Investing.com’s stocks of the week

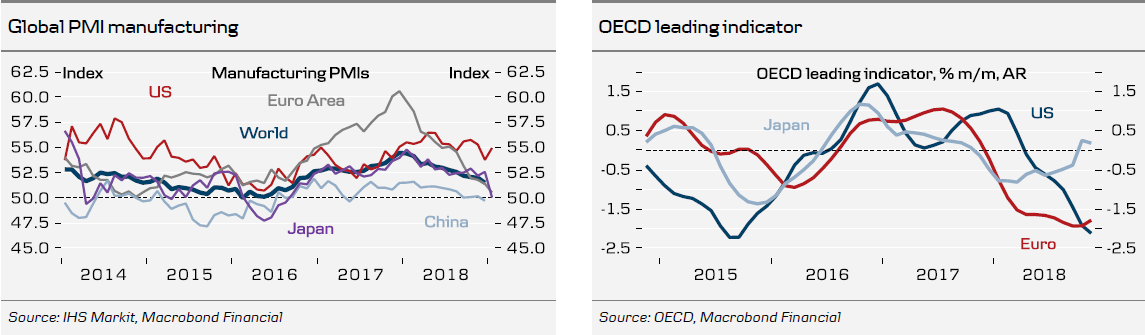

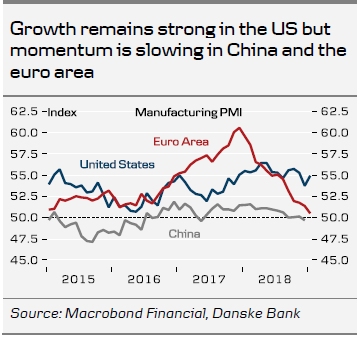

After a dismal end to 2018, parts of the global economy are showing rays of light. In both the US and China, manufacturing PMI rose slightly in January compared with December. Hence, despite the global manufacturing slowdown and the government shutdown in the US combined with the US-China trade tensions, the US economy looks in decent shape. In China, the export component of the official PMI manufacturing survey rose slightly in January. The level for the PMI still points to weak growth in China in Q1 but we see some tentative signs of stabilisation.

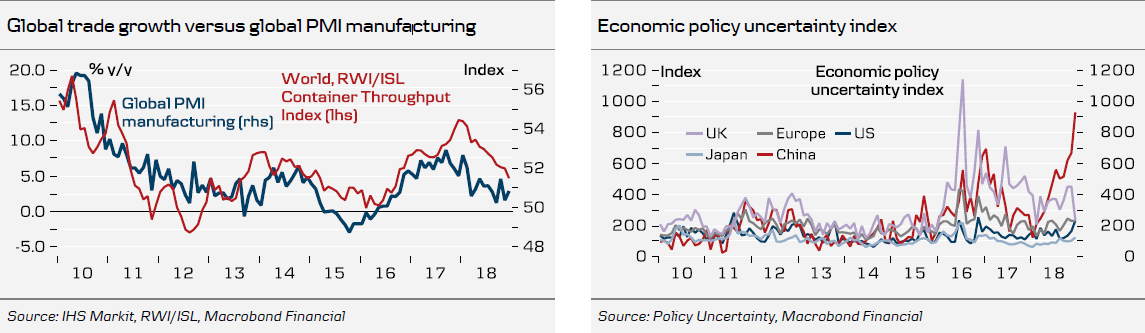

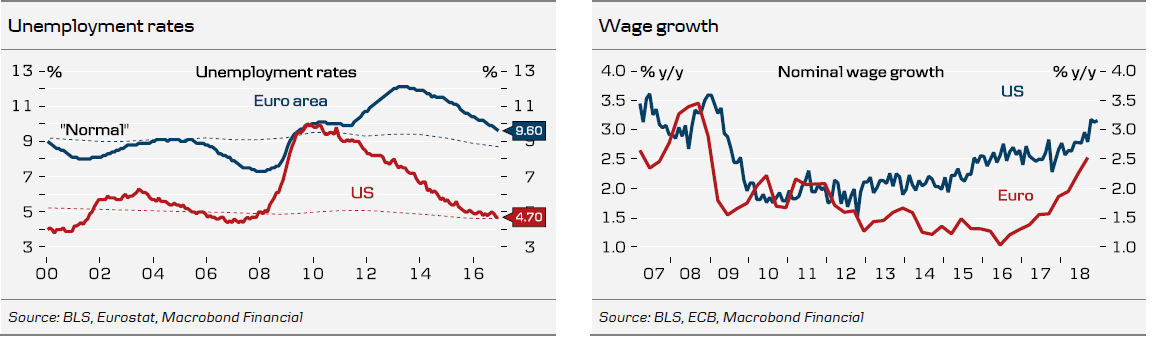

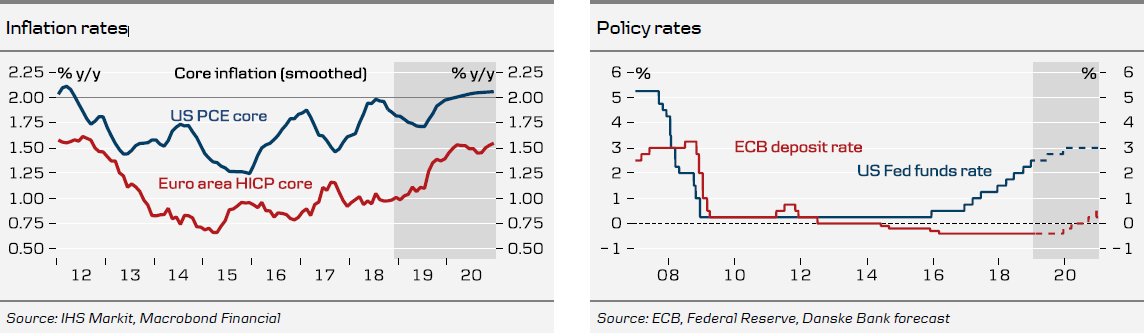

On the other hand, the economic performance of the euro area continues to look weak. Q4 GDP of 0.2% q/q confirmed a lacklustre growth finish in 2018 and macro data continues to point to a tough start for the euro area economy in 2019. PMIs eased further in January to the lowest level since 2014, with no rebound yet in sight, while the German Ifo index slipped into slowdown territory for the first time since 2012 (see also Research Germany – The epicentre of the euro area slowdown, 27 January). While the global economy is painting a mix picture, we still look for a moderate recovery later in the spring. China has provided a lot of stimulus through monetary policy easing and more infrastructure investments – and the government has signalled further stimulus in the form of major tax cuts. We expect a turn in the Chinese cycle to provide an improvement in the demand for other emerging markets as well as for Europe. In addition, we expect lower headline inflation from the fall in oil prices to lift consumers’ disposable income, particularly in the US.

Much hinges on resolving the trade dispute between the China and the US. This week, a high-level delegation from China is visiting Washington to lay the ground for a deal ahead of the 90-day deadline for end-February. Signals from the discussions have been positive lately but difficult structural issues need to be tackled, such as protection of intellectual property rights, forced technology transfer and non-tariff barriers as well as the enforcement of the deal. Our base case remains that two sides will agree on a trade deal, putting a probability of 75% on a trade deal by the end of Q2.

Amid the uncertain global outlook, major central banks have adopted a more cautious tone lately. The ECB flagged downside risks to its growth forecast at its last, hinting that it will reassess the implications of the slowdown for monetary policy at the March meeting. Similarly, the Fed has clearly signalled a more cautious approach with regard to further rate hikes and balance sheet reduction. However, based on our positive macro outlook for the global economy (and hence markets), we still expect the Fed to hike this year and the ECB to raise its deposit rate by December. However, uncertainty about these calls has increased due to the current uncertain global outlook.

A major political risk stems from the unresolved Brexit discussions between the UK and the EU. On 29 January, a majority in the UK parliament supported May's Brexit deal provided that a new deal with the EU can be struck on ‘alternative arrangements’ for the backstop. Uncertainty remains high and time is limited but overall we still think that May’s deal (or something very similar) will pass eventually (40% chance) and the second most likely outcome is a second EU referendum (30%). For more details, see Brexit Monitor: May has two and half weeks to renegotiate the backstop, 30 January.

Macro charts overview