Motorola (NYSE:MSI) was downgraded by ValuEngine from a "buy" rating to a "hold" rating in a note issued to investors on Tuesday, MarketBeat.com reports.

MSI has been the subject of several other reports. Citigroup (NYSE:C) reissued a "buy" rating and issued a $102.00 price objective (up from $93.00) on shares of Motorola in a research report on Friday, May 5th. Cowen and Company reduced their price objective on Motorola Solutions from $77.00 to $75.00 and set a "market perform" rating for the company in a research report on Friday, May 5th.

Credit Suisse (SIX:CSGN) increased their price objective on Motorola from $90.00 to $95.00 and gave the company an "outperform" rating in a research report on Friday, May 5th.

Deutsche Bank (DE:DBKGn) increased their price objective on Motorola from $70.00 to $73.00 and gave the company a "hold" rating in a research report on Monday, May 8th.

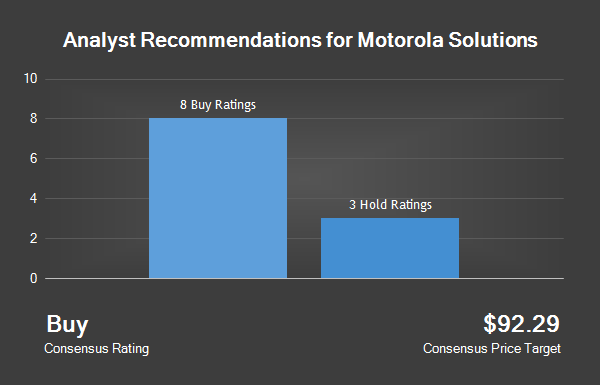

Finally, MKM Partners reaffirmed a "neutral" rating and issued a $83.00 target price (up from $76.00) on shares of Motorola in a research report on Monday, May 8th. Five research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. The stock has a consensus rating of "Buy" and an average price target of $92.85.

Motorola traded down 0.91% during midday trading on Tuesday, reaching $86.41. 1,275,808 shares of the company were exchanged. The firm's 50-day moving average price is $88.92 and its 200 day moving average price is $84.86. Motorola Solutions has a 52-week low of $71.24 and a 52-week high of $93.75. The stock has a market capitalization of $14.05 billion, a price-to-earnings ratio of 22.79 and a beta of 0.32.

Motorola last released its quarterly earnings data on Thursday, August 3rd. The communications equipment provider reported $1.06 EPS for the quarter, topping analysts' consensus estimates of $0.99 by $0.07. Motorola Solutions had a negative return on equity of 93.44% and a net margin of 10.38%. The firm had revenue of $1.50 billion for the quarter, compared to the consensus estimate of $1.46 billion. During the same quarter in the prior year, the company posted $1.03 earnings per share. The firm's revenue was up 4.7% on a year-over-year basis. Equities analysts predict that Motorola Solutions will post $5.29 earnings per share for the current year.

In related news, EVP Eduardo F. Conrado sold 6,998 shares of the company's stock in a transaction on Tuesday, August 8th. The stock was sold at an average price of $89.13, for a total transaction of $623,731.74. Following the completion of the sale, the executive vice president now directly owns 22,858 shares in the company, valued at approximately $2,037,333.54.

The sale was disclosed in a filing with the SEC, which is available through this link. Also, EVP Bruce W. Brda sold 25,299 shares of the company's stock in a transaction on Monday, August 7th. The stock was sold at an average price of $89.11, for a total value of $2,254,393.89. Following the sale, the executive vice president now owns 23,829 shares of the company's stock, valued at $2,123,402.19. The disclosure for this sale can be found here. 2.50% of the stock is owned by corporate insiders.

Institutional investors have recently modified their holdings of the company. Vanguard Group Inc. boosted its position in shares of Motorola by 1.6% in the second quarter. Vanguard Group now owns 16,290,817 shares of the communications equipment provider's stock worth $1,413,066,000 after buying an additional 254,399 shares during the last quarter. Lazard Asset Management LLC boosted its position in shares of Motorola by 6.7% in the second quarter. Lazard Asset Management now owns 9,589,218 shares of the communications equipment provider's stock worth $831,768,000 after buying an additional 600,229 shares during the last quarter.

State Street (NYSE:STT) boosted its position in shares of Motorola by 1.8% in the second quarter. State Street Corp now owns 7,734,797 shares of the communications equipment provider's stock worth $670,905,000 after buying an additional 135,926 shares during the last quarter

. Parnassus Investments boosted its position in shares of Motorola by 3.6% in the first quarter. Parnassus Investments now owns 7,319,437 shares of the communications equipment provider's stock worth $614,408,000 after buying an additional 256,152 shares during the last quarter.

Finally, Neuberger Berman Group boosted its position in shares of Motorola by 2.1% in the second quarter. Neuberger Berman Group now owns 5,458,346 shares of the communications equipment provider's stock worth $473,457,000 after buying an additional 110,330 shares during the last quarter. 87.62% of the stock is owned by institutional investors and hedge funds.

About Motorola Solutions

Motorola Solutions, Inc is a provider of communication infrastructure, devices, accessories, software and services. The Company operates through two segments: Products and Services. The Company's Products segment offers a portfolio of infrastructure, devices, accessories and software. The Products segment has two product lines: Devices and Systems.

To view ValuEngine's full report, visit ValuEngine's official website.