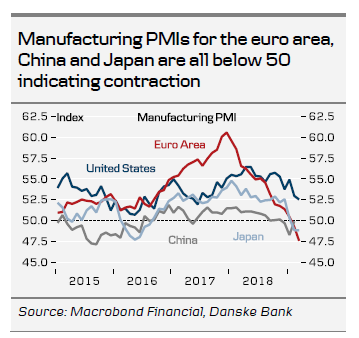

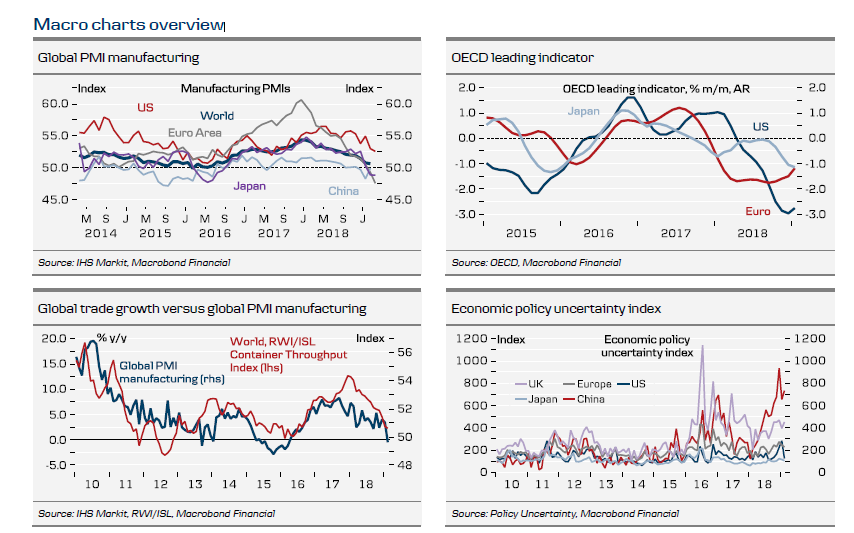

Global economic momentum remained fragile in March and recession fears made a strong comeback in markets , as the global manufacturing cycle shifted further into lower gear. Despite encouraging signs of strengthening domestic demand, spring has not yet arrived for the Eurozone economy and the ground remains particularly frozen in Germany's industrial sector (see here ). Brexit uncertainty has been an important headwind for Europe as of late and while the risk of a no-deal Brexit has decreased following the EU leaders' decision to extend the deadline to 12 April, it has by no means disappeared as the UK parliament remains deadlocked in its search for a way forward (see here ). Amid the already abundant uncertainties for the euro area outlook, another risk factor has resurfaced with the threat of US tariffs on European cars. That said, at the current stage we still attach a relatively low probability of them coming into effect near term.

A US-China trade deal in Q2 remains one of the key building blocks for our expectation of a rebound in the global economy. Although progress in the negotiations seems to have stalled as of late on the tricky question of enforcement mechanisms, this is not unusual as we are entering the final 'rocky' stage and we still expect a deal to be signed at a US-China summit in the coming months (both April and June have been mentioned). Meanwhile, signals that the Chinese economy is bottoming out in Q1 are getting more frequent and fiscal easing through VAT cuts should further support the recovery ahead.

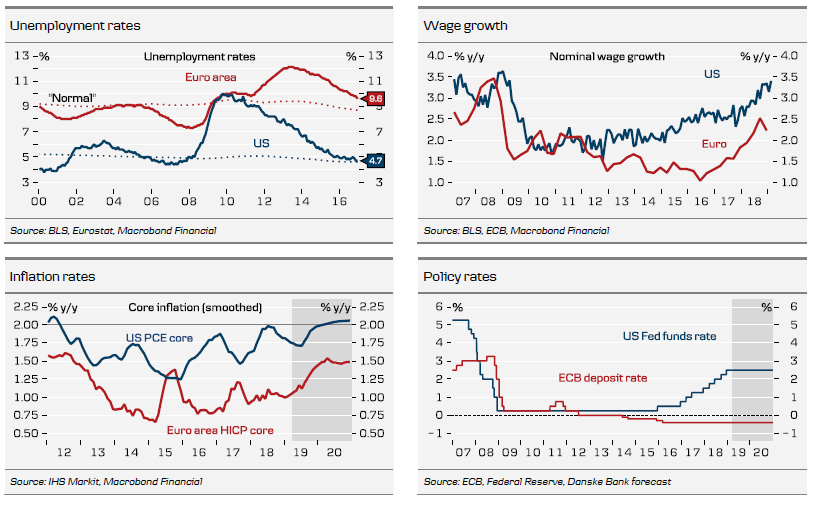

Following a string of disappointing data, central banks on both sides of the Atlantic are shifting course towards a more dovish direction. The ECB has become increasingly worried about a structural slowdown of the Eurozone economy and the side effects of a prolonged period of negative rates (see here ). It has opened the door for further easing by extending its forward guidance (rates remaining at present levels 'at least through the end of 2019') , while also announcing another liquidity operation (TLTRO3) to spur lending growth to the real economy. In light of this, we now forecast no interest rate changes to any of the ECB's policy rates within the next 12 months. The ECB was not the only major central bank to perform a dovish tilt. Similarly, the Fed shifted gear, now signalling no rate hikes this year and just one hike in 2020, while the balance sheet run-down will already stop in September. We have not experienced the Fed pausing for a prolonged time and then resuming the hiking cycle and hence we no longer expect the Fed to hike this year either (see here ).

The dovish tilt from central bankers, however, did not dispel markets' increasing worries about the global cyclical outlook. 10Y German Bund yields moved below zero and in the US, the yield curve started to invert, with the 10Y Treasury yield falling below the 3M (NYSE:MMM) rate for the first time since 2007. Although such an inversion historically has coincided with recession hitting within 18-24 months, the yield spread itself does not trigger an economic downturn and while the US industrial sector seems to have hit a rough patch - not being immune to global developments - we still think the US economy overall is in good shape and remains supported by fiscal stimulus this year.

Near term we project a continued environment of low rates and flatter curves, while we see potential for a wider 'ECB easing risk premium' to weigh on EUR/USD in the short term.