Last week, markets fell as rising expectations of a tapering of stimulus from the Federal Reserve hit investor confidence. However, investors seem to want to have their cake and eat it too. Even as expectations of an earlier exit from quantitative easing rise, U.S. equity markets overnight hit new record highs. It appears that the logic is that if the Federal Reserve is confident enough to consider reducing stimulus then the U.S. economy must be doing very well. Let's all buy! The U.S. dollar continues to be the main beneficiary of the debate surrounding stimulus as it again rose against all its major trading counter-parts. EUR fell to as low as 1.2850 while USD/JPY opens the morning at 1.0220.

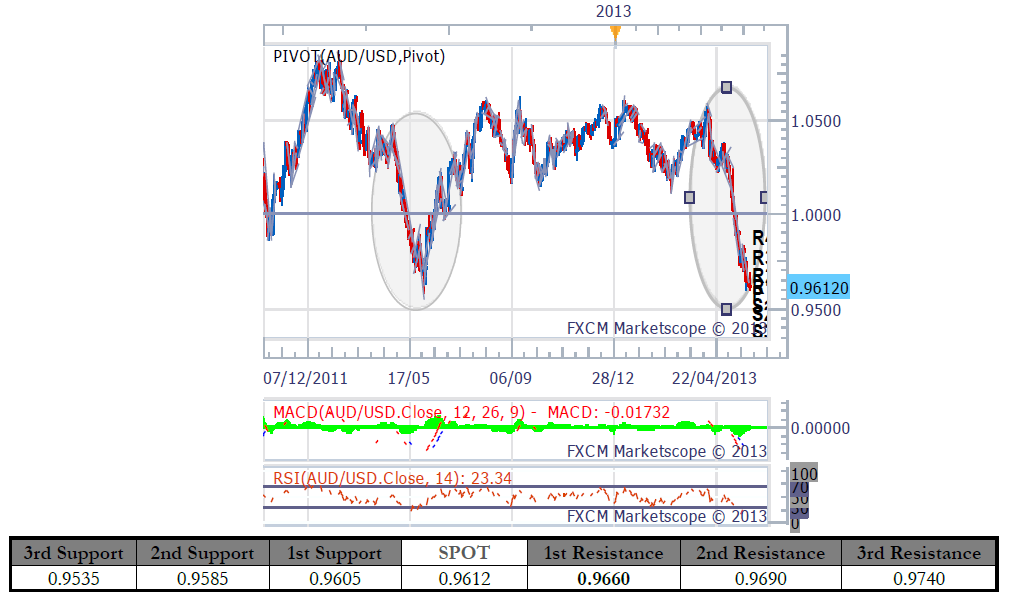

The Australian dollar continues to struggle under the weight of U.S. dollar strength and mounting concerns over Chinese growth prospects. Whilst we have been consistently bearish the Australian dollar and have maintained a price target of below parity even as the currency traded above 1.0500, we are now even surprised by the change in heart of a number of market commentators who not so long ago were calling the local unit to 1.3000 rather then 0.9500. The fact that there is now a de-cidedly bearish view on the Australian dollar across almost all of the usual suspects suggests to us that we are due for an ag-gressive short squeeze higher. The Australian dollar is struggling at 0.9620 this morning.

U.S. equity markets have gained after the Memorial Day public holiday with the Dow Jones Industrial Index gaining to an-other record high as consumer confidence rose to the highest levels since the global financial crisis and house prices gained by the largest margin in seven years. A broadening recovery in the U.S. is giving investors confidence that, even if the Feder-al Reserve cuts back stimulus, that the rally in U.S. equities will continue. The S&P 500 gained 0.63% to 1,660 as financial stocks such as State Street gained. Earlier in Europe, the DAX gained 1.16% while the FTSE surged 1.62%.

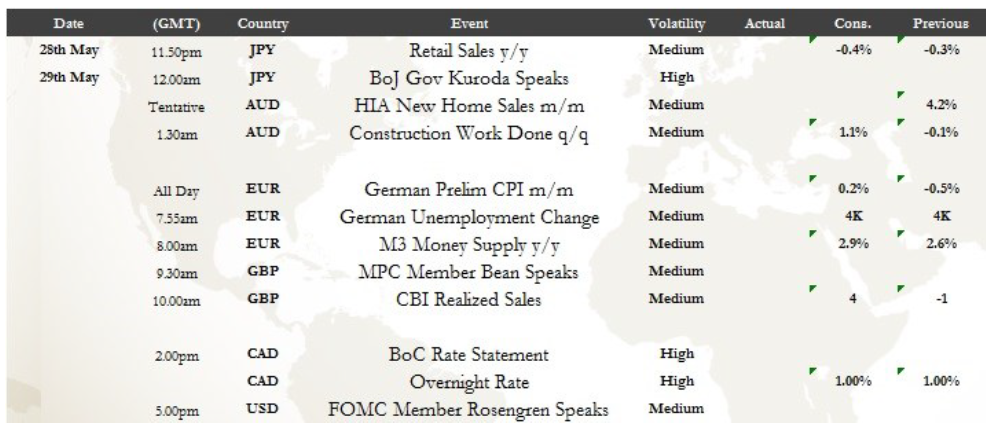

EUR/USD tanked just after the NY close yesterday as the market was looking for a shakeout and drive in the price below 1.2900 but with the market in a mix of lag from the US holiday and the nervousness about the next direction for the Euro and the USD the move could not extend or build solid momentum. Two attempts to break 1.2880 failed and the following recovery took the price to the earlier breakdown point of 1.2925. European bulls tried to take the price high but weaker than expected German data capped any idea of breaking 1.2950. However, the better than expected US data was to control the market with break down smashing through the 1.2880 support to hit our major support at 1.2850. Since the price has traded between 1.2950 and 1.2975. Over the next 24 hours there is some German data that should have an impact. Employment and CPI both are expected to be flat to slightly better. Will Euro lift we think so but not likely above 1.2920 for today.

Compass Direction

Short-Term Medium-Term

NEUTRAL NEUTRAL

AUD/USD traded similar to Monday with the price taking a leg lower during the morning session to break 0.9600 again and fail with little follow through momentum as we believe the bears are starting to get nervous about the direction the AUD will take over the next month or two. The reversal started to get double bottom momentum with the price jumping from 0.9620 to 0.9650 on bears covering and talk of a large M&A flow order. As the pair continued to climb even German Import data couldn’t slow the pace with AUD reaching just short of 0.9700 as the US morning approached. We looked set for a pattern like last Thursday but better than expected US data robbed the markets of a chance of a real clean out of the short to medium term bears. And now we have it opening Wednesday at 0.9612 having given up all of the gains. We are looking at the longer term picture on today’s chart and the pattern of this resent fall almost mirrors last years same move to the date and price. Everyone was a bear

on the bounce I don’t think we will this time.

Compass Direction

Short-Term Medium-Term

NEUTRAL NEUTRAL

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Morning Fundamentals: US Equity Markets Hit New Highs

Published 05/29/2013, 08:32 AM

Updated 07/09/2023, 06:31 AM

Morning Fundamentals: US Equity Markets Hit New Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.