The big news out of China is its decision to end its one-child policy. For investors, however, the news is that the process of re-balancing from financially driven infrastructure growth to household and consumer led growth continues.

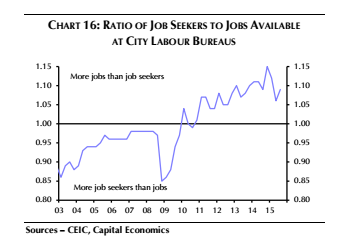

A couple of data points came across my desk that confirms this view. First, Capital Economics noted that the Chinese job market remains tight, which reinforces political stability and takes pressure off the urgency for economic growth at any price (via Ambrose Evans-Prichard):

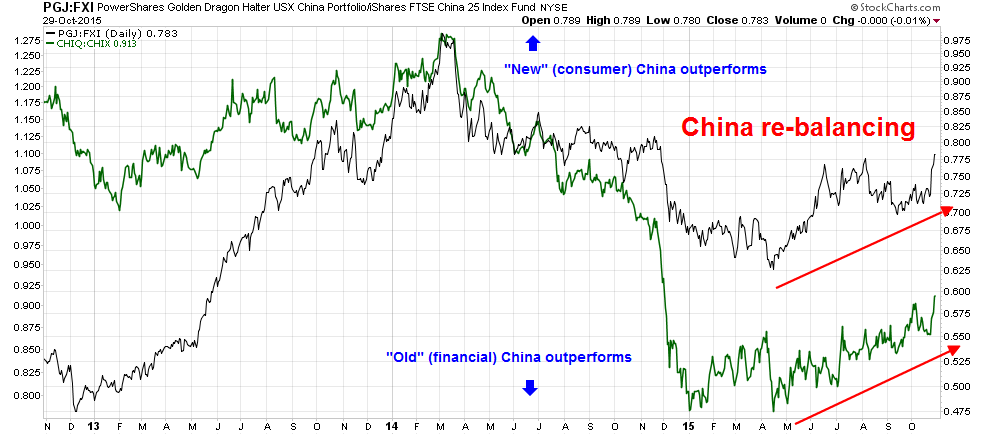

In addition, I recently referenced a couple of pairs trades (PowerShares Golden Dragon China Port (N:PGJ):iShares China Large-Cap (N:FXI) and Global X China Consumer (N:CHIQ):Global X China Financials (N:CHIX)) which bought baskets of Chinese consumer oriented stocks and shorted Chinese financials (see Two better ways to play Chinese growth). Both of these pairs indicate the ascendancy of the consumer sector.

As we await China's PMI release later today (Sunday), keep these points in mind should the data come in below consensus. Even if the growth outlook were to disappoint, growth is shifting from "bad" value-destroying growth to "good" consumer led sustainable growth. So don't freak out.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (""Qwest""). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.