Risk sentiment softened on Monday and during the Asian session Tuesday, perhaps due to more hawkish remarks by central bank officials.

ECB’s Jens Weidmann said that inflation in the Eurozone is not dead and that he wants to discuss when to end emergency programs adopted to fight the coronavirus pandemic, while Fed Board Governor Quarles hinted that labor participation doesn’t need to return to pre-pandemic levels before raising rates.

USD Rebounds And Equities Slide On Hawkish CB Members

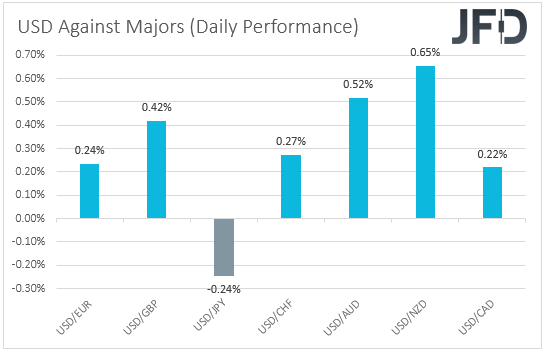

The US dollar traded higher against all but one of the other major currencies on Monday and during the Asian session Tuesday. It gained the most versus NZD, AUD, and GBP, while it underperformed only against JPY.

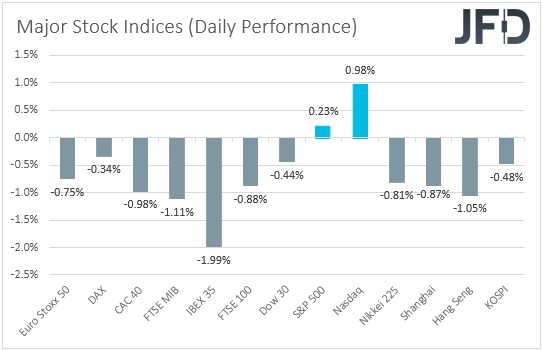

The strengthening of the US dollar and the Japanese yen, combined with the weakening of the risk-linked aussie and kiwi, suggests that markets turned to risk-off yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU indices traded in the red, and although sentiment improved somewhat during the US session, it deteriorated again today in Asia.

In our view, the driver was once again comments by central bank officials. Getting the ball rolling with the Eurozone and the ECB, Executive Board member Fabio Panetta seemed to be in agreement with President Lagarde and Chief Economist Lane that monetary and fiscal policy support should not be withdrawn prematurely.

However, Governing Council member Jens Weidmann said that “inflation is not dead” and that he wanted to discuss when emergency ends from a monetary policy point of view. He believes that running a pandemic emergency plan after the pandemic was over isn’t honest.

Weidmann’s remarks were certainly more hawkish than those of Lagarde, Lane and Panetta, and that’s why European equities may have come under some selling interest.

Later in the day, we heard from Richmond Fed President Thomas Barkin and Fed Board Governor Randal Quarles.

Barkin said that he expects inflation to moderate over time to more normal levels, comments suggesting that he belongs to the camp of those wanting interest rates to stay low for a while longer, but Quarles noted that the labor participation doesn’t need to return to pre-COVID levels, because of baby-boomer retirements.

In our view, this can be translated as seeing the case for raising rates sooner as appropriate. So, with his comments suggesting that he is another member in favor of raising interest rates, perhaps as early as next year, investors may be now becoming more concerned and that’s why risk appetite softened again today in Asia.

As for our view, although we may see equities correcting lower and the dollar strengthening for a while more, we prefer to stick to our cautious stance and wait for more and clearer hints and clues as to how central bank officials intend to move forward.

With that in mind, today, we will get to hear again from ECB President Christine Lagarde and ECB Governing Council Jens Weidmann. Although we already know their views on monetary policy, we may get more precise remarks on what may be the next moves of the Council as a whole.

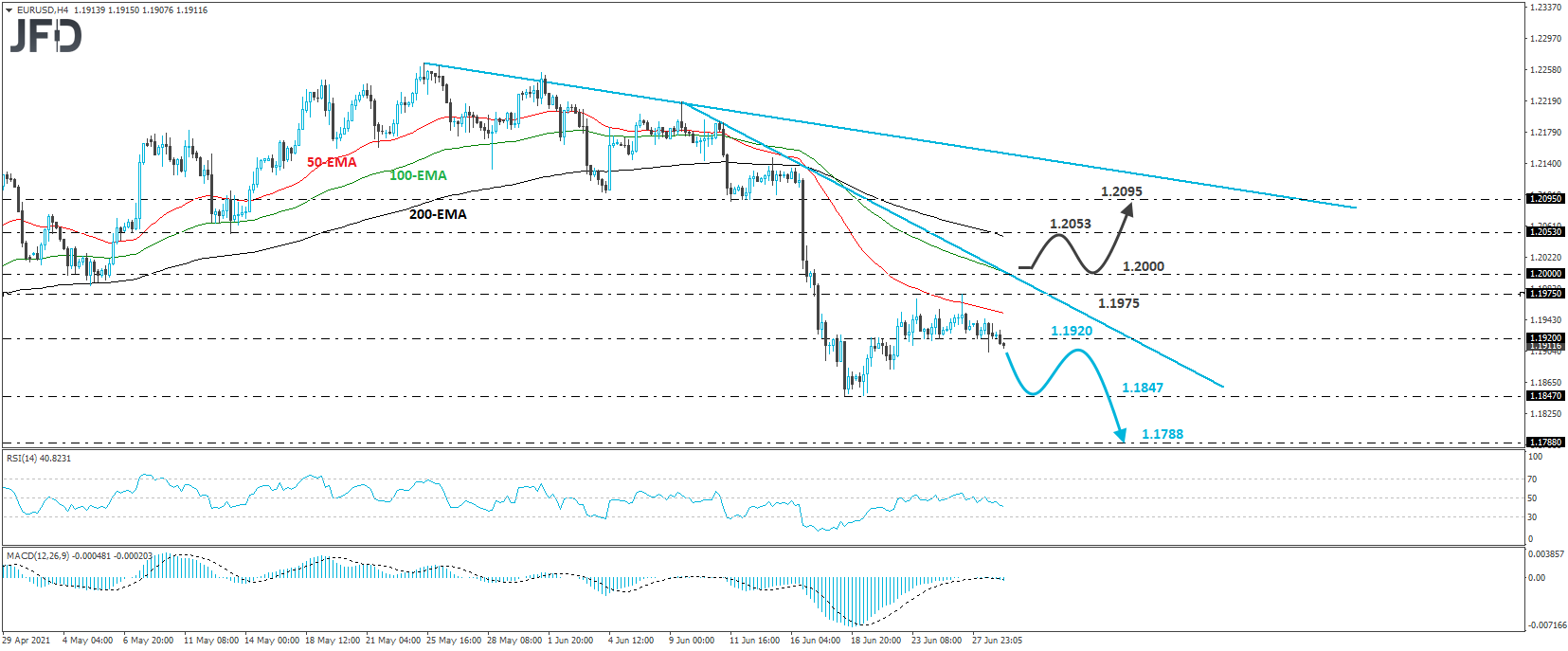

EUR/USD - Technical Outlook

EUR/USD traded slightly lower yesterday, briefly breaking below the 1.1920 support zone. Overall, the pair continues to trade below the downside resistance line drawn from the high of June 9, and that’s why we will consider the short-term outlook to still be negative.

At the time of writing, the rate was back below the 1.1920 barrier, a move that may have opened the path for another test near the 1.1847 area, defined as a support by the lows of June 18 and 21.

If the bears are not willing to stop there, a break lower would confirm a forthcoming lower low and may see scope for extensions towards the 1.7788 hurdle, marked by the inside swing high of Apr. 2.

On the upside, we would like to see a recovery back above 1.2000 before we abandon the bearish case, at least in the short run. This may encourage the bulls to push the action towards the 1.2053 obstacle, marked by the inside swing low of May 13, the break of which could extend the recovery towards the inside swing low of June 11, at 1.2095, or towards the downside resistance line taken from the high of May 25.

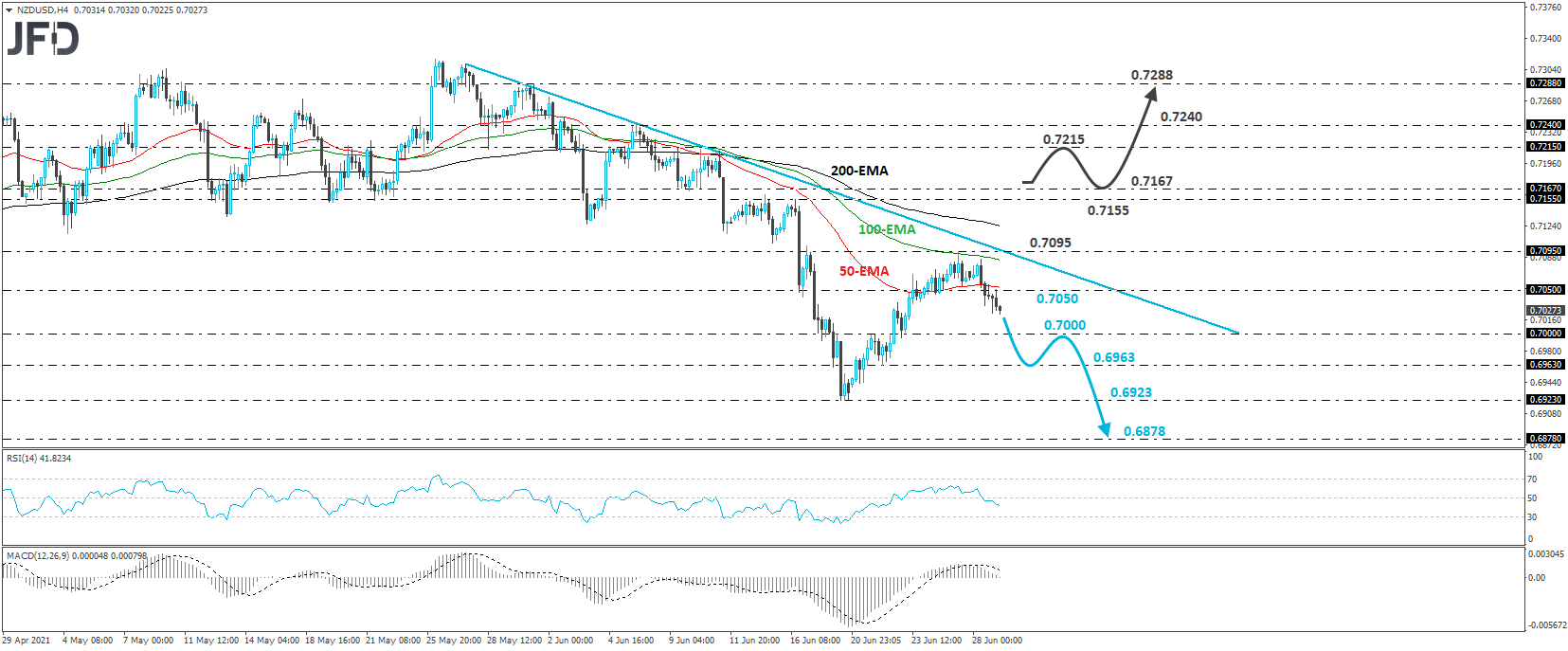

NZD/USD – Technical Outlook

NZD/USD traded south as well yesterday and today in Asia, breaking below the 0.7050 area. Despite the decent recovery between June 18 and 25, the pair continues to trade below the downside resistance line taken from the high of May 27, something that keeps the short-term bias to the downside in our view.

We believe that the dip below 0.7050 may have paved the way towards the psychological zone of 0.7000, where another break may extend the slide towards the low of June 22, at 0.6963.

If that barrier is not able to stop the slide either, then we may see extensions towards the low of June 18, at around 0.6923. Another break, below 0.6923, would confirm a forthcoming lower low and perhaps set the stage for the lows of November 18 and 19, near 0.6878.

In order to start examining whether the outlook has turned positive, we would like to see a break above 0.7167. The rate would already be above the aforementioned downside line, and perhaps above all of its moving averages on the 4-hour chart. This may allow advances towards the 0.7215 zone or the 0.7240 barrier, defined as resistances by the highs of June 9 and 7 respectively.

If the bulls are not willing to stop near neither of those areas, then the advance may get extended towards the 0.7288 territory, marked by the high of June 1.

As For Today's Events

During the European session, Germany’s preliminary inflation data for June is due to be released. Both the CPI and HICP rates are forecast to have declined to +2.3% yoy and +2.1% yoy from +2.5% and +2.4%, respectively, something that may raise speculation that Eurozone’s headline inflation, due out tomorrow, may slow down as well.

Later in the day, from the US, we get the Conference Board consumer confidence index for the same month, which is expected to rise to 119.0 from 117.2.

With regards to the energy market, we have the API (American Petroleum Institute) report on crude oil inventories for last week.