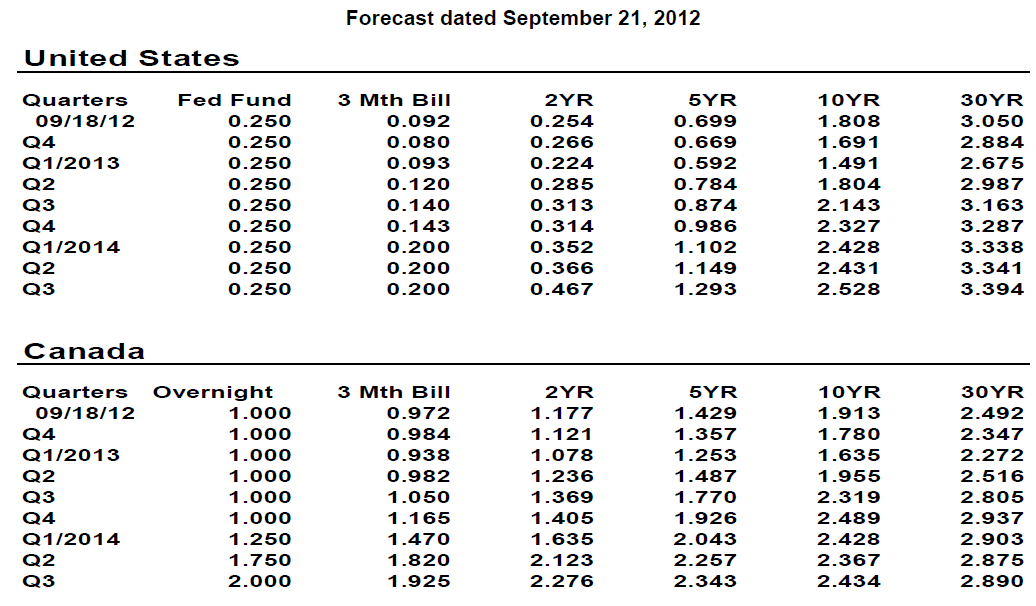

With only three months left in 2012, it would be surprising if the U.S. labour market outlook improved fast enough to satisfy the FOMC. So the odds are that the asset-purchase program will extend into 2013. In Europe, Spain remains a challenge. Yet on the back of the ECB commitment and the German Constitutional court ruling, Spain is now able to borrow at a decent rate in the front end of the yield curve. In that context, safe-haven flows to U.S. Treasurys are likely to taper off.

Yet, our GDP growth forecast of less than1% in early 2013 leads us to believe that 10-year Treasurys will trade below 1.60% before breaking above their current 200-day moving average of 1.83% to trade mostly between 2.0% and 2.5% in the second half of 2013. We see the economy closing the year on a stronger note (+3.1%, Q4/Q3).

In light of slowing economic momentum in Canada, together with the FOMC’s open-ended QE3 and its guidance extending its low-rate outlook to mid-2015, the Bank of Canada’s urge to withdraw some monetary stimulus must have diminished. We now see no tightening by the Bank before Q1 2014.

Two steps forward

In late August there was still much uncertainty about Europe. Markets were waiting for Germany’s Constitutional Court to rule on the ESM. No details were available regarding ECB president Mario Draghi’s commitment to “do whatever it takes” to protect the eurozone from collapse. Fear that September elections in the Netherlands would bring anti-Europeans to power was rampant.

At the time, we were mostly concerned by article 10 of the ESM treaty regarding changes in authorized capital stock. This article reads as follows:

The Board of Governors shall review regularly and at least every five years the maximum lending volume and the adequacy of the authorised capital stock of the ESM. It may decide to change the authorised capital stock and amend Article 8 and Annex II accordingly. … [emphasis added] In our reading, the Board’s authority to change the authorized capital of the ESM violated the spirit of the German constitution. Fortunately, the Constitutional Court, instead of simply ruling against ratification of the treaty, approved its implementation on the following conditions:

(1) Germany’s liability cannot exceed €190 billion ($246 billion) without the authorization of the Bundestag (federal parliament), even if other interpretations of the ESM treaty language are possible.

(2) Assurance must be given that professional secrecy required of ESM board members and employees will not interfere with the Bundestag's right to information. In other words, the Court ruled that article 10 was not acceptable but the ESM treaty could be ratified with proper amendment.

According to Der Spiegel magazine, both conditions have been addressed in a declaration to be signed by the European Union ambassadors of the 17 eurozone countries. The declaration is to clarify that a country's maximum liability established in the treaty can be exceeded only with the permission of that country's parliament. The declaration will also strengthen the rights of parliaments to obtain information from ESM. Thus it appears most likely that the European Stability Mechanism (ESM) will finally be put in place this fall.

Meanwhile, the ECB has now provided some details of its outright monetary transactions (OMT) program. This program provides that the ECB may purchase an unlimited quantity of 3-year or shorter bonds in the secondary market. Though ECB support will be subject to strict conditionality, the pieces of the puzzle are falling into place and an adequate firewall (ESM+OMT) should be soon in place.

That will be a major step in the right direction. The bond market, not waiting for its realization, reacted with a significant downward shift in the Spanish yield curve. Three-year bonds, having traded as high as 7.79% on July 25, closed September 21 at 3.64%.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monthly Fixed Income Monitor: Poor Outlook For US Labor Market

Published 10/04/2012, 03:14 AM

Updated 05/14/2017, 06:45 AM

Monthly Fixed Income Monitor: Poor Outlook For US Labor Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.