Investing.com’s stocks of the week

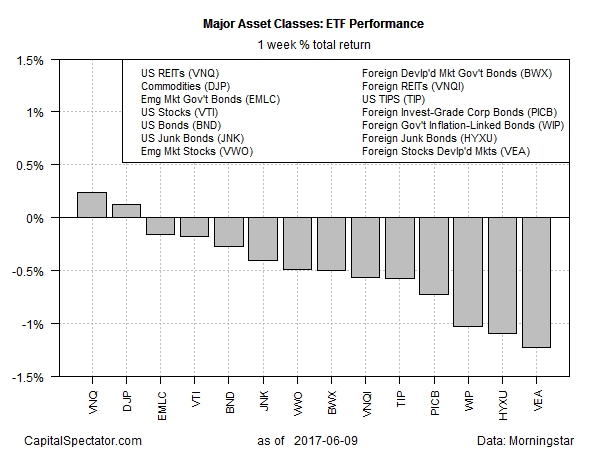

The first full week of trading in June took a bite out of most markets. Only US real estate investment trusts (REITs) and broadly defined commodities bucked the downward trend for the major asset classes last week, based on a set of representative exchange-traded products.

Vanguard REIT (NYSE:VNQ) posted the strongest performance for the week through June 9. The fund inched up 0.2%, marking VNQ’s fourth straight weekly advance.

The broadly defined commodities space was a close second. iPath Bloomberg Commodity (NYSE:DJP) edged up 0.1% last week. But the fractional gain barely registered: the exchange-traded note remained close to its lowest level of the year so far.

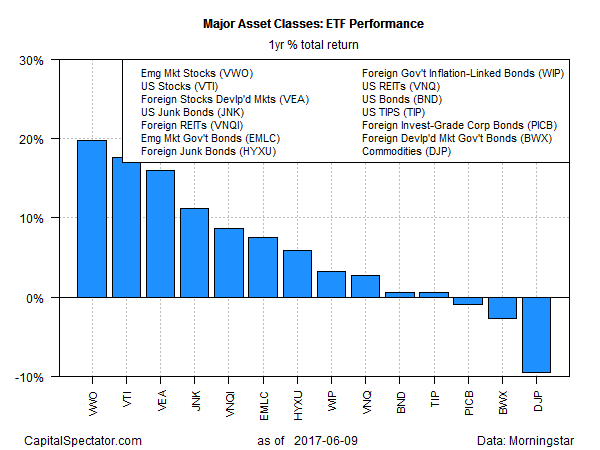

In the one-year column, solid gains continue to dominate, led by emerging-markets stocks. Vanguard FTSE Emerging Markets (NYSE:VWO) posted a strong 19.8% total return for the year through June 9, the best performance among the major asset classes for trailing one-year results.

Meanwhile, commodities remain dead last over the past 12 months. DJP is currently suffering with a 9.5% loss, the biggest one-year decline in more than a year.