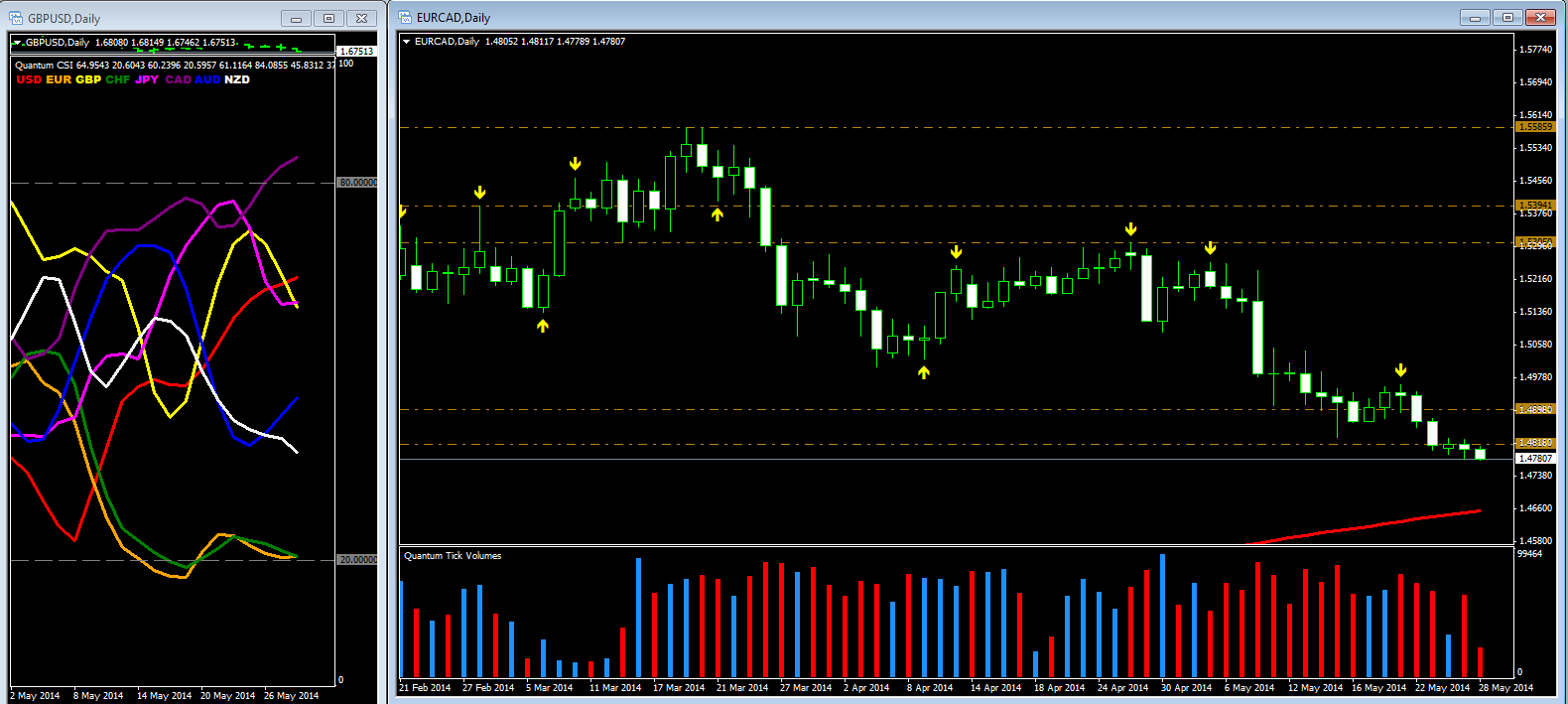

With end of month approaching and national holidays across most of Europe tomorrow (Ascension Day), this may a good time to look at alternative currencies which are reaching extreme overbought or oversold conditions. Examples include the Commodity Dollars, the Canadian in particular which is heavily overbought on the daily chart and on the faster time frames. Meanwhile the New Zealand Dollar is heading south and the Swiss Franc is bumping along the bottom.

Given the above, one pair to consider may be the EUR/CAD which has seen a modicum of buying in the past couple of days at the 1.4790 area and is now approaching the 200 MA. However, the pair has recently breached a support region at the 1.4818 region and is trading at time of writing at 1.4784. Ideally, what we want to see here is an increase in volumes representative of further buying with a move back first through the 1.4818 area, and preferably the second level of resistance at 1.4898. This should then provide a solid platform for a longer term upwards trend for this pair.