GOLD has held up relatively well overnight given the strong show of support for tapering from the latest Federal Reserve Minutes and this is an extremely positive sign for the metal and we now expect the upward momentum to continue and to push gold above $1,400 within the next week. A few members had even expressed their view that tapering might be needed even sooner than expected. However, investors should not be too quick to rush into believing that tapering is inevitable this year. The language has not changed.

The economy must improve before tapering is considered and although 65% of economists surveyed by the major news services believe that tapering will occur in September, we are still yet to be convinced. So we have even more reason to maintain our bullish short and medium term outlook for gold. Gold mine takeovers and acquisitions by producers based in China and Hong Kong have risen to an all time high this year. We are currently working on an investment by a Chinese entity into a Mali based gold company. Demand in China has exploded and consumption is set to overtake India this year.

Compass Direction

Short-Term Medium-Term

BULLISH BULLISH

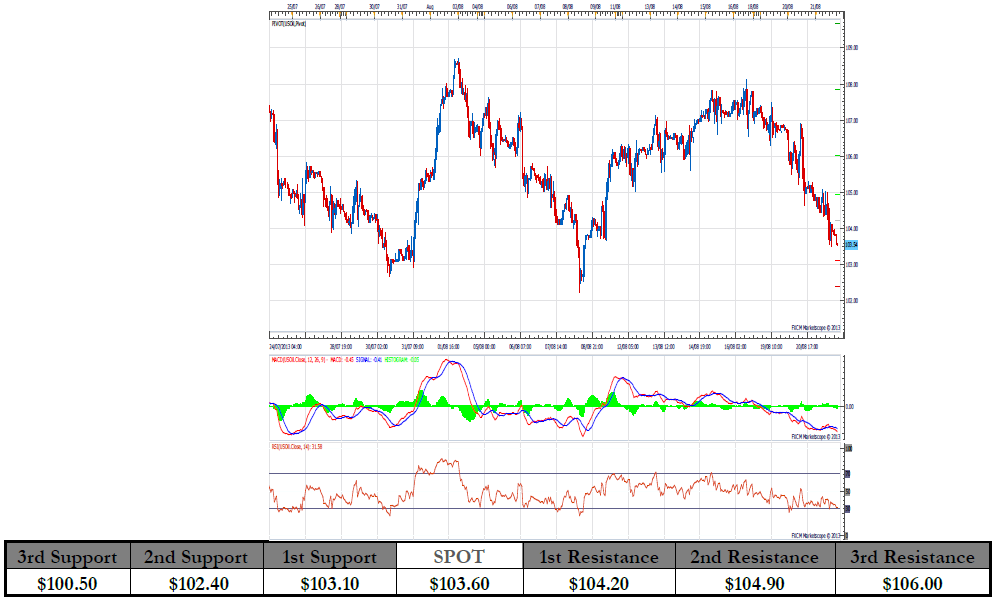

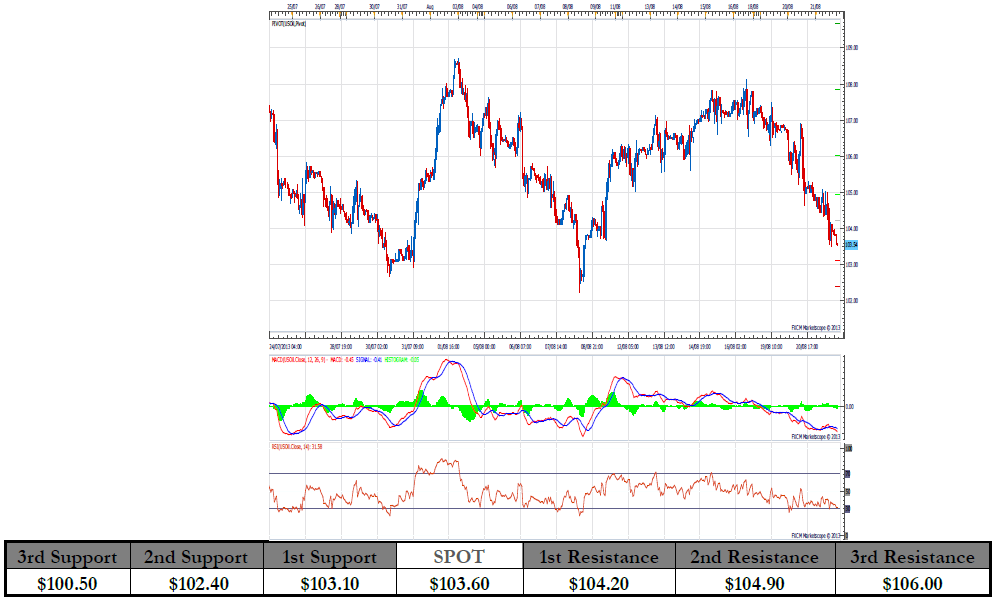

US Oil (WTI) has fallen to its lowest levels in two weeks after suffering a second day of heavy falls, losing more than 1% to below $104.00 in response to Fed Minutes that were interpreted as being more supportive of a reduction in stimulus. Part of the reason for WTI's recent fall has also been a reversal of the aggressive switching from Brent to WTI that had seen the spread between the two contract to zero briefly. The spread has now widened to almost $6 dollars as we see switching back from WTI to Brent. Factors that may cause supplies at Cushing to rise, including some pipeline operation disruptions, have also played a role in the price fall.

Furthermore, the fear premium in relation to the situation in Egypt and concerns over the closure of the Suez Canal is beginning to unwind as fears of a rapid escalation of turmoil in the Middle East subsides. Even so, Brent continues to be supported by the unrest. Fundamentals continue to point to lower prices with production still near their highest levels since 1989 with refineries operating at above 90% of capacity. We maintain our bearish outlook for WTI in both the short to medium term and expect prices below $100 within the next week.

Compass Direction

Short-Term Medium-Term

BEARISH BEARISH

The economy must improve before tapering is considered and although 65% of economists surveyed by the major news services believe that tapering will occur in September, we are still yet to be convinced. So we have even more reason to maintain our bullish short and medium term outlook for gold. Gold mine takeovers and acquisitions by producers based in China and Hong Kong have risen to an all time high this year. We are currently working on an investment by a Chinese entity into a Mali based gold company. Demand in China has exploded and consumption is set to overtake India this year.

Compass Direction

Short-Term Medium-Term

BULLISH BULLISH

US Oil (WTI) has fallen to its lowest levels in two weeks after suffering a second day of heavy falls, losing more than 1% to below $104.00 in response to Fed Minutes that were interpreted as being more supportive of a reduction in stimulus. Part of the reason for WTI's recent fall has also been a reversal of the aggressive switching from Brent to WTI that had seen the spread between the two contract to zero briefly. The spread has now widened to almost $6 dollars as we see switching back from WTI to Brent. Factors that may cause supplies at Cushing to rise, including some pipeline operation disruptions, have also played a role in the price fall.

Furthermore, the fear premium in relation to the situation in Egypt and concerns over the closure of the Suez Canal is beginning to unwind as fears of a rapid escalation of turmoil in the Middle East subsides. Even so, Brent continues to be supported by the unrest. Fundamentals continue to point to lower prices with production still near their highest levels since 1989 with refineries operating at above 90% of capacity. We maintain our bearish outlook for WTI in both the short to medium term and expect prices below $100 within the next week.

Compass Direction

Short-Term Medium-Term

BEARISH BEARISH