Cardinal Health Inc (NYSE:CAH) will take its turn in the earnings confessional before the open on Monday. Ahead of the event, the pharmaceuticals distributor just flashed a bearish signal which could spell trouble in the near term.

For starters, Cardinal Health's history of post-earnings reactions has been less than promising. The security has averaged a 5.2% single-session post-earnings move over the past eight quarters -- where three of the past four have been negative. Following the most recent release in May, CAH stock dropped a whopping 21.4% the day after reporting.

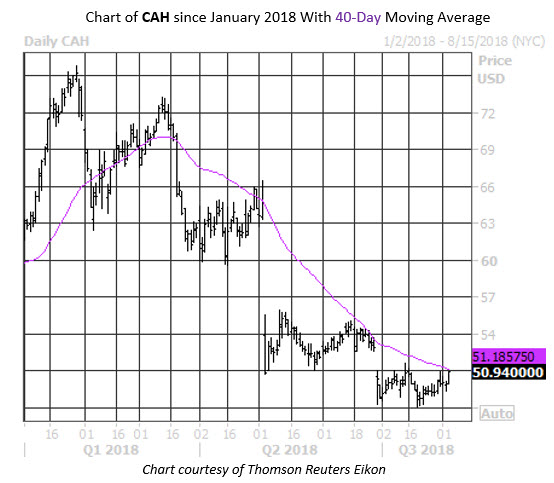

At last check, Cardinal Health stock was up 1.8% to trade at $50.94. The healthcare name has shed 27% year-over-year, carving out a channel of lower lows thanks to four bear gaps in 2018. The equity is now within a chip-shot of its 40-day moving average after spending most of 2018 below the trendline. According to Schaeffer's Senior Quantitative Analyst Rocky White, in the 12 most recent times CAH has come within one standard deviation of this trendline after a lengthy stay below it, the security has gone on to average a one-month loss of 2.55%, with 64% of those returns negative.

Should the drug retailer extend its recent slide, there is ample room aboard the bearish bandwagon. Although short interest increased by 30% in the two most recent reporting periods, the 9.72 million shares sold short represents a meager 3.7% of CAH's total available float, or only 2.8 times the average daily pace of trading.

In the options pits, the attitude leans toward calls. The stock's 10-day call/put volume ratio of 1.37 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 80th percentile of its annual range. This indicates a healthier-than-usual appetite for long calls over puts in the past two weeks. An unwinding of these bullish bets could push CAH lower.

Traders, whether bullish or bearish, may want to consider Cardinal Health options, since it's been a good target for premium buyers during the past year. That's according to its Schaeffer's Volatility Scorecard (SVS) of 78 out of 100, which shows it's tended to make much bigger-than-expected moves on the charts compared to what the options market was expecting.