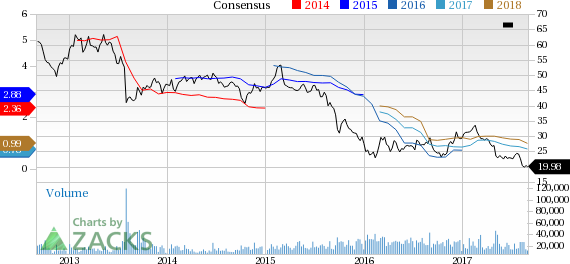

About a month has gone by since the last earnings report for Mosaic Company (NYSE:MOS) . Shares have lost about 12.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Mosaic's Earnings and Revenues Beat Estimates in Q2

Mosaic reported net income of $97.3 million or $0.28 per share in the second quarter of 2017, as against net loss of $10.2 million or $0.03 per share recorded a year ago.

Earnings, barring one-time items, were $0.29 per share that beat the Zacks Consensus Estimate of $0.25.

The company’s revenues rose roughly 4.8% year over year to $1,754.6 million in the reported quarter. The figure also topped the Zacks Consensus Estimate of $1,649.4 million. The company gained from strong global demand for phosphates and potash during the quarter.

Segment Highlights

Revenues from Mosaic’s Phosphates segment were flat year over year at $975 million in the second quarter of 2017, as lower prices of finished products offset higher sales volume. The segment’s gross margin declined to $76 million from $100 million a year ago, owing to higher ammonia costs and lower finished product selling prices, partly offset by reduced sulfur and phosphate rock costs.

Potash division’s sales rose around 2.4% year over year to $468 million in the quarter, driven by higher sales volume. Gross margin in the quarter was $110 million compared with $53 million reported a year ago. The improvement was mainly driven by lower cost of production as a result of lower plant spending and higher operating rates.

Revenues from the International Distribution segment went up around 9.2% year over year to $583 million owing to increased sales volumes, partly offset by lower selling prices. Gross margin was $39 million, compared with $5 million reported a year ago.

Financials

Mosaic’s cash and cash equivalents amounted to $660.6 million as of Jun 30, 2017, down around 37.6% year over year.

Long-term debt rose to $3,799.7 million as of Jun 30, 2017, from $3,772.6 million as of Jun 30, 2016.

Mosaic’s capital expenditures were $169 million in the reported quarter.

Operating cash flow was $243 million in the quarter, down 58.4% from $584 million in the year-ago quarter.

Outlook

Mosaic expects phosphates sales volumes in the band of 2.2–2.5 million tons for the third quarter of 2017 compared with 2.5 million tons for the same quarter in 2016. Average selling price, FOB plant, is expected to be in the range of $310–$330 per ton. The segment gross margin rate is expected to be in the band of 7–9%.

Potash sales volumes have been forecast in the range of 1.9–2.2 million tons for the third quarter, compared with 2.2 million tons in the prior year quarter. Average selling price, FOB plant, is expected in the band of $165–$180 per ton and the gross margin rate is anticipated to be in the band of 15–18%.

Total sales volumes for the International Distribution segment are expected to range from 2.3–2.6 million tons for the third quarter of 2017, compared with 2.2 million tons in the prior-year quarter. The segment gross margin is estimated to be in the low $20 per ton range.

The company now expects phosphates sales volumes in the range of 9.5 to 10 million tons for 2017, narrowed from 9.5 to 10.25 million tons expected earlier. It has also narrowed its potash sales volumes guidance to the range of 8.1 to 8.6 million tons from 8 to 8.75 million tons expected earlier. Moreover, Mosaic now sees International Distribution sales volumes in the range of 6.75 to 7.25 million tons, down from prior view of 7 to 7.5 million tons.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter.

VGM Scores

At this time, the stock has a nice Growth Score of B, though it is lagging a bit on the momentum front with a C. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for value and growth investors than momentum investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Mosaic Company (The) (MOS): Free Stock Analysis Report

Original post

Zacks Investment Research