Lordy, what a day. It’s about 2 in the afternoon here, and I’m ready to take a nap. The Twitter (TWTR) IPO was a success (for the employees/founders and investment banks) and a failure (for the public bagholders, all of whom are in the red now). The strange thing about the market lately (and I just started noticing this last week) is that in spite of the “headline” indexes making new highs, the “rot” that we talk about so much here on Slope is very ready.

Today was a carbon copy of yesterday for me. The bell opens; my portfolio is deep in the red; it slips to a five-digit loss……..then it stalls……….then starts fighting back………and by the end of the day, it’s no longer a five-digit loss, but a five-figure profit. Indeed, today was the most profitable day I’ve had in, I think, months.

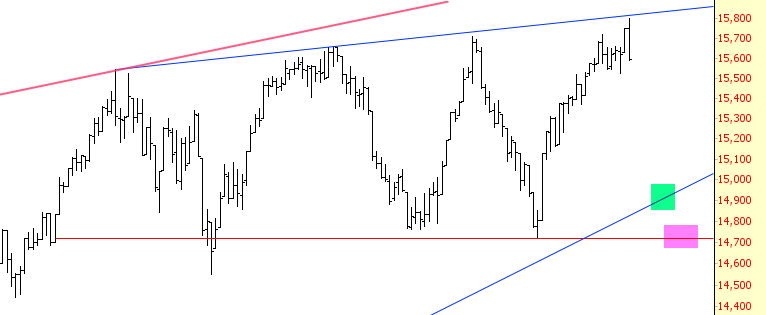

And while it seems like the market is really “down” at this point, it was only at the beginning of the day that the S&P was at the highest point in the history of the planet Earth. So, ummm, I think there is a hell of a lot of downside to go. Looking at the Dow Industrials (INDU), for example, it seems feasible we could slip to the target I’ve tinted in green (I haven’t laid it out very well, but somewhere around 15,000) and, breaking that, perhaps even challenge the critically-important shelf of support represented by the horizontal line.

But we’re going to need one more good ‘chop’ to the market to really make the downtrend plain. Obviously Friday – with its pre-opening jobs report – is a candidate for such a day. But it’s just as easily a candidate for a bounce. Look at the Dow Composite, for example, and see how its price is resting on support. It needs to break this line for the market to really start rolling over.

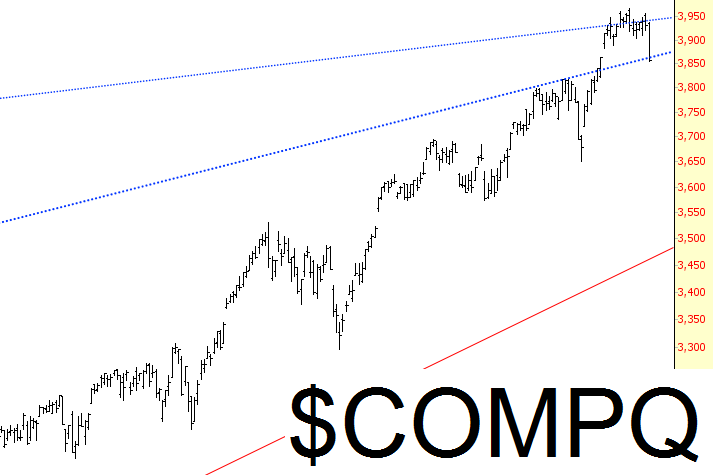

The same can be said for the NASDAQ 100, whose price likewise is at a support (former resistance) level.

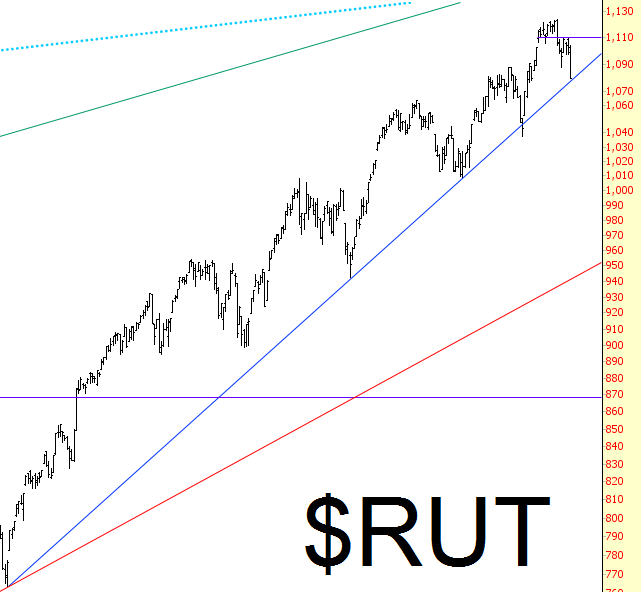

My focus has been on small caps, and the Russell now (unlike so many other indexes) has tagged the same supporting trendline it tagged during the depths of the ridiculous October Congressional stalemate. If we can break this line in earnest, its role will flop from support to resistance, and it is officially party time here on the Slope of Hope.

Such a break would open up the pathway to more meaningful targets, such as about 1625 on the S&P 500, right where major support is (dating back to the March 2009 bottom).

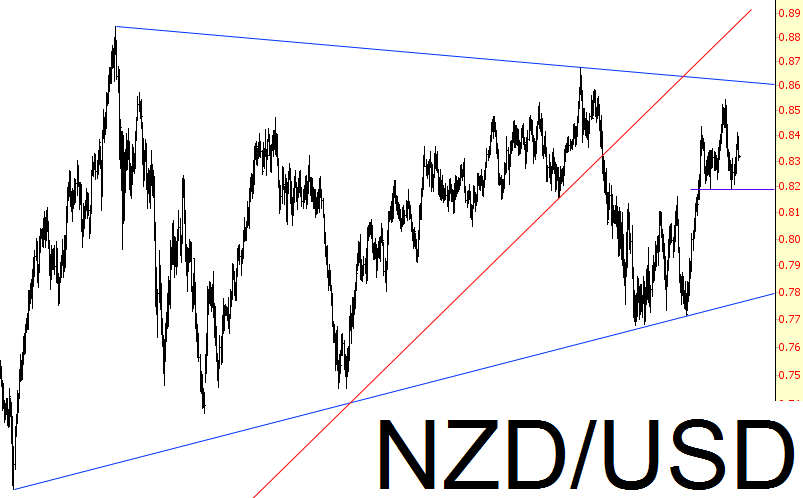

I’ll close with a non-equity chart: below is the cross-rate between the New Zealand kiwi and the US dollar. Over the past month, a small head and shoulders pattern has been forming. A break of the neckline would send this down to its supporting trendline and perhaps – just perhaps – give it a chance to break the big symmetric triangle. If it does, the level of “party” goes up tenfold.

So we’re at a fairly important crossroads here. The zeitgeist out there is feeling right for a bear market, from the Obamacare catastrophe to the unintended consequences of the currency wars. If Friday can be a reasonably red day, the bears’ grasp on this market will strength.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

More Market Downside To Come?

Published 11/07/2013, 05:53 PM

Updated 07/09/2023, 06:31 AM

More Market Downside To Come?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.