- Europe remains the world’s weakest link as the euro zone tries to manage an increasingly difficult polarization of the economic and financial landscape within its borders. After more than two years of stress from sovereign-debt problems, particularly those of Greece, Portugal, Ireland, Spain and Italy, a true resolution has yet to be found. Governments have been forced into serious austerity, but the result has been serious braking of the European economy, especially in countries forced into government deleveraging.

- Dynamics in capital markets seems to be showing signs that central banks will continue to be active in promoting an easing in financial conditions. In the advanced economies, central banks have exhausted the working ability of traditional policy tools at their disposal. As a result going forward only alternative methods of stimulus can be promoted.

- The current soft patch in the U.S. will crimp the organic growth of corporate top lines. Our proxy for the sales revenue of S&P 1500 companies points to a slower 12-month gain in Q2. Current observations suggest that seasonally adjusted sales in Q2 were down from Q1. That would be the first quarter-to-quarter contraction since 2009.

- Market expectations for profitability are once again turning sour in response to earnings downgrades, affecting both the S&P 500 and the S&P/TSX.

- At this writing, bottom-up price forecasts for the TSX Composite are in our opinion overoptimistic. The consensus estimate suggests that the Canadian index will be trading just above 14,400 in 12 months, up about 25% from today. Since we think the international landscape is likely to get worse before it gets better, we see the consensus outlook for the next 12 months as overoptimistic.

- With the weakness in the price of commodities over the past couple months combined with worst than expected economic activity in North America for Q2, we are reducing the Canadian S&P/TSX Composite earnings estimate for year-end from 925 to 850. Based on a trailing P/E of 13.5 we are revising down our 2012 year-end price target of 12,720 to 11,500.

Market participants enter the second half of the year,facing a challenging outlook. Much has happened over,the last few months but little has changed. Europe,remains the world’s weakest link as the euro zone tries,to manage an increasingly difficult polarization of the,economic and financial landscape within its borders.,After more than two years of stress from sovereigndebt,problems, particularly those of Greece, Portugal,,Ireland, Spain and Italy, a true resolution has yet to,be found. Yes, governments have been forced into,serious austerity, but the result has been serious,braking of the European economy, especially in,countries forced into government deleveraging. The,implication is that lower growth potential has become,a structural issue, not a short-term phenomenon. The,challenge for the euro zone is to create a system in,which monetary union is bolstered by fiscal unification,,leading ultimately to improved prospects for the zone,and its trouble spots.

G20 meeting boosts IMF resources

All leaders present at the recent G20 meeting, which,focused on the euro-zone challenge, recognized that,Europe must be strengthened to avert another global,recession. Some necessary measures have been,announced, the most noteworthy being extra firepower,for IMF lending. The $456 billion in additional funds,pledged will almost double the organization’s lending,capacity. However, more than half the pledge is from,the European Union, and almost $200 billion of that is,from euro-country governments. Neither the U.S. nor,Canada made a contribution.

Show us the money

Dynamics in capital markets seems to be showing,signs that central banks will continue to be active in,promoting an easing in financial conditions. Over the,past couple years much market strength has been,supported by monetary policy stimulus and new,injections of liquidity towards the financial system.

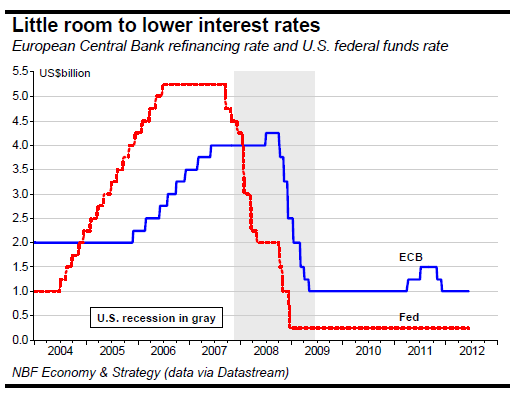

In the advanced economies, central banks have,exhausted the working ability of traditional policy,tools at their disposal. Both the ECB and the Federal,Reserve have allowed interest rates to fall to,unprecedented levels as these institutions attempted,to put forth their best hand to support economic,activity. As a result going forward only alternative,methods of stimulus can be promoted.

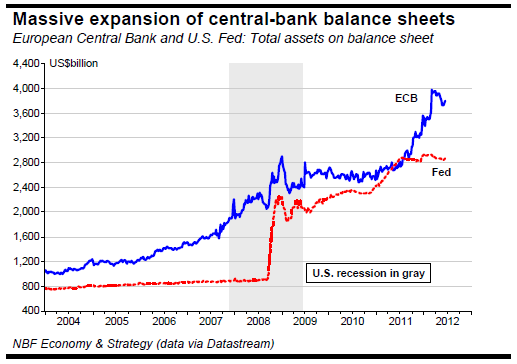

With developed economies yet to gain the desired,traction, both the ECB and the Fed have consistently,focused on dramatic expansion of their balance-sheet,assets by means of lending operations and asset,purchases. Given the poor growth outlook of the,advanced economies, more expansion of the monetary,base can be expected.

For now, the FOMC has extended Operation Twist, its,program to lengthen the average maturity of the,securities it holds. The Committee intends to buy,another $267 billion in Treasuries maturing in 6 to 30,years and sell or redeem an equal volume maturing,in approximately 3 years or less. The operation will,exhaust the Fed’s holdings of short-term securities,,and thus its ability to twist again, by the end of 2012.

To Read the Entire Report Please Click on the pdf File Below.