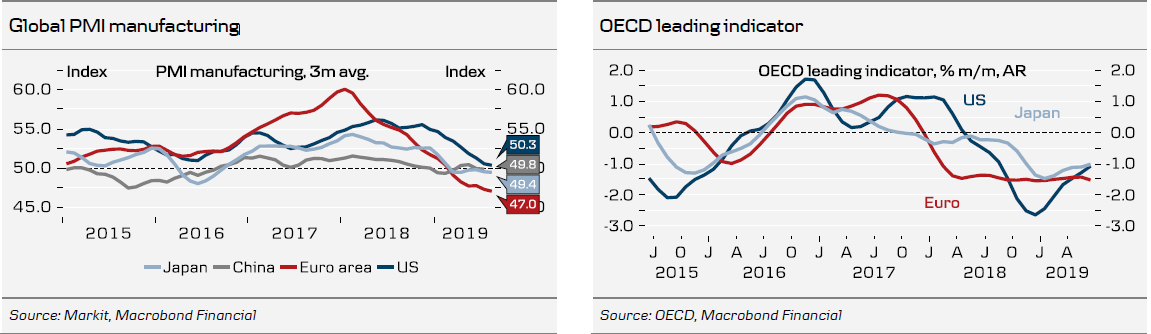

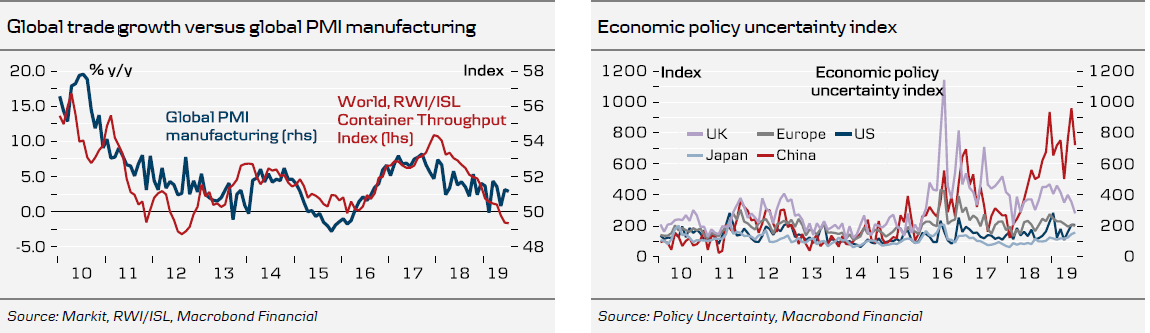

The global macroeconomic backdrop has weakened significantly since we published The Big Picture – Renewed trade dispute casts shadow over global economy on 11 June. The escalation of the trade war between China and the US means our new base case is there will be no trade deal ahead of the US presidential election next year. Hence, we have updated our economic forecasts for the US, China, the eurozone, Germany, Japan and several emerging markets. On aggregate, we downgrade the outlook for the global economy in coming years (see Global Economic Update – Stuck in the mud but no hard landing yet, 22 August). We have lowered our growth outlook, expecting global growth to be 3% in 2019, followed by a slight pickup to 3.2% in 2020 and 3.3% in 2021 (versus 3.2% in 2019 and 3.4% in both 2020 and 2021 previously). The risk of a more pronounced downturn has increased. However, in our view, there is also possible upside from a sudden breakthrough in US-China trade negotiations, more aggressive central bank easing and still strong consumer confidence.

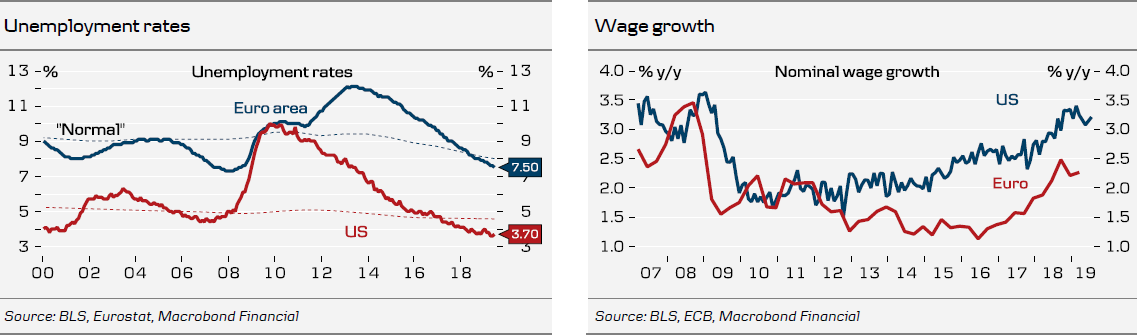

We have seen a more significant US 2s10s yield curve inversion, as investors still fear the US will fall into a recession one to two years down the road. However, near term, the probability of a US recession seems low. US consumers are quite upbeat. ‘Current situation’ jumped to a new cycle high and, while the expectations component fell, it remains relatively high (at the same level as the averages in 2017 and 2018) and significantly higher than in early 2019. Consumer confidence is not the best leading indicator but a recession needs some element of negative animal spirits, which is not present, at least not yet. The consumer side of the US economy still looks solid but manufacturing is struggling.

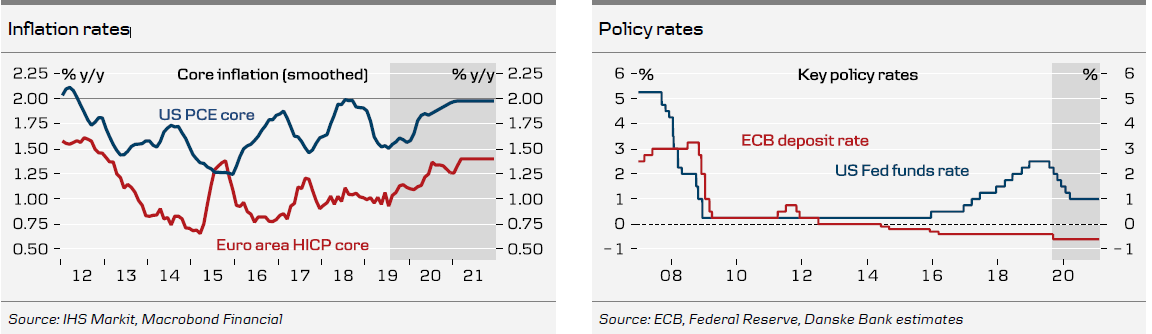

We have changed our Fed call. We now expect the Fed to deliver five more 25bp rate cuts, taking the target range to 0.75-1.00% at the March meeting. We still do not expect the Fed to pre-commit to more easing but believe that it will stick to its current ad hoc approach. For details see FOMC Research – New Fed call: five more from Fed, 15 August. Fed Chair Jerome Powell recognised at the annual Jackson Hole monetary policy conference that global uncertainty has risen and global growth slowed further since the initial cut in July.

Macro charts overview

With respect to Brexit, the recent development has led us to change our view (see Brexit Monitor – More complicated, but not impossible, to block no-deal Brexit, 29 August). Our new Brexit base case is that a small majority in the House of Commons will eventually bring the Boris Johnson government down, form a temporary government, ask the EU 27 for an extension and call for an election once the extension is granted (40%). We want to stress that uncertainty is high and this is not a high conviction call. The likelihood of a no-deal Brexit has also increased on the back of the prorogation, as it limits the possible ways for politicians to block it (30%). We also note the positive developments between the UK government and the EU and think the probability of a Brexit deal passing has increased to 20%. Our old base case with an outright extension without an election seems like the less likely scenario now (10%).