This morning I joined Ade Nurul Safrina on CNBC “Closing Bell” Indonesia to discuss the Fed’s move yesterday, Emerging Markets, Earnings and Markets Outlook moving forward. Thanks to Safrina and Fitria for having me on:

CPS

As many of you know, Cooper Standard started as one of our largest three positions (by capital deployed) in May of 2022 and has grown into our largest position through price appreciation.

Those of you who listen to the podcast|videocast and were in at the $4-6 range are now up at least ~3x+ or ~200%+. Even if you first heard about it on Liz Claman’s The Claman Countdown on Fox Business on June 7, 2022:

Or on December 28, 2022 with Kelly O’Grady:

You still have at least a double or triple so far.

This week when GM reported, it became evident that the thesis is playing out exactly as we presented last May.

For another look-through on Auto production, you need only listen to the colorful CEO of Cliff’s Natural Resources. He not only lays out the bull case for autos, he has a bit of unsolicited advice for the host (a must listen)!

CPS reports Thursday, August 3 (after the bell).

MMM

A couple months back we put out a very unconventional pick in 3M (NYSE:MMM):

Like Liz Claman (above), Charles Payne is not afraid of featuring managers who think differently from the crowd. It’s what makes their shows the best in the business.

I’ll be on Making Money with Charles Payne (Fox Business) on Tuesday at 2pm. Tune in if you are free.

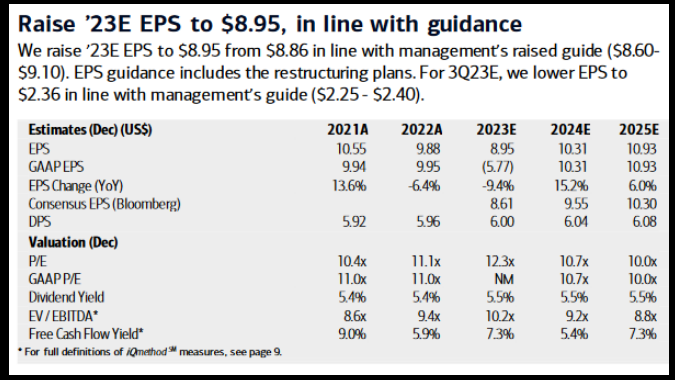

After beating earnings and raising guidance this week, Bank of America (NYSE:BAC) upgraded the stock and forward estimates:

MMM is now coming out of its slumber and starting to move:

With the PFAS settlement reached last month, and the Earplug litigation mediation expected to resolve in coming months, the catalysts are lining up to begin a significant recovery:

BABA

When I said on Charles Payne’s show that “this will be the last chance to buy Alibaba (NYSE:BABA) under $100,” I wasn’t kidding:

We anticipated the Politburo meeting to be a catalyst for Chinese markets and it has been:

Here are the key takeaways summarized by Reuters:

The Rest

As we mentioned in our now famous “Sea Change” article from June 1, Banks and Small caps are now leading the way:

From June 1, 2023:

We are at the cusp of a sea change, and the knock on effects will be material. We expect to see two meaningful changes in coming months as a result of the Fed being done:

1) The Dollar will resume its downtrend after a "debt ceiling safe haven bid" in recent weeks.

The most directly impacted asset classes from this development will be the groups that have beed left behind in the recent rally:

a) Emerging Markets and China will resume the untrend they began in October. China trades inversely with the USD and is the heaviest weighting in Emerging Markets Indices.

b) Biotech will accelerate its slow recovery from last May's low as risk comes back into the market.

c) Any multi-national company with revenues abroad will increase earnings materially as the USD weakens. Roughly 40% of S&P 500 revenues are generated outside of the U.S. For example, Intel (NASDAQ:INTC) gets ~82% of their revenues from outside U.S. 3M (MMM) gets ~49% of their revenues from outside U.S.

Paypal (PYPL) gets ~47% of their revenues from outside U.S. VF Corp (NYSE:VFC) gets ~45% of their revenues from outside U.S. Stanley Black and Decker (SWK) gets ~45% of their revenues from outside U.S. Baxter International (NYSE:BAX) gets ~45% of their revenues from outside U.S.

2) Long Term Treasuries will begin to get bid after a few weeks of heavy issuance following the debt deal:

Interest rate sensitive sectors will get bid:

a) REITS have been left for dead. As the long end of the curve gets bid and rates come down, you will see this group begin to recover.

b) BANKS will start to get bid again as their portfolio and loan book "mark-to-market" improves - reducing the need to raise capital. Funding costs will begin to moderate as deposit rates becomes more competitive to alternatives.

c) Small Caps will get bid as banks begin to recover. They have been a major laggard this year.

THE FED

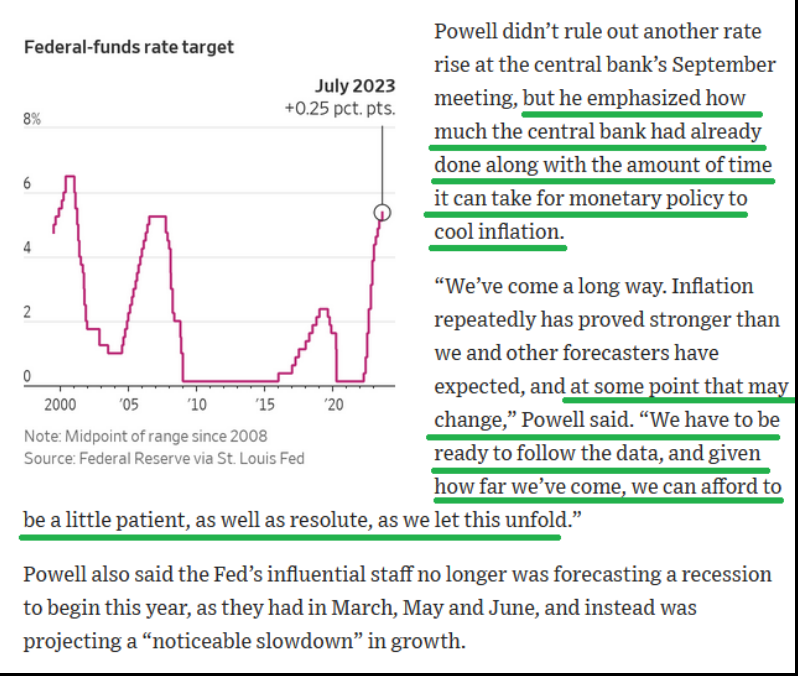

Everything you need to know about the Fed Meeting is summarized by these lines in Nick Timiraos’ (The Fed Whisperer) article following the Fed Meeting:

The Fed is done. They just don’t know it yet…

2 Jobs reports and 2 inflation reports before the September meeting will put the final nail in the coffin of relentless tightening. If they stop (correctly), they will be able to keep rates elevated for some time. If they overshoot (lower probability), they will be cutting in months…

I covered this (and a lot more) on the David Lin Report yesterday. Thanks to David for having me on. You can watch it here:

Positioning

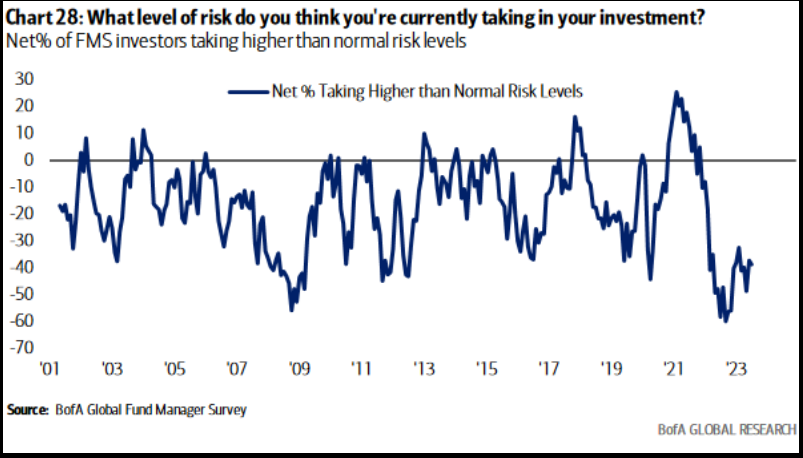

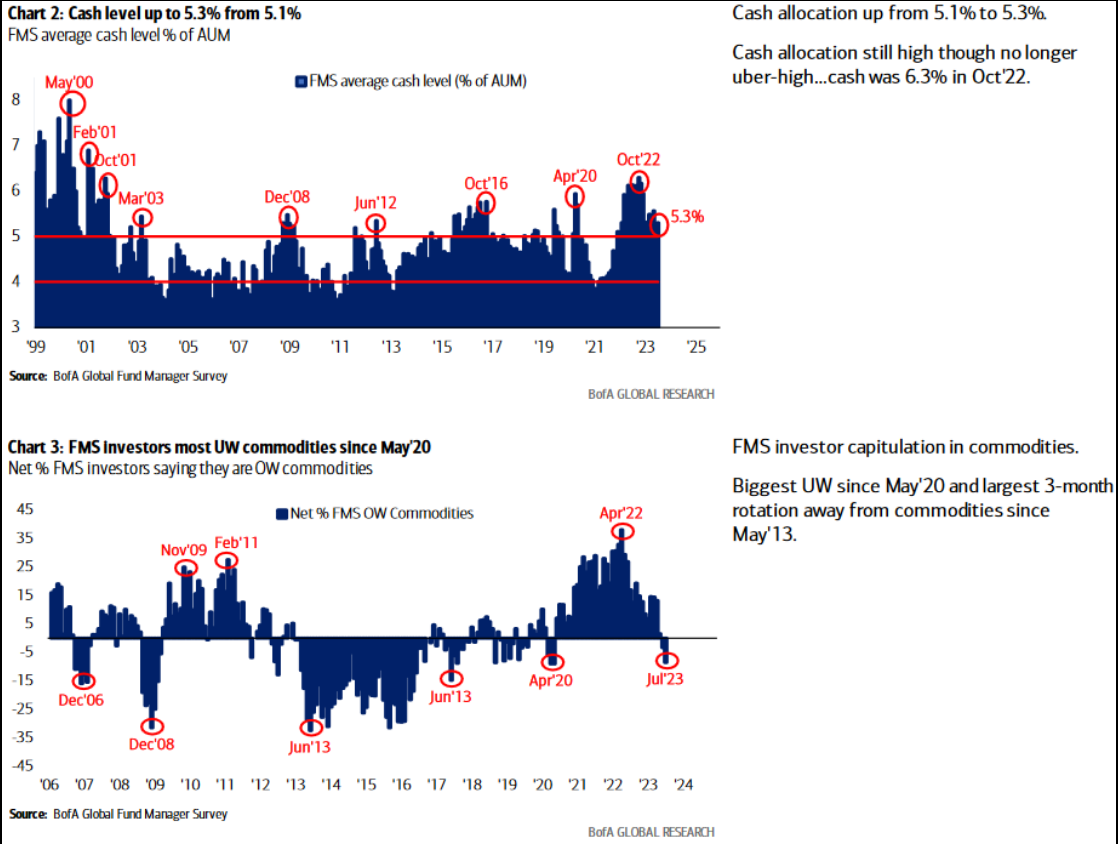

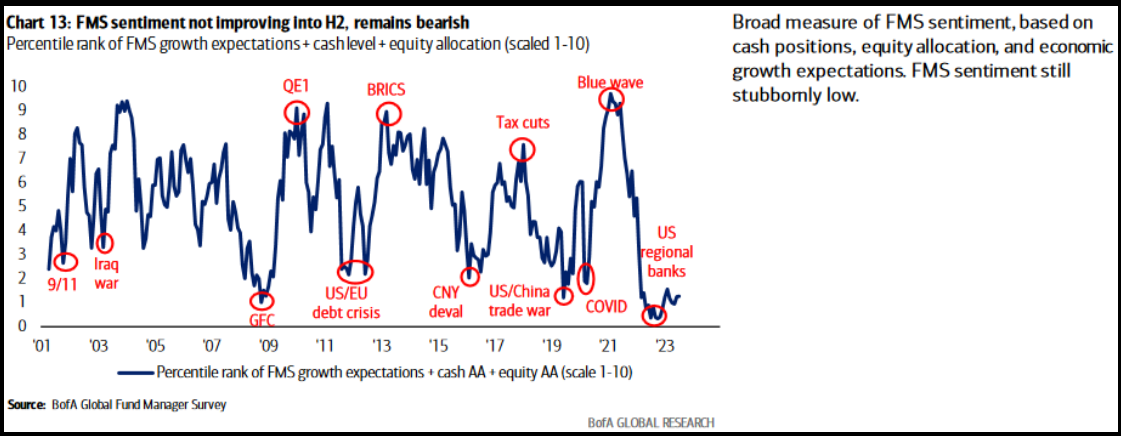

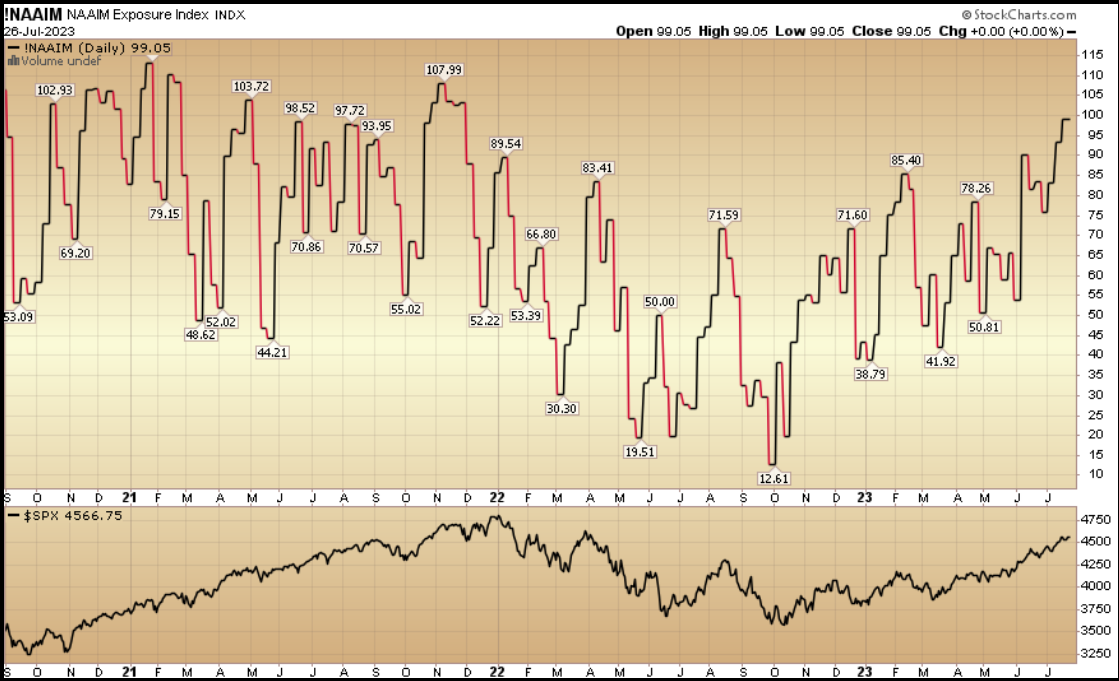

As a friendly reminder, we are moving into a seasonally weak period and volatility is to be expected. We anticipate normal 3-5% pullbacks (if they come) will be met by a large institutional bid playing “catch up” into year end – in an attempt to salvage performance that is devastatingly missing their benchmarks year-to-date (present company not included):

Now onto the shorter term view for the General Market:

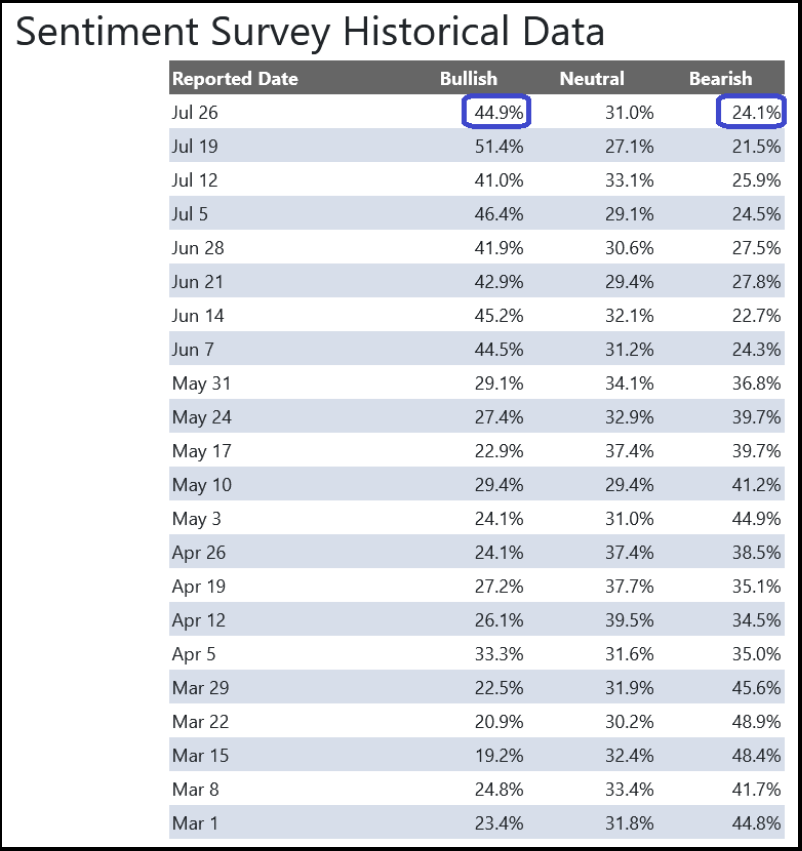

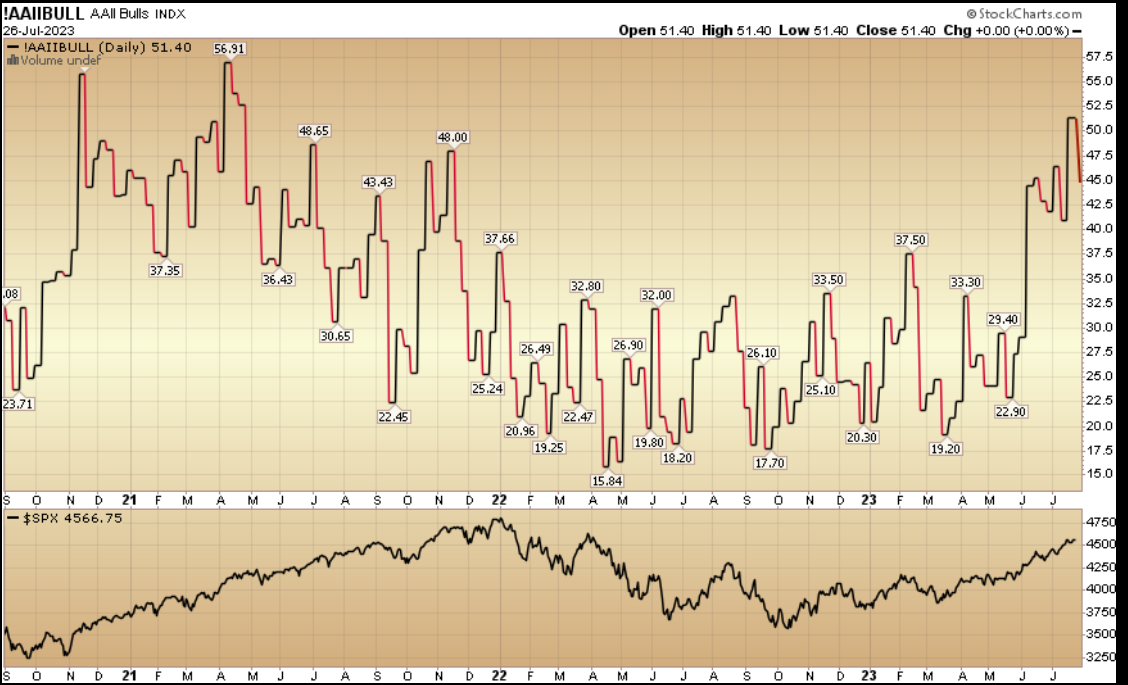

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 44.9% from 51.4% the previous week. Bearish Percent rose to 24.1% from 21.5%. The retail investor is still optimistic. This can stay elevated for some time based on positioning coming into these levels, but it would not surprise us to see a little give-back in coming weeks (even if we were to push a bit higher first). Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy pullbacks through year-end.

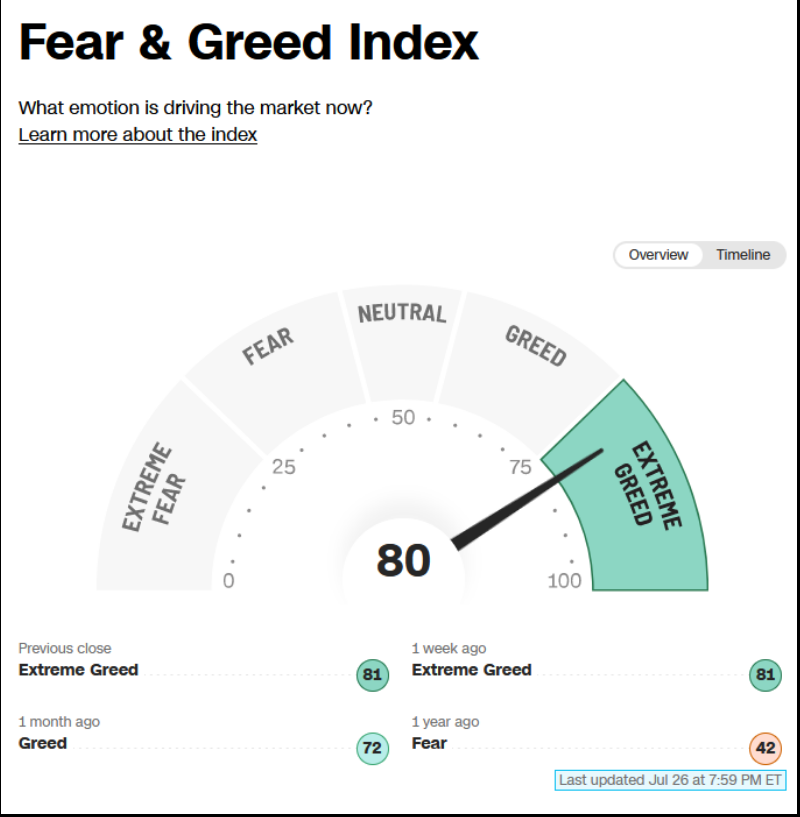

The CNN “Fear and Greed” ticked down from 82 last week to 80 this week. Sentiment is hot and has remained pinned for several weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 99.05% this week from 93.34% equity exposure last week. Managers have been chasing the rally.

This content was originally published on Hedgefundtips.com.