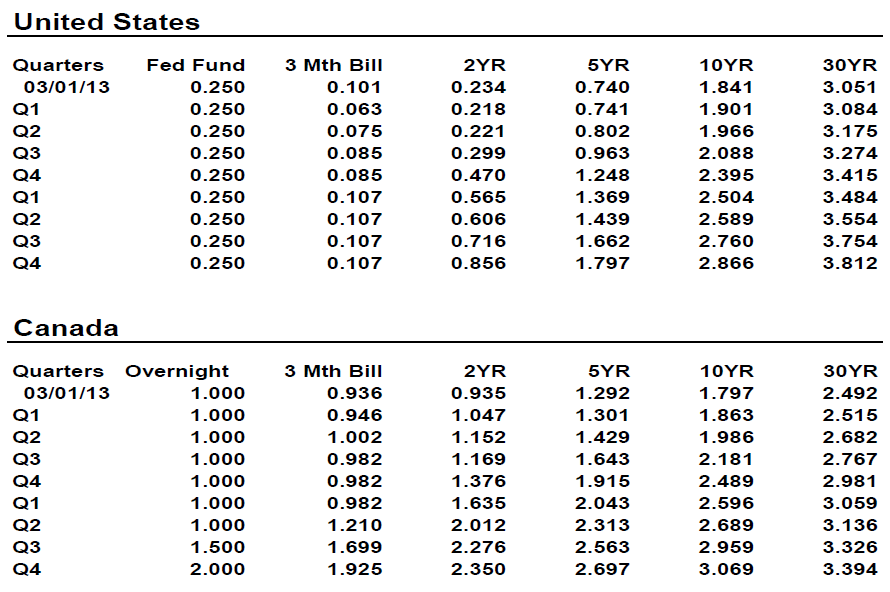

- In our view, given the efficacy, costs and risks of the Fed’s long-Treasury purchase program, the FOMC will look for opportunities, as the minutes put it, to “taper or end” these purchases sooner rather than latter. We think GDP growth will show enough momentum to allow the Fed to do so by the end of this year. We see 10-year Treasuries trading at about 2.40% by year end.

- We now see the Bank staying on the sidelines in 2013 and raising rates only in the third quarter of 2014, instead of March of that year as we previously foresaw. We expect the Canada 10-year yield to be trading just under 2.50% by year's end, as it will follow the lead of U.S. Treasuries. This scenario assumes that fears concerning convertibility or redenomination risk in the eurozone bond market will not return to center stage.

Canadian bond market:

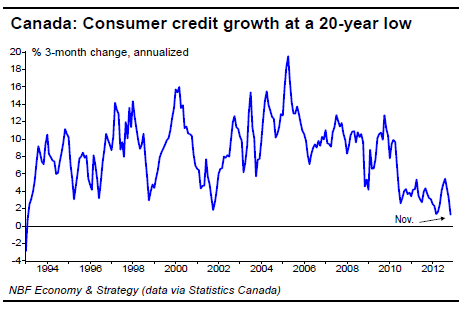

A 2013 outlook with little promise: Canadian retail sales fell a stunning 2.1% in the last month of 2012. These results were so weak that they left December sales down 0.7% from a year earlier, the first 12-month contraction since 2009. The weakness reflected a sharp deceleration of consumer credit growth.

The retail report added to evidence that Canada ended the year poorly. Together with drops in real wholesaling and manufacturing reported earlier, the slide in retail volume makes for a triple whammy that resulted in a December monthly GDP contraction of 0.2%, the worst showing since last February. That makes Q4 the second quarter in a row of GDP growth below 1% annualized. The output gap (the difference between actual and potential GDP) has been widening for nine months now, and recent indicators suggest that the economy is unlikely to gain enough momentum to narrow the gap in Q1.

Moreover, our economic forecast and expectations of provincial fiscal discipline point to a slight rise in the unemployment rate over the coming 10 months, to 7.4% from 7.0%. Such a development would preclude an early reversal of the Bank of Canada’s accommodative monetary policy stance.

To Read the Entire Report Please Click on the pdf File Below.