USD not far from peak

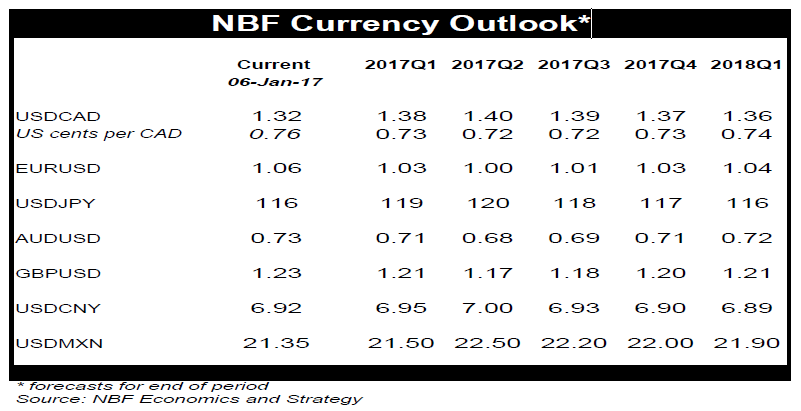

- Still-favourable yields mean the trade-weighted US dollar has room to run over the near term. Abovepotential U.S. GDP growth over the next couple of quarters and a resilient labour market could have markets price more rate hikes over the coming months than the two they currently expect for this year. But the USD rally could run out of steam by the second half of the year if, as we expect, the Fed tones down its hawkish message as it assesses risks posed by past USD appreciation. We are leaving our currency forecasts largely unchanged this month.

- Some of the forces that propelled the Canadian dollar last year, such as foreign portfolio inflows, are set to fade. The persistence of soft oil prices and the Bank of Canada's dovish rhetoric could cause a further widening of U.S.-Canada interest rate spreads. The large current account deficit is also a concern for the loonie, more so considering it is being financed entirely by short term foreign capital flows which can reverse on a whim. We continue to expect USDCAD to head towards the upper end of the 1.30-1.40 range by mid-year, before coming back later in 2017.

US dollar extends winning streak …

The trade-weighted US dollar managed to appreciate for a fourth consecutive year in 2016, cumulating gains since end-2012 to almost 30%, the biggest four-year jump ever recorded.

To read the entire report Please click on the pdf File Below