Market Commentary

USD better bid overnight with much of the gains occurring in the US trading after US 2 Year note higher by more than 8bps to trade above 0.80% for the first time since 2011. Lower than expected prints in retail sales, empire manufacturing and industrial production did not deter the recovery in the USD.

US CPI will be eyed for the final first tier data before FOMC starts today. Although Fed watches PCE as a gauge of medium term inflationary pressures, CPI is another useful indicator in the absence of other stronger market cues. Consensus expects core inflation to rise 0.1%m/m in Aug, steady from the month prior.

EUR/USD slipped overnight following positive showing on equities. ZEW survey was better than expected. Inverse relationship between EUR and risk sentiment still holds (positive equity sentiment sees EUR softer).

GBP fell amid broad USD strength. Aug CPI came in as expected; core CPI was slightly weaker than July; while PPI was worse than expected. Focus today on July employment data.

USD/JPY slipped lower to 119.40 yesterday after the BOJ and Kuroda doused expectations of a rate hike (BOJ kept policy unchanged as expected). Since then, pair has rebounded back above the 120-handle on the back of broad dollar strength.

Technical Commentary

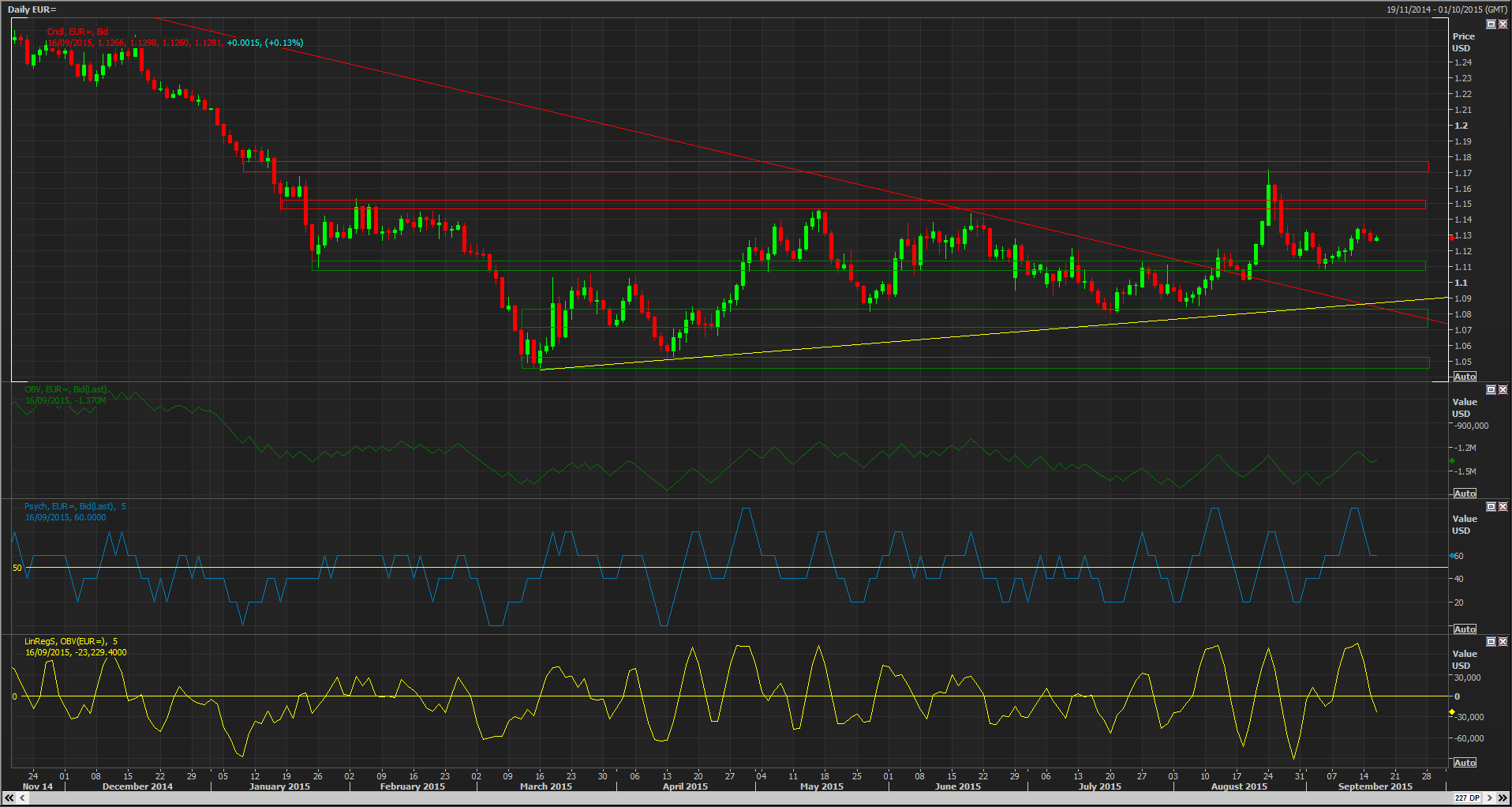

EUR/USD Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bearish

- Retest of bids towards 1.1250 attracts buyers as this level holds expect grind back towards 1.1370’s highs, failure at 1.1250 opens move back to 1.1150 base of the recent advance.

- Daily Order Flow bullish; OBV sideways to up, Linear Regression and Psychology rolling over to retest midpoints from above

- Monitoring intraday price and Order Flow indicators on a test of 1.1250 or 1.14

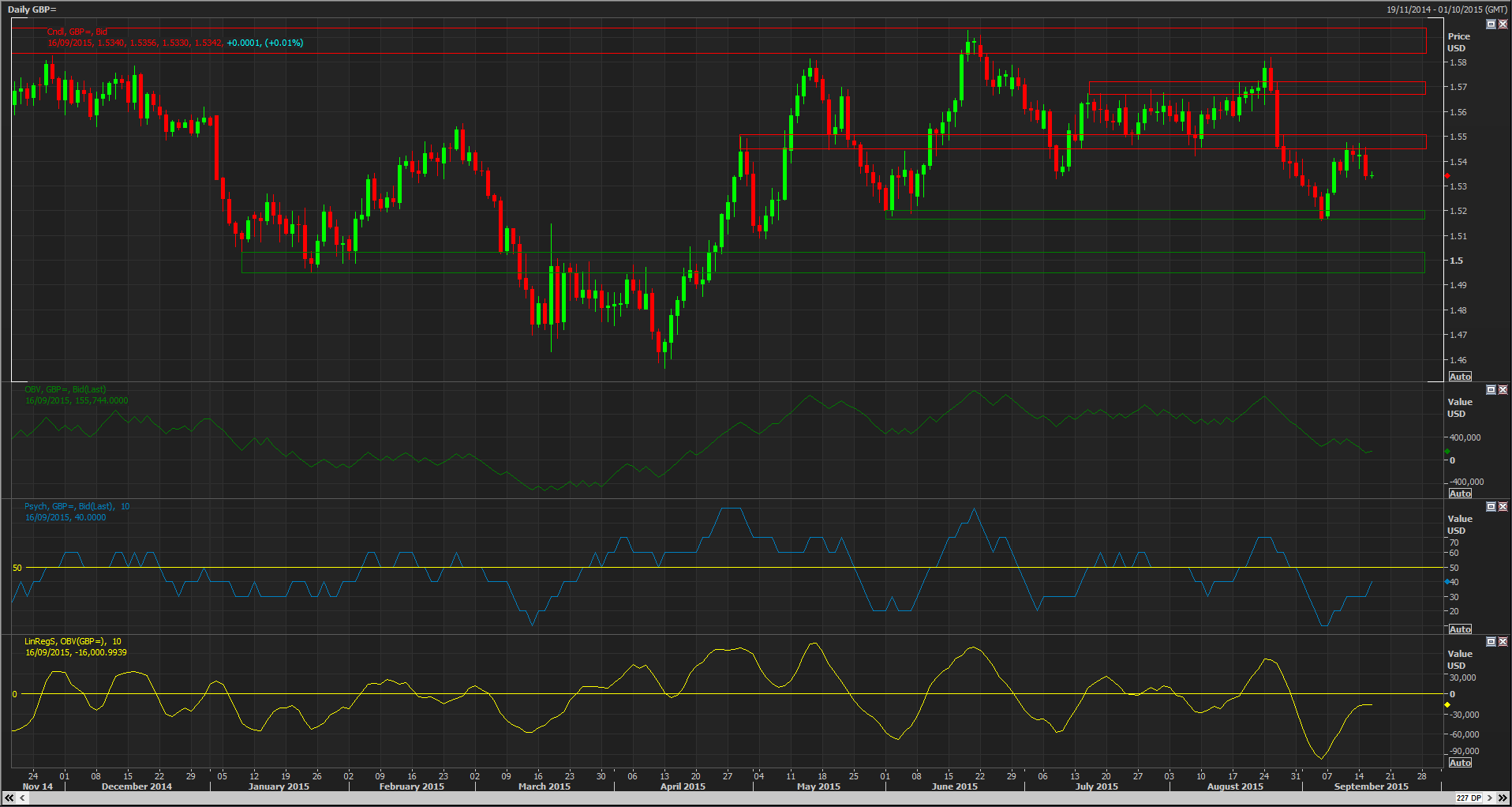

GBP/USD: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bearish

- Failure at 1.5350 opens retest of range lows towards 1.52 while 1.54 caps intraday upside reactions

- Daily Order Flow bullish; OBV sideways to down, Linear Regression and Psychology bearish but attempting retest of midpoint from below

- Monitoring intraday price action and Order Flow indicators on a test of 1.52 or 1.5550

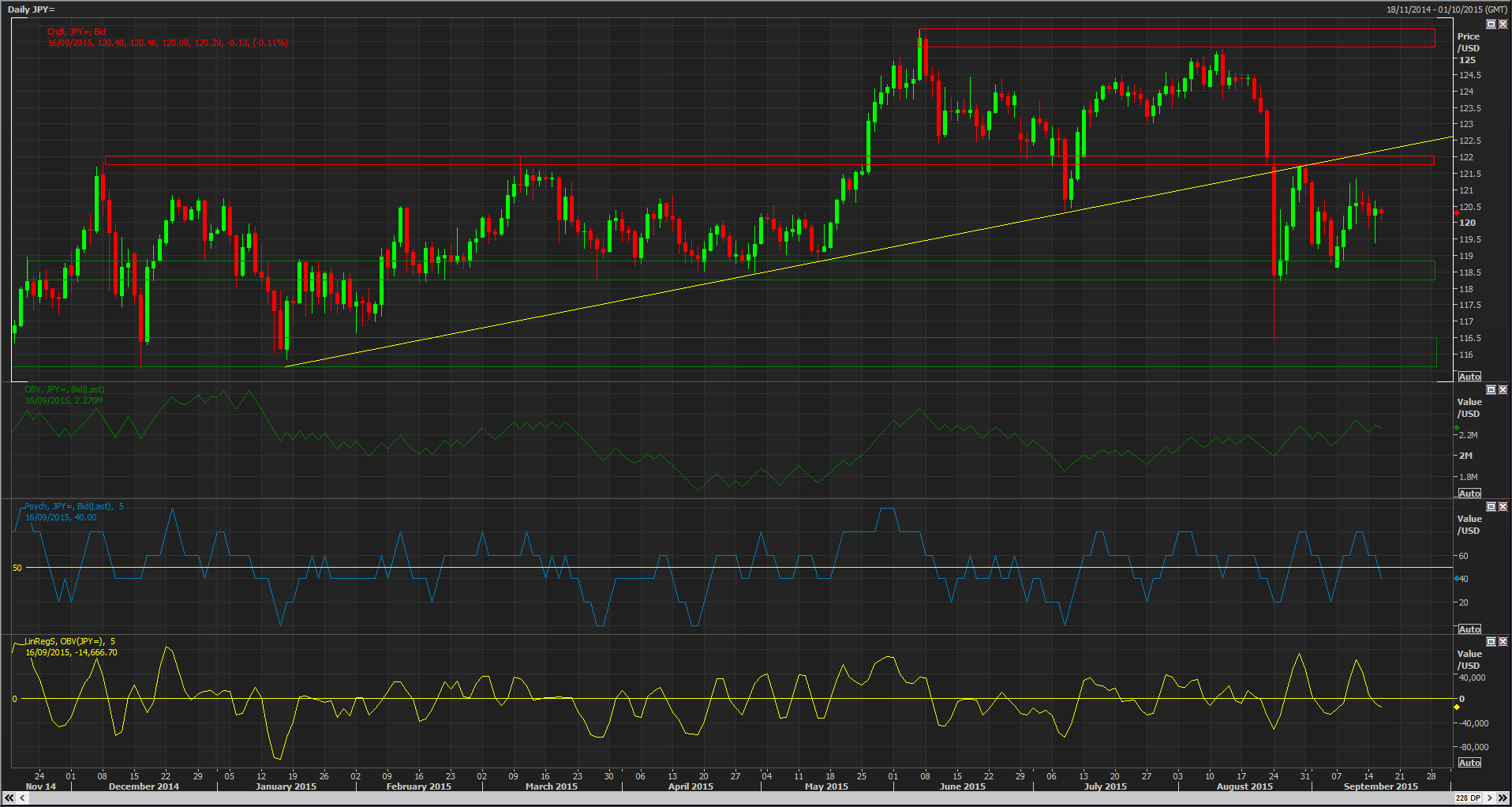

USD/JPY: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bullish

- Retest of 119.50 attracts buyers, 121.50/119.50 range for now. Only a close back above 122.50 relieves downside pressure.

- Daily Order Flow bullish; OBV sideways to down, Linear Regression and Psychology pierce midpoints from above

- Monitoring intraday price action and Order Flow indicators on a test of 119 or 122

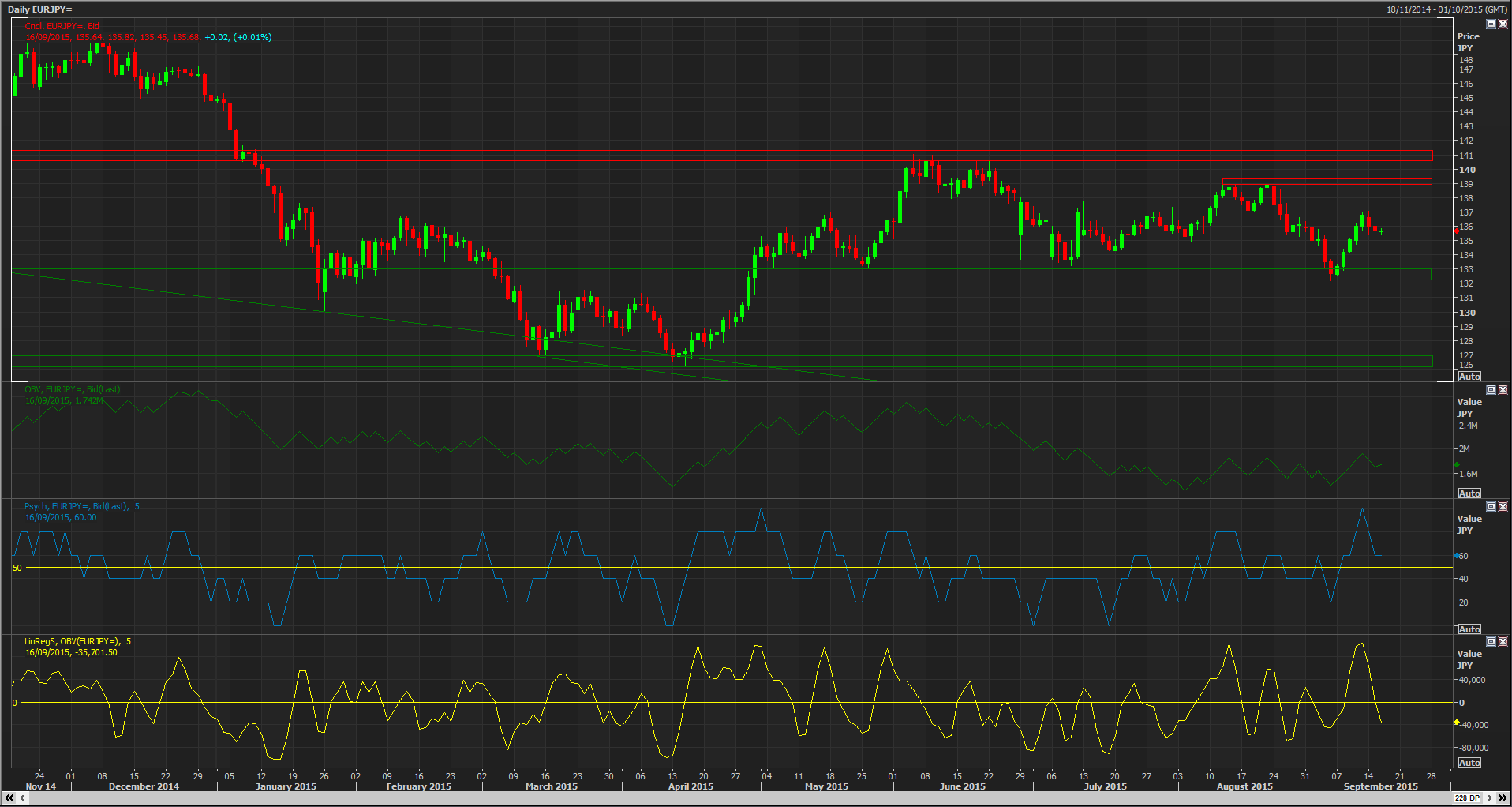

EUR/JPY: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bearish

- While 135 supports intraday downside reactions expect a retest of range resistance towards 138.50. A failure at 135 would target a breach of 132 next

- Daily Order Flow bullish; OBV sideways to up, Linear Regression and Psychology rolling over to retest midpoints from above

- Monitoring intraday price action and Order Flow indicators at 138 or 132