The US dollar has fallen out of favour with the markets thanks to speculation that interest rates will be kept on hold for some time. With the FOMC meeting later today, the Fed could provide an insight into whether or not a June hike is still on the cards.

What it all comes down to is the chance of an interest rate hike in June or later in the year. The last FOMC meeting was seen by the market as more dovish than expected and the data since then has added weight to the view that a June hike is not going to happen. Employment figures have missed the mark recently with the latest unemployment claims up to 295k from 268k at the beginning of April. The last Nonfarm was a big disappointment at 126k down from 295k the previous month.

Further adding weight to the argument for a later lift off for rates has been retail sales which have consistently come in under market expectations. GDP has played its part too with Q4 2014 GDP dipping to 2.2% (annualised) from 5.0% in Q3. The market will keep a close eye on the Q1 2015 GDP figure due out shortly before the FOMC meeting.

The likelihood of the Fed committing to a rate hike in June is very slim at this stage. The US economy just doesn’t look robust enough to warrant normalising the interest rate. We are likely to see the Fed remain on the dovish side and cite the weak data as a reason for holding interest rates steady at this meeting, which will signal to the market that June is too soon. If that happens the US dollar is likely to continue its bearish run.

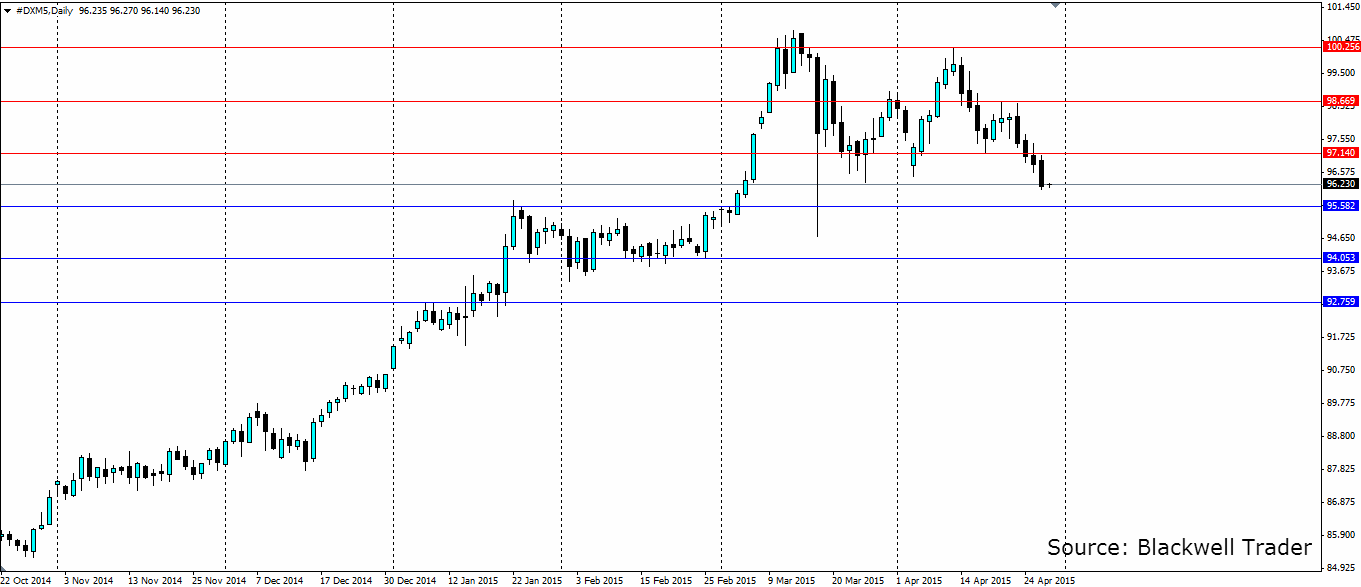

If the Fed remains dovish as expected, look for support to be found at 95.58, 94.05 and 92.75 with the price sitting on support at the current level. This level is also the neckline of the ugly head and shoulders pattern at the top of the recent bullish run. If we see the Fed take a more hawkish stance than usual, look for resistance at 97.14, 98.66 and 100.25.

The FOMC meeting coming up is likely to see the Fed remain dovish thanks to recent weak economic data. If this is the case, the dollar’s recent bearish run is likely to continue.