Over the last 10 months the FOMC policy stance has evolved significantly. Last April, with the FOMC on the way to completing its purchase of $600 billion in longterm Treasuries, the FOMC staff was busy giving a presentation on strategies for normalizing the stance and the conduct of monetary policy over time. Participants noted at the time that discussing strategy for normalization did not mean the process would necessarily begin soon. The pace and sequencing of policy steps would be driven by the objectives of maximum employment and price stability.

In the months that followed, economic growth was disappointing and the FOMC turned more dovish. By August it was suggesting that economic conditions were “likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.” A month later came the announcement of Operation Twist – the Fed’s purchase by the end of June 2012 of $400 billion in Treasuries with remaining maturities of 6 years to 30 years and the sale of an equal volume of Treasuries with remaining maturities of 3 years or less. Then in January, with unemployment still high and inflation expected to remain subdued, the committee extended its “exceptionally low” fed funds rate guidance to “at least through late 2014.” It also reported that six of its participants thought the policy rate would still be unchanged at the end of 2014. Two of them thought no rate increase would be warranted until 2016. Those who saw the first increase occurring in 2015 anticipated a rate of ½ percent at the end of that year. For the two who put the first increase in 2016, the appropriate target rate at the end of that year would be 1½ and 1¾ percent. Not only do rate hikes seem to have been pushed farther away but, according to the minutes of the January 24-25 meeting, “a few Committee members observed that … economic conditions ... could warrant the initiation of additional securities purchases before long." San Francisco Fed president John Williams and Chicago Fed president Charles Evans have been publicly supporting more asset purchases lately.

The Fed is not alone in its dovish turn. Some 18 central banks have eased since the beginning of the fourth quarter. These include the Bank of England, which announced further purchases of gilts, the Bank of Japan, which raised the target of its asset purchase program, and the Bank of China, which has cut its bank reserve-ratio requirements effective February 24, just a few days before the ECB proceeds with its second round of LTRO.

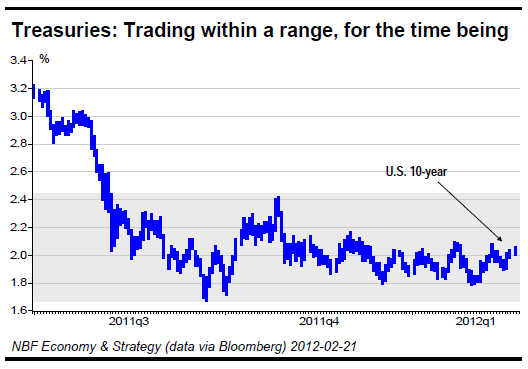

With so many central banks targeting low rates, it would be hard to argue that yields at the long end of the curve are at risk in the coming month. News from Europe on Greece and Portugal could obviously add some volatility to 10-year Treasuries, but even if safehaven flows were to abate, the fair value of 10-year Treasuries would not exceed 2.5% by our model. Europe is not the only source of uncertainty about the global economy. Tensions in the Middle East remain high, with significant risk of an oil-price spike if the standoff with Iran deteriorates.

After 2012 the outlook for the bond market seems more uncertain. Under current U.S. law, substantial changes in tax and spending policies will take effect next year. The CBO projects that if current laws are implemented, the deficit will fall to 3.7% of GDP in 2013 from 8.7% in 2011. That would mean a greatly reduced borrowing requirement. In recent years, however, policymakers have shown a strong tendency to make significant temporary changes in tax and spending laws. The next administration is unlikely to depart from the trend. What fiscal choices will it make? What response will they trigger from the Fed?

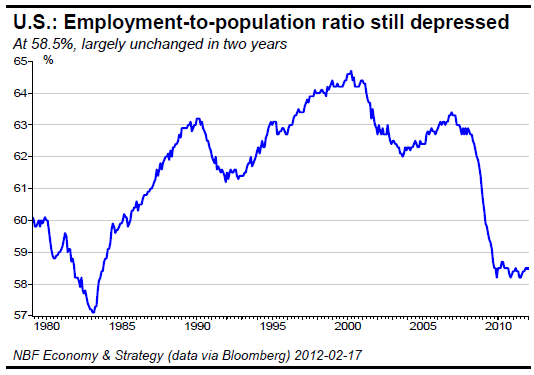

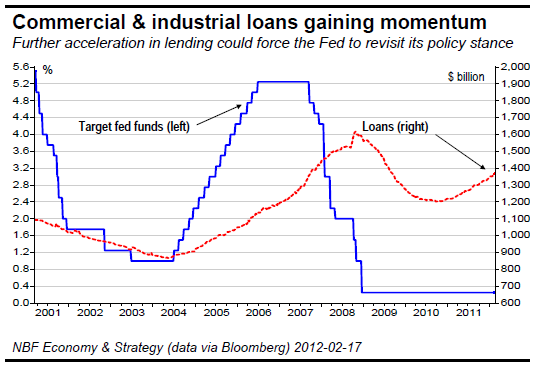

In the Fed’s view, the employment-to-population ratio strongly suggests that enough labour power remains idle to keep labour costs in check for many years, a justification for keeping its policy rate low for a long time. Yet there is room for skepticism that the Fed will keep its policy rate unchanged until 2014. We have long argued that the Fed stance will be driven not only by the labour market but also by developments in bank credit.

On that front, the volume of commercial and industrial loans outstanding is now up 12.1% from early February 2011. Moreover, the most recent Senior Loan Officer survey reported the strongest loan demand from smaller firms since 2005. This is a sign of stronger activity among small businesses, a key sector for job creation. The pickup in lending also suggests that monetary policy is getting more traction. With banks holding huge excess reserves, the Fed will have to keep close tabs on developments to make sure these excess reserves do not turn into too much money chasing too few goods a year from now.

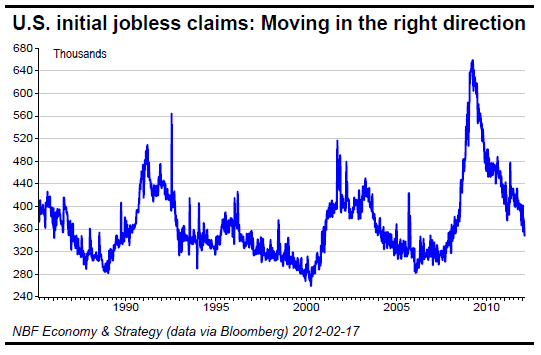

Although the speeches of some Fed officials suggest that the bar is low for QE3 and it could be implemented in coming months, we would argue that the increase in bank lending and the decline of jobless claims to a four-year low do not support further expansion of the Fed’s balance sheet.

Bottom line: For the time being we see no significant threat on the horizon to the lifespan of the range that 10-year Treasuries have been trading in since August.

Fair value is still likely to drift higher over time, but the fiscal choices the U.S. will make for 2013 could have important implications for the Treasury borrowing requirement. These choices are likely to come at a time when the funds that have continued to flow into the U.S. from abroad could be attracted elsewhere, especially if the European prospect improves. Thus it is too early for a firm view on the interaction of these forces going into next year. At this stage our base case scenario is a change in U.S. tax law resulting in deficits larger than the CBO baseline projection as the next administration seeks to smooth out the impact of deficit reduction on the economy. We expect the fair value of 10-years to drift up to a range of 2.75%–3.05% in 2013, with the odds skewed to the upper part of that range.

… and in Canada

The advent of budget season is attracting attention to provincial public finances. The Commission on the Reform of Ontario’s Public Services recently proposed re-engineering the way health care is delivered. With health care spending growing faster than revenue in all provinces, many of its recommendations should be of interest across the country. The report also reminded investors that the status quo would lead to a probable doubling of Ontario’s budget deficit by 2017-18, to about $30 billion. The commission, chaired by Don Drummond, was not the only voice to present a bleak picture of Ontario’s fiscal future. The Conference Board of Canada released a study suggesting that under current spending programs, Ontario would take until 2021-22 to balance its budget. Although it could be argued that the challenge facing Ontario can be met, a significant effort to curb spending will be required in the next budget. Without that effort, the expected length of the path to budget balance will weigh on rating-agency assessments of the province’s credit. Though DBRS still sounds little inclined to blow the whistle, Moody’s put Ontario on credit watch in December.

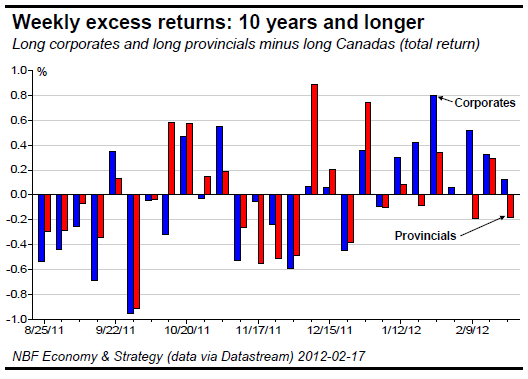

For the time being, we plan to maintain the small underweighting in provincial bonds that we initiated in late January in favour of corporate bonds. From January 25 to February 17, long corporates returned a total of 1.11% compared to 0.16% for provincials and 0.19% for Canadas. Among mid terms, total returns over the same period were 0.95% for corporates, 0.04% for provincials and minus 0.4% for Canadas.

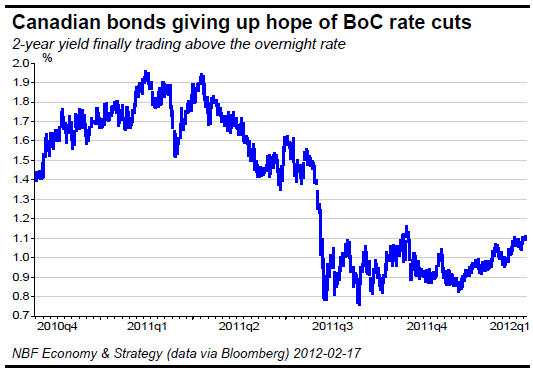

Economists have been arguing for quite some time that the most likely path for monetary policy was an unchanged BoC overnight rate in 2012. This view was not shared by market participants. Late last year and even as late as last month, the market was pricing in significant odds of Canadian rate cuts. Beginning in early February, however, 2-year bonds have been trading consistently above the overnight rate, suggesting that the market has finally come around to the idea that the Bank of Canada will stay on hold for the next 12 months.

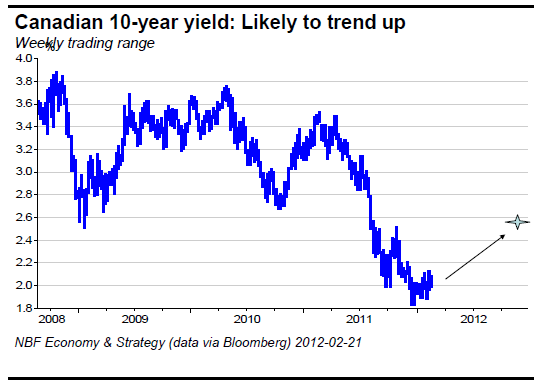

At the long end of the yield curve, we are inclined to think the path of least resistance will be a modest bearsteepening trend in the second half of 2012. This view obviously reflects not only our outlook for the Canadian economy but our belief that developments in the U.S. will not prompt the Fed to expand its balance sheet through another large-scale purchase program. Events in Europe could challenge this base case scenario from time to time.

We are keeping our portfolio duration slightly longer than benchmark by an overweighting of bonds maturing in 4 to 5 years and an underweighting of 1- to 2-years.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

More Central Banks Turn to Easing

Published 02/28/2012, 06:59 AM

Updated 05/14/2017, 06:45 AM

More Central Banks Turn to Easing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.