US mortgages post a massive weekly decline since 2008 without any increase in demand from homeowners and potential buyers.

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac (OTC:FMCC), revealed that mortgage rates had taken their worst weekly decline since 2008. According to them, the average for a 30-year loan fell to 5.3%, the lowest in a month and down from 5.7% last week.

Furthermore, the report also revealed that the 30-year fixed-rate mortgage dropped by half a percent over the last two weeks. This fall of over 24 basis points has come amidst growing concerns about a potential recession.

Mortgage Demand Sinks Alongside Rates

While mortgage rates have declined, the demand for mortgages has also nosedived recently. According to reports from the Mortgage Bankers Association, total mortgage demand dropped 5.4% from one week ago. The new data considered this week’s holiday adjustments for early closings on the Friday before independence day.

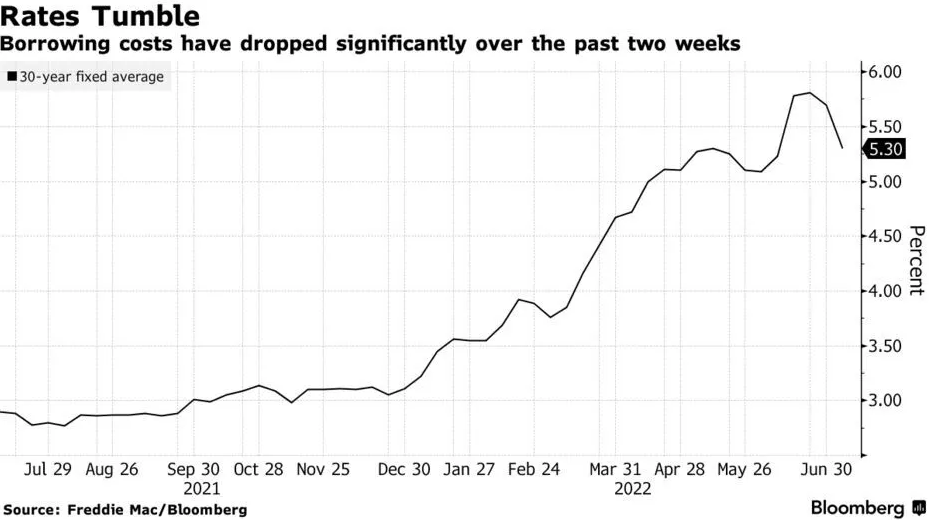

Source: Bloomberg

According to Freddie Mac, the steep rate increase that began to depress the US home market this year is starting to ease slightly for buyers. As seen above, mortgage rates trended within a very tight range between July 2021 and December 2021. However, the start of 2022 saw the rate break out and continue to climb, reaching nearly 6% before the recent slump.

Consequently, the steep rate increase has made more houses available, and homeowners have lowered their prices in some locations. Nonetheless, these have not caused any significant increase in the demand for these properties.

Speaking about the mortgage rate drop-off, Sam Khater, Freddie Mac’s chief economist, revealed he expects the housing markets to continue normalizing. He cited a likely slowdown of the US economy and low housing affordability as factors that would normalize the housing situation. He said,

“While the drop provides minor relief to buyers, the housing market will continue to normalize if home-price growth materially slows due to the combination of low housing affordability and an expected economic slowdown.”

According to Freddie Mac, the steep rate increase that began to depress the US home market this year is starting to ease slightly for buyers. As seen above, mortgage rates trended within a very tight range between July 2021 and December 2021. However, the start of 2022 saw the rate break out and continue to climb, reaching nearly 6% before the recent slump.

Consequently, the steep rate increase has made more houses available, and homeowners have lowered their prices in some locations. Nonetheless, these have not caused any significant increase in the demand for these properties.

Speaking about the mortgage rate drop-off, Sam Khater, Freddie Mac’s chief economist, revealed he expects the housing markets to continue normalizing. He cited a likely slowdown of the US economy and low housing affordability as factors that would normalize the housing situation. He said,

“While the drop provides minor relief to buyers, the housing market will continue to normalize if home-price growth materially slows due to the combination of low housing affordability and an expected economic slowdown.”

US Housing Market Cools Down Following Another Interest Rate Hike

With the Feds poised to hike interest rates by 50-75 basis points in July, investors are analyzing the possible effects on the housing markets. The Federal Reserve hopes to rein in galloping inflation by increasing its benchmark rates to slow down the economy.

The resultant effect of the Feds policy has been a lull in the housing market. According to reports, investor concerns are reflected in house loan refinancing applications which slumped 8% for the week. Compared to a year ago, it is down a whopping 78%. Also, from 30.3% last week, the refinance portion of mortgage activity fell to 29.6% of all applications.

Furthermore, home purchase applications decreased by 4% and 17% for the week and the year, respectively. However, Realtor.com, in its June housing report, Realtor.com revealed that the for-sale inventory was rebounding and increasing at its fastest annual pace ever. While up 18.7% year over year, there are still 53.2% fewer houses available compared with June 2019.

While increasing rates and recession worries have begun to temper the real estate market, Joel Berner, senior economist research analyst for Realtor.com, believes that the shift could be positive for potential buyers if trends continue. According to him, they may benefit from the boom in properties for sale and lock in a reduced monthly payment with mortgage rate stabilization.