For all the negative news over the past 24 hours markets have been trading broadly sideways so far this week. The big news overnight was the ratings agency Moody’s cutting the outlook on the Netherlands, Luxembourg, and most importantly Germany. While this is not a ratings cut, it means that the agency is looking to cut ratings going forward, contingent on a number of factors. This leaves Finland as the only AAA rated country in the Eurozone with a still stable outlook. Finland is the one country that asks for collateral to be posted against its contributions to bailouts and this is the likely reason.

The main reasons for the downgrade are fears over a Greek exit, plus the likelihood that further payments will have to be made from the core to the periphery, in order to shore up the latters’ finances. We heard from the German economy minister over the weekend that the “horror” associated with a Greek exit had diminished in recent weeks and this, alongside chatter that the IMF will not fund the Greeks anymore, has put markets once again on a timeline for a September default. The obvious fear here is contagion and the effects on Italy and particularly Spain.

The troika visits Greece today to discuss just how badly the country has missed its deficit reduction targets. As we said yesterday, Greece is also asking for an additional round of bailout funding totalling somewhere around EUR50bn; this is last chance saloon type stuff for Greece and we still hold firm on our belief that Greece will leave the single currency in early 2013.

It was all about Spain though yesterday with economic data compounding travails in bond markets. The Bank of Spain, who had previously revised 2013 growth expectations lower, released the latest estimate of Q2 GDP. This came in at -0.4% lower than Q1’s and threw Minister de Guindos’s assertions that Spain will be fine because it is growing, straight in the gutter.

The news from Moody’s has done nothing to help bond movements overall. 10yr rates hit a high of over 7.5%, way past normal levels that see a bailout from the authorities and there was pressure all along the curve with the yield on the 5yr now more than that of the 10. What this means briefly is that Spain is having to pay more money to borrow in the short term than in the long term which is a classic sign of an upcoming recession and funding issues. It’s almost poetic that Spain has a 3 and 6 month bill auction later today.

China was able to halt the overnight slide briefly by releasing its latest PMI reading for the manufacturing industry, that showed an uptick (49.5) against the previous figure of 48.2. Although still in contraction, it was viewed as a slight positive, but it has not been enough to stop the risk aversion in its tracks; one manufacturing figure cannot trump a debt crisis.

PMIs from the Eurozone are due throughout the morning with particular focus on France’s and Germany’s numbers.

We regularly talk about “turnaround Tuesday” and I think that today could be a classic example of a bit of a short squeeze on those looking for euro annihilation. A rising EURUSD would drag GBPUSD with it although GBPEUR would be set for a move back towards 1.27. GBPUSD was well supported at 1.55 yesterday and we hope it can base here for a move higher through the week.

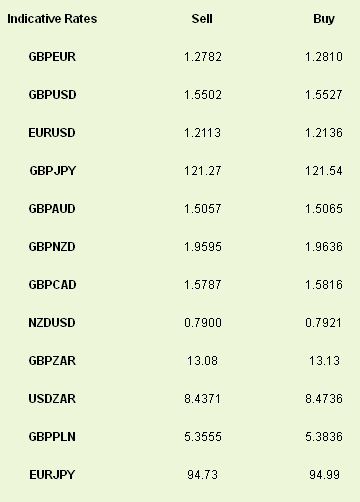

Latest exchange rates at time of writing

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI