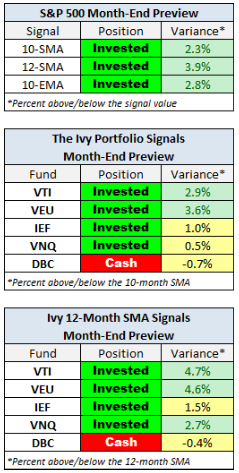

Here is a preview of the monthly moving averages I track on the last business day of the month. All three S&P 500 strategies are now signaling "invested" -- unchanged from last month. However, the one of the Ivy Portfolio ETFs, DBC (the PowerShares DB Commodity Index), is tentatively signaling a move to cash, a fractional 0.7% below the signal value. Also two of the other "invested" ETFs are within a percent of a signal.

Positions that are less than 2% from a signal are highlighted in yellow. In this month's preview, three carry the yellow alert.

Note: My inclusion of the S&P 500 index updates is intended to illustrate a popular moving moving-average timing strategy. The index signals also give a general sense of how US equities are behaving. However, for followers of a moving average strategy, the general practice is to make buy/sell decisions on the signals for each specific investment, not based on a broad index. Even if you're investing in a fund that tracks the S&P 500 (e.g., Vanguard's VFINX or the SPY ETF) the moving average signals for the funds will occasionally differ from the underlying index because of dividend reinvestment, which is not factored into the index closes.

The Ivy Portfolio

The second of the three adjacent tables above previews the 10-month SMA timing signals for the five asset classes highlighted in The Ivy Portfolio.

I've also included (third table) the 12-month SMA timing signals for the Ivy ETFs in response to the many requests I've received to include this slightly longer time frame.

After the end-of-month market close later today, I'll update the monthly moving average feature with charts to illustrate.

The bottom line, as I've pointed out earlier, is that these moving-average signals have a good track record for long-term gains while avoiding major losses. They're not fool-proof, but they essentially dodged the 2007-2009 bear and captured significant gains since the initial buy signals after the March 2009 low.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Moving Averages: Month-End Preview

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.