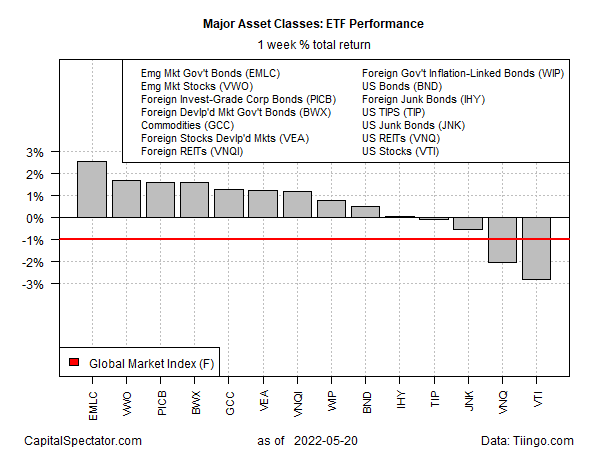

After weeks of widespread losses, markets around the world were mostly higher for the trading week through Friday, May 20, based on a set of ETFs. The main exceptions: stocks and real estate investment trusts in the US, which posted substantial weekly declines.

The strongest gain for the major asset classes last week: government bonds in emerging markets. After six straight weeks of loss, VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC) rose sharply, gaining 2.6%.

Despite the upside reversal, it’s not obvious that the fund’s bearish trend has run its course, based on a price trend that still looks set for more downside risk.

Stocks in emerging markets were last week’s second-strongest gainer. Here, too, after six weeks of loss, Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) revived.

But the 1.7% rise still looks like noise in an ongoing correction.

Emerging economies are headed for “tough terrain” in the near term because of blowback from the Russia-Ukraine war, predicts Atsi Sheth, global head of strategy and research for Moody’s Investors Service via Reuters, which reports:

The Moody’s ratings agency “forecasts in a report that nearly 30% of rated non-financial companies in emerging markets would face ‘heightened credit risks’ in a worst-case scenario in which Russia’s invasion of Ukraine triggers a global recession and liquidity squeeze, including a suspension of energy trade between Europe and Russia.”

US stocks certainly endured rough terrain last week—again. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) shed 2.8% last week despite a heroic rally late in Friday’s session. The decline marks the seventh consecutive week of red ink for VTI.

US real estate fell nearly as much: Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) tumbled 2.0%, the fourth straight weekly slide.

The Global Market Index (GMI.F) fell for a seventh week, shedding 1.0%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

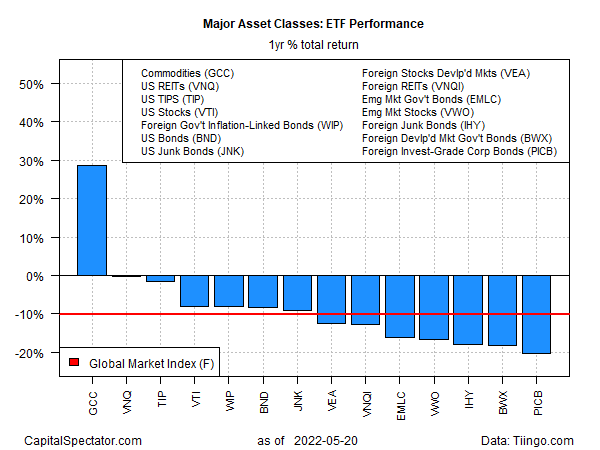

For the one-year return, broadly defined commodities via WisdomTree Continuous Commodity Index Fund (NYSE:GCC) are the only slice of the major asset classes with a positive change—by a huge margin: GCC is up nearly 30% over the past 12 months.

The biggest one-year loss for the major asset classes: Invesco International Corporate Bond ETF (NYSE:PICB), which is down roughly 20%.

GMI.F’s one-year loss: -10.2%.

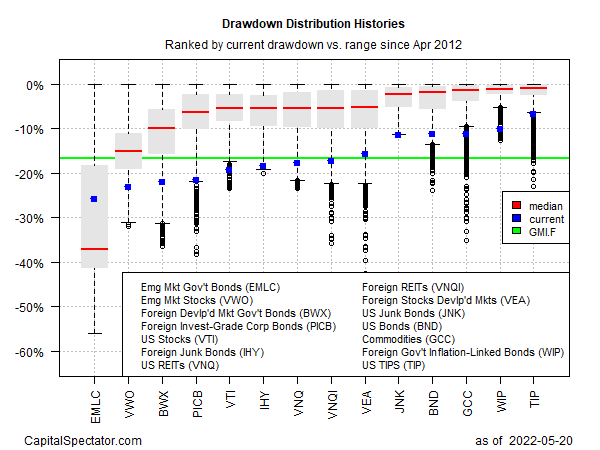

Drawdowns for the major asset classes range from moderate—roughly -7% for inflation-indexed Treasuries via iShares TIPS Bond ETF (NYSE:TIP)—to steep: nearly -26% for emerging markets government bonds via (EMLC).

GMI.F’s current drawdown: -16.6%.