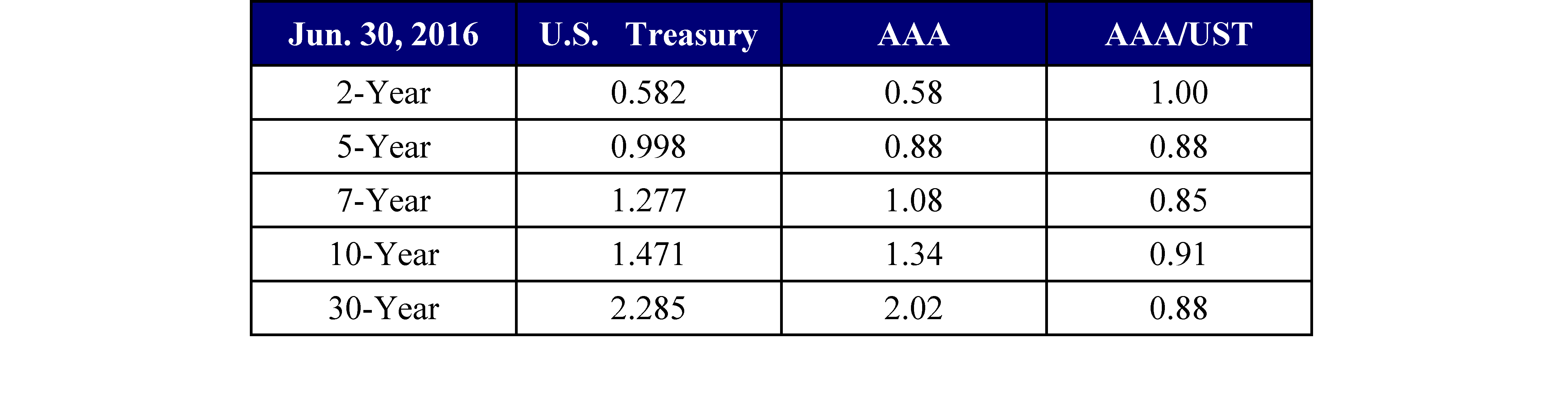

The municipal bond market finally slowed down during 3Q2016, as shown in Tables 1 and 2.

The muni market cheapened on both a nominal and a relative basis. Why?

Some of this backup has been caused by the drift up in yields since the post-Brexit lows were reached in late June. To refresh people’s memories, the 10-year and 30-year US Treasury bonds galloped to lower yield levels after the Brexit vote. The 10-year US Treasury yield dropped from 1.75% to 1.35% within a couple weeks post-Brexit. The 30-year US Treasury yield moved from 2.55% to 2.10%. From those low points, the market has backed up somewhat in a series of fits and starts, with the 10-year getting back to 1.73% and the 30-year back to 2.46% before moving somewhat lower as the Federal Reserve passed on raising the fed funds target in their September 20–21 meetings. Part of this backup in yields was the recognition that the post-Brexit reaction was overdone. There will be at least a couple of years before Brexit is completed.

The effect of Brexit on US interest rates has been muted. While there are some conflicting reports, many of the indicators we look at show an improving US economy. Unemployment rate continues to decline; initial jobless claims have decreased; labor participation rates have stabilized; headline inflation increased after its precipitous drop in early 2015 because of the drop in oil; and core CPI moved above 2% this year and stayed there. The University of Michigan Survey has maintained a reading above 90. And though the Federal Reserve held off on raising the target for fed funds on September 21, they made it clear they are looking to move in December if today’s conditions remain in place.

The big drop in interest rates post-Brexit also triggered another wave of supply of municipal bonds in the new-issue market. Many of these issues were to advance refund older, higher-coupon issues. With many other issues being called or maturing, the amount of net new issuance is small; but bond issues still have to clear the market. The Bond Buyer Visible Supply (dollar volume of bonds to be offered over the next 30 days) is shown in Figure 1. It has climbed since the start of the year and took a large jump post-Brexit. That jump put pressure on the market and cheapened tax-free bonds relative to Treasuries.

Short-term yields have also jumped in the muni market, more or less in concert with US Treasuries. We expect to see a continuing rise in short-term muni rates. Part of this is market consternation over a Federal Reserve that clearly seems poised to raise the target for fed funds. More important are some of the dysfunctional forces at work in the money market funds area. On October 14, 2016, money market funds will have to comply with reforms passed two years ago that will allow money market funds that invest in US government securities to maintain a net asset value (NAV) of 1. Other money market funds (including municipal) will have a fluctuating NAV. Given the low nominal level of short-term rates, most participants have opted for government money market funds. This has caused an outflow from municipal money market funds this year and has caused the rates on such instruments as municipal floating rate bonds (which have a short-term put agreement and have been a staple of municipal money market funds) to climb from 0.05% at the beginning of 2016 to 0.70% currently.

How does all of this affect Cumberland Advisors’ strategy? We began to shorten duration in total return accounts at the end of 1Q2016. We did so because of the drop in the nominal rate of intermediate and longer-term municipal bond yields, but also because the drop in the munis/Treasuries ratio – in other words, the mispricing of munis that was so prevalent in 2015’s supply bulge – started to correct.

We picked up the pace of shortening with the drop in yields post-Brexit. The extended rush into bonds after the Brexit vote gave us an opportunity to sell a number of long-term holdings at substantial profits and to further reduce durations on total return accounts. Our thought was that this type of inflection point is usually followed by a backup in yields, reflecting a reversion to the mean. This time was no exception.

Going forward, we expect the Federal Reserve to hike short-term interest rates in December 2016. Short-term yields should move up in anticipation of that hike. In addition, short-term instruments such as municipal floaters should offer decent value in the short end of the market as the money-market universe crosses the threshold of October 14. We are shortening duration by moving more paper to the shorter end of a “barbell” strategy. Longer paper will include premium bonds that we believe are good candidates to become prerefunded by their issuers. And of course, we remain vigilant on credit.