EUR/USD traded to a 7 week high during the US session as the market has taken positively to the better than expected German Factory Orders report, that added fuel to the fire that the European Union has turned the corner on the short lived recession period that most economists thought that they were in. Euro opened the European session at 1.3260 with the data providing the kick that started the run towards breaking 1.3300.

However, it wasn’t until the early US morning that the momentum broke the level and since we have seen the price trade around the 1.3300 handle before closing just above. Is it time to get bulled up on the Euro with our belief that the Fed will not taper before the years end as the numbers are still to mixed and the key points to Bernanke are still missing the mark. Its one that could be better played in the crosses like AUD/EUR or even EUR/JPY. German Industrial Numbers are a must to watch tonight.

Compass Direction

Short-Term Medium-Term

NEUTRAL NEUTRAL

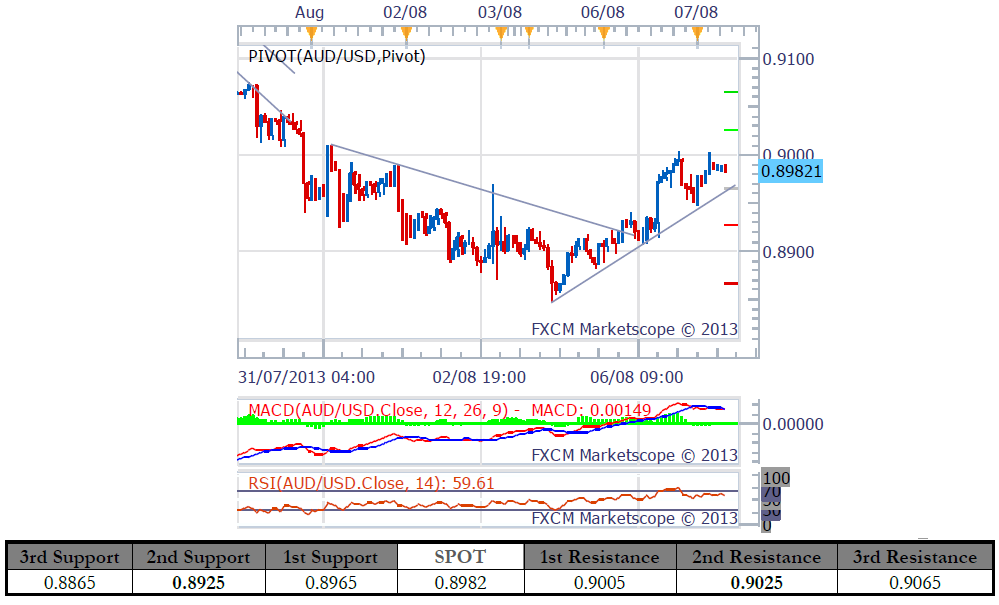

AUD/USD was spooked during late afternoon trade by lower than expected Trade Balance data which should have helped lift the price. However, a mix of negative sentiment leading into the afternoon RBA announcement was enough for the price to dip towards 0.8900. Solid buying at the handle supported and after the release of only a 0.25% cut to the official interest rates to 2.50% the AUD broke higher. Catching out overly bearish shorts. The 0.9000 handle was now in play with a range of importers to spec guys seen on the offer.

The European and US session was a mix of 0.8950 and 0.9000 with the afternoon US session happy to close at 0.8980, despite Euro closing with a bid tone. Australian Home Loan data and RBA Assist Gov Debelle speaks. Some are calling for yesterdays cut to be the last but his expected comments are more of the watch and see. Positioning over the next couple of days will be difficult as bulls will try and get on board on the break of 0.9000 should it happen but watch out for the false break.

Compass Direction

Short-Term Medium-Term

NEUTRAL NEUTRAL

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Morning Fundamentals: EUR/USD Traded To A 7 Week High

Published 08/07/2013, 06:52 AM

Updated 07/09/2023, 06:31 AM

Morning Fundamentals: EUR/USD Traded To A 7 Week High

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.