It seems as if Deutsche Bank (DE:DBKGn) is on everyone’s mind, even if nobody knows exactly why. Stocks were down today which is really unremarkable but has become so by the standards of just this year where nothing bad is supposed to be able to intrude. That aside, the news from Germany was quite unnerving. Bloomberg reported early this afternoon that large hedge fund clients had already pulled business from the German giant.

The funds, which use the bank’s prime brokerage service, have moved part of their listed derivatives holdings to other firms this week, according to an internal bank document seen by Bloomberg News. Among them are Izzy Englander’s $34 billion Millennium Partners, Chris Rokos’s $4 billion Rokos Capital Management, and the $14 billion Capula Investment Management, said a person familiar with the situation who declined to be identified talking about confidential client matters.

The media still continues to blame DB’s woes on the assumed $14 billion DOJ settlement related to RMBS of the housing bubble era. While that is undoubtedly a good part of what might be unsettling some folks, it is but the symptom not the cause. It was reported on CNBC (via The Guardian) that,

“When you look at what’s going on in the Deutsche Bank options, you’re seeing a lot of puts being bought,” said Daniel Deming, managing director at KKM Financial. “So you’re getting some concerns that this could turn into something bigger.”

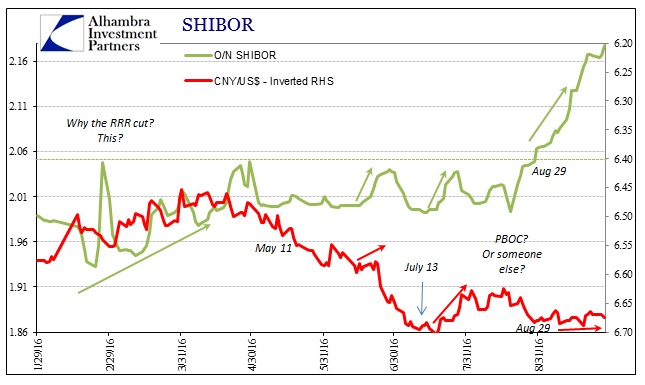

From the outside that seems almost overstated because “something” bigger isn’t ever reported. In unbiased reality, this “something” has been building for weeks, perhaps months. If I had to guess, it is being transmuted by pressure aimed squarely at Asia, alternating at times between Japan and China. In China, “it” has forced a total reorientation of immediate liquidity priorities. That cannot be overstated.

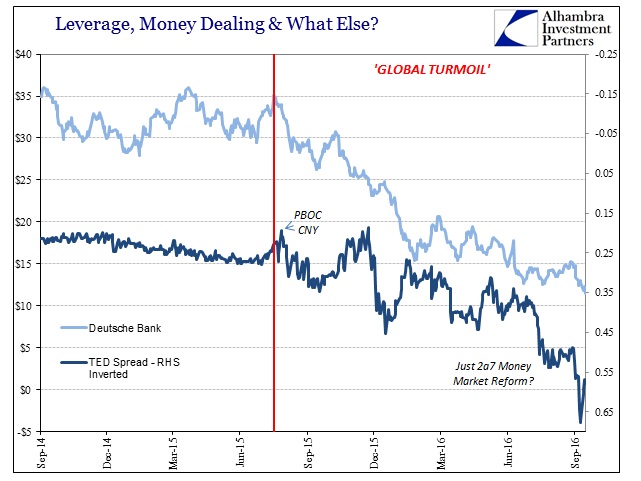

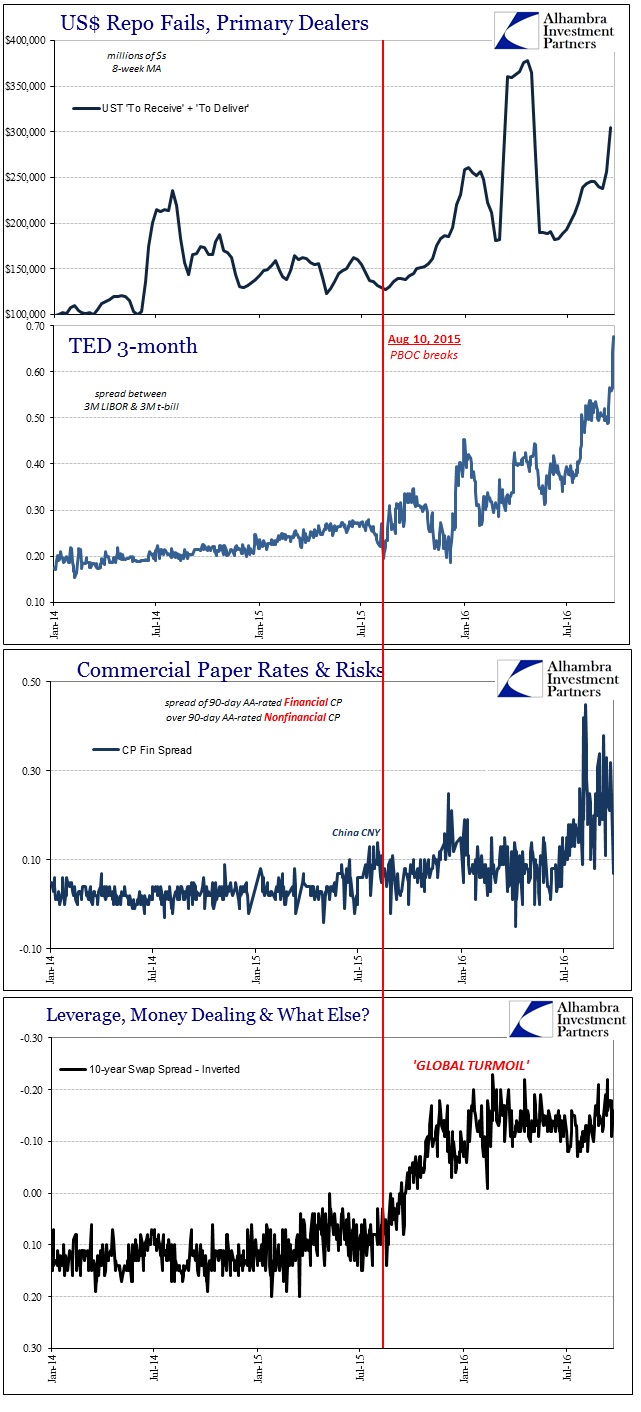

The effects are not obscured in eurodollars, as you might be forced to suspect from either the lack of reporting on it or the intensity to which absurd excuses are applied to make it all seem benign nothingness. The “something bigger” is right there out in the open, easy to see for anyone willing to put in but a bare minimum amount of effort:

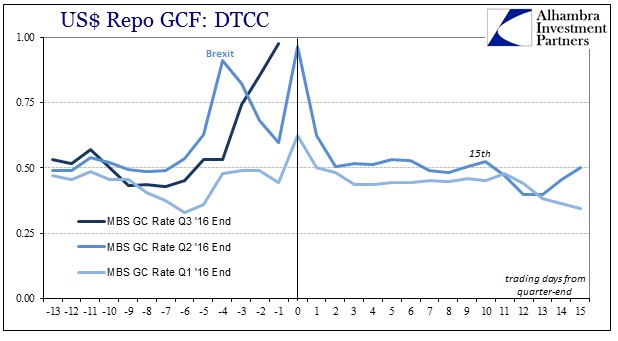

The latest to further highlight “something” is the repo market yet again. It has become standard that GC rates spike at each quarter end, with the MBS GC rate jumping to 62.2 bps on March 31 and 96 bps on June 30. These have been typically one-day events, at most involving the day before and after each quarter end. Heading toward the end of this quarter, the repo rate has been rising and sharply for this entire week. DTCC figures the repo rate today at 97.6 bps, already higher the day before the quarter end than at the last one – which was already suspiciously high to begin with.

In fact, the current rate in UST as well as MBS is significantly above the level achieved in the aftermath of Brexit. As I wrote a few days ago:

It is absolutely ridiculous the lengths that are being taken to avoid acknowledging the increasingly troubling global “dollar” shortage. We can debate and argue what is causing this “something”, but the evidence for it and for what it is has become is overwhelming.

While attention is rightly focused on Deutsche Bank it is only so because the bank is the most visible symptom being the most vulnerable participant in this “something.” DB is just an outbreak so prominent that the mainstream can no longer pretend there is nothing worth reporting – but they can still obscure why that might be, focusing on the canard about the DOJ settlement. This is a systemic issue, one that is as plain as Deutsche’s stock price.

Liquidity risk is indicated pretty much everywhere, a direct assault not just on mainstream conventions about monetary policy but monetary competency itself. As Alan Greenspan said in June 2000:

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition.

It is much more than Deutsche Bank that at this very moment would agree for once with the “maestro’s” highly unusual candidness. No matter how impressive (sounding) their credentials, for central bankers it is becoming extremely difficult even for the media to ignore just how much they really don’t know what they are doing.