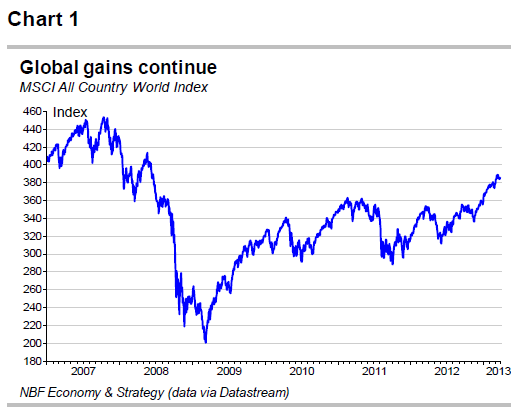

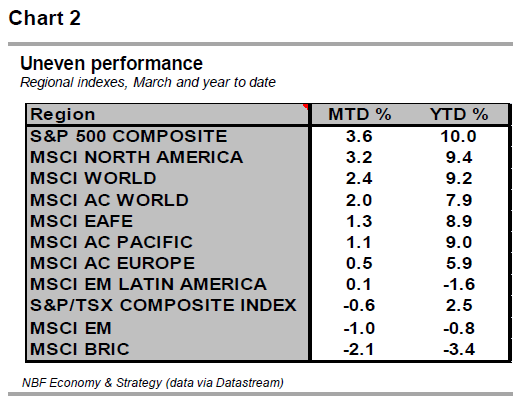

The world’s equity markets advanced further in March. The MSCI All Country index rose 2.0%, a fifth straight monthly gain. It is now up 24% from last June. However, gain was not broad-based. Much of it was due to a 3.6% surge of the S&P 500. Emerging markets, especially the BRIC countries, ended the month down considerably. The Canadian market once more lagged the global index.

look To U.S. Private Sector

We remain comfortable with our recommendation to overweight U.S. equities relative to our benchmark. In our view, the U.S. is one of the few countries where the private sector has room to increase leverage in support of growth -- enough to fully offset the drag of fiscal austerity. For the first time in this cycle, consumers are getting a boost both from the labour market and from the wealth effects of a rising stock market and rising property values.

As events in Cyprus have shown, the euro zone remains in a parlous state. Small as Cyprus may be, we think its plight has further undermined confidence in the euro zone. In the coming weeks it will be important to monitor bank deposits in the countries that are going through hard times. We do not exclude the possibility that a combination of poor economic conditions and mistrust of banks will cause outflows to resume.

Q4 earnings in Canada lacked lustre. As in the U.S., Financials did well. But the profits of Canadian nonfinancials slipped 16.3%, with major retreats in Energy, Materials and IT. This showing was distinctly worse than the expectations. U.S. nonfinancials, meanwhile, beat expectations with earnings growth of 2.0%.

We leave our asset mix unchanged this month at our benchmark allocation of 55% equities and 40% fixed income. U.S. economic growth seems to be picking up against a backdrop of low inflation and supportive monetary policy. The euro zone remains a basket case, a lacklustre economy where credit continues to contract for both businesses and households. We remain wary of the potential of the Cyprus episode to sap confidence in the monetary union.

Q1 Ends On High Note …In The U.S.

The world’s equity markets advanced further in March. The MSCI All Country index rose 2.0%, a fifth straight monthly gain. It is now up 24% from last June (chart1).

However, the March gain was not broad-based. Much of it was due to a 3.6% surge of the S&P 500 (chart 2). Emerging markets, especially the BRIC countries, ended the month down considerably.

The Canadian market once more lagged the global index. At close of trading March 28 it was up 2.5% year to date while the All Country World index was up 7.9%

U.S. Is Still Place To Be

The S&P 500 ended March at an all-time high of 1569 (chart). The U.S. benchmark index has been buoyed in recent months by an improving economy and by yet another round of quantitative easing from the Federal Reserve. Yet even after its latest push, its ratio of price to forward earnings is only about 14, slightly below the long-term average of 15.3 (chart 3).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monthly Equity Monitor: Where To Stash Your Cash

Published 04/04/2013, 10:25 AM

Updated 05/14/2017, 06:45 AM

Monthly Equity Monitor: Where To Stash Your Cash

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.