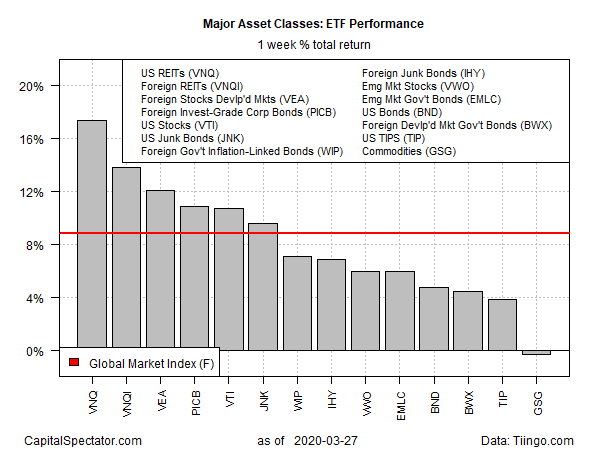

The major asset classes posted widespread gains last week, but the reprieve may be brief as the world continues to grapple with coronavirus risk. But for the trading week ended Friday, Mar. 27, broad-based gains prevailed, based on a set of exchange-traded funds.

US real estate investment trusts (REITs) posted the biggest bounce for the major asset classes. Vanguard Real Estate (NYSE:VNQ) surged 17.4% for the week just passed. That’s an extraordinary gain, although it follows even greater losses in recent weeks.

Notably, the second-strongest performer last week also in the property realm via foreign real estate. Vanguard Global ex-U.S. Real Estate (NASDAQ:VNQI) soared 13.8%, albeit in the wake of several weeks of dramatic declines.

All the major asset classes rose last week, except for broadly defined commodities, which posted a fractional decline. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) slipped 0.3% over the five trading days through Mar. 27.

Meanwhile, the Global Market Index (GMI.F) bounced sharply higher. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights rose an unusually strong 8.8% in one week, but only after suffering a deep haircut previously.

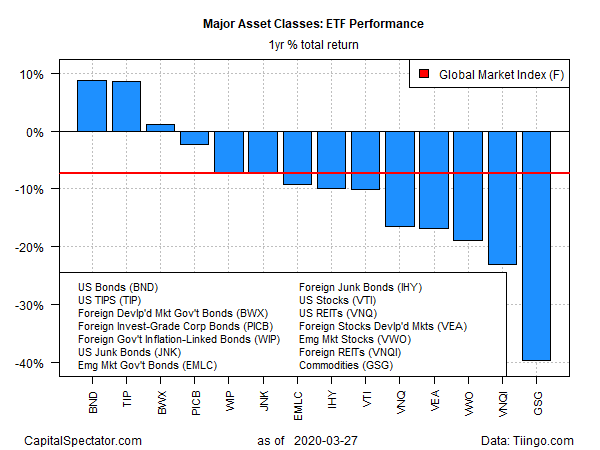

For the one-year trend, only a handful of bonds remain in positive territory after the recent carnage that cut deeply into markets around the world. Investment-grade US bonds are currently in the top spot for one-year results. Vanguard Total US Bond Market (NASDAQ:BND) is higher by 8.9% on a total return basis vs. the year-ago price.

Most of the major asset classes are underwater for the trailing one-year window. The biggest loss: broadly defined commodities. The iShares S&P GSCI Commodity-Indexed Trust (GSG) is down roughly 40% relative to this point in 2019.

GMI.F is also suffering on a one-year basis, posting a 7.3% decline through last week’s close.

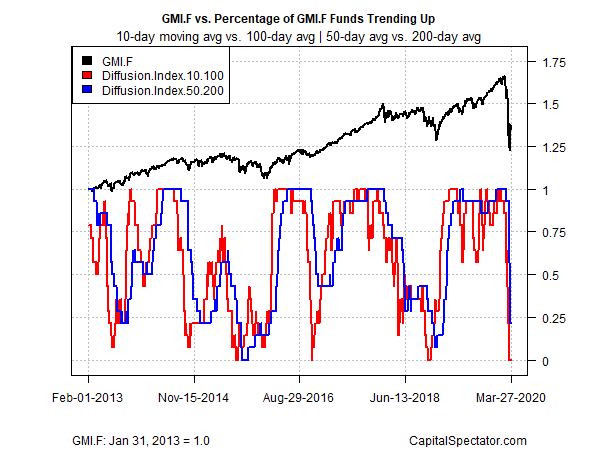

Profiling momentum for the ETFs listed above shows the extent of the damage from the recent selling wave. The profile is based on the 10-day moving average relative to its 100-day counterpart for the short-term trend, and the 50-day average vs. 200-day average to track the longer-term bias. Not surprisingly, deeply negative trends prevail. The fall from grace has been sharp and sudden and there’s no sign that the deeply bearish aura is set to lift.