Carpenter Technology Corporation (NYSE:CRS) entered into a strategic alliance with Samuel, Son & Co. to provide end-to-end supply chain solutions for the additive manufacturing market. The deal will offer customers with turnkey solutions catered to their needs by combining full range of additive manufacturing capabilities.

Samuel recently entered into a purchase agreement with Burloak Technologies, a leading supplier of highly-engineered additive manufacturing solutions. Carpenter Technology’s leading position in powder metals and specialty wire, along with Samuel’s expertise in metal processing, manufacturing and distribution and Burloak’s competence as world class design and development capabilities, offers excellent integrated supply chain solution to customers across all segments of additive manufacturing market.

Carpenter Technology and Samuel revealed that the deal will offer a new dimension to additive manufacturing. It shall provide customers the powder of their choice, prototyping, design, material qualification, production and delivery. Customers in additive manufacturing market will also be able to solve real-time contract requirements seamlessly as the strategic alliance will give full access to design engineering and R&D capabilities.

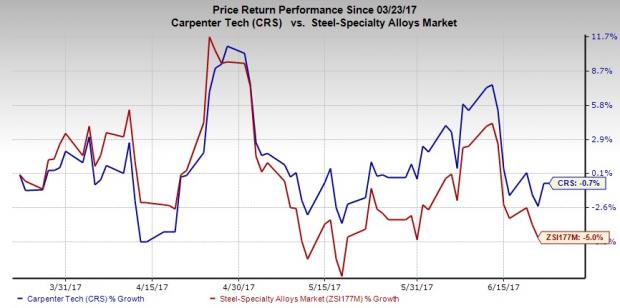

Carpenter Technology’s shares dipped roughly 0.7% in the last three months, outperforming the Zacks categorized Steel-Speciality industry’s decline of 5%.

Carpenter Technology delivered a strong performance in the third quarter of fiscal 2017 (ended Mar 31, 2017), on the back of improving market conditions and continuing execution of Carpenter Operating Model which delivered additional efficiency gains. The company also witnessed improved demand in the aerospace market.

As activity levels continue to improve in North America, the company expects to capitalize on the market and grow. The company also remains on track with the integration of titanium powder buyout and its new titanium powder applications and capabilities are gaining traction in several of its end-use markets.

Moving ahead, the company remains focused on improving operations and leveraging on improved demand across end-use markets and increasing prospects in the additive manufacturing space. Carpenter Technology also noted that backlogs are growing as the company leverages on solution-driven approach to expand market opportunities and customer-base. Overall, the company is well-positioned to enhance profitability on the back of accelerated revenues growth.

Carpenter Technology currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Potash Corporation of Saskatchewan Inc. (NYSE:POT) and Huntsman Corporation (NYSE:HUN) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Potash Corporation has expected long-term earnings growth rate of 6.5%.

Huntsman has expected long-term earnings growth rate of 7%.

The Best & Worst of Zacks

Today you are invited to download the full, up-to-the-minute list of 220 Zacks Rank #1 "Strong Buys" free of charge. From 1988 through 2015 this list has averaged a stellar gain of +25% per year. Plus, you may download 220 Zacks Rank #5 "Strong Sells." Even though this list holds many stocks that seem to be solid, it has historically performed 6X worse than the market. See these critical buys and sells free >>

Huntsman Corporation (HUN): Free Stock Analysis Report

Potash Corporation of Saskatchewan Inc. (POT): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

Original post

Zacks Investment Research