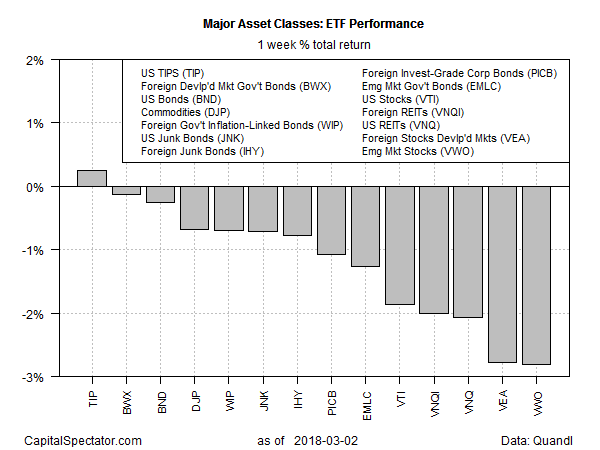

Last week’s trading ended in the red for all but one of the major asset classes, based on a set of exchange-traded products. US inflation-linked Treasuries edged higher over the five trading days through March 2, while losses weighed on everything else.

The iShares TIPS Bond (NYSE:TIP) ticked up 0.2% last week, an outlier gain vs. the downtrend that otherwise dominated last week’s trading. Buoyed by renewed expectations that inflation is firming, TIP edged up for a second week in a row.

Betting on inflation, as Bloomberg reports, “finally seems to be working.” The question is whether the trade has legs? Mohit Kumar, who oversees rates strategy at Credit Agricole in London, has doubts. “There are a number of structural factors out there which would subdue inflation. A flatter break-even curve tends to suggest the rise in inflation could be short-lived.”

Last week’s biggest decline among the major asset classes was in emerging markets stocks. Vanguard FTSE Emerging Markets (NYSE:VWO) fell 2.8%, the first weekly setback in three weeks.

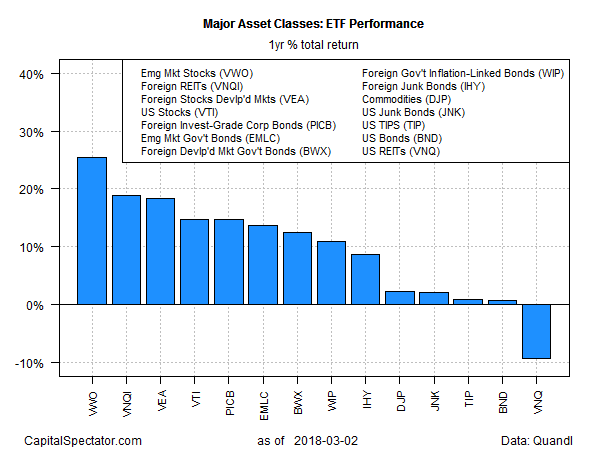

For the one-year trend, however, VWO continues to dominate. It posted a 25.5% total return over the trailing 12 months through Mar. 2. The gain reflects a healthy premium over the second-best one-year performer: foreign real estate viaVanguard Global ex-US Real Estate (NASDAQ:VNQI), which is ahead by 18.8% over the past year (252 trading days).

US real estate investment trusts are still posting the lone case of red ink for the one-year change. Vanguard Real Estate (NYSE:VNQ) was in the hole by 9.4% at Friday’s close vs. the year-earlier price after adjusting for payouts.