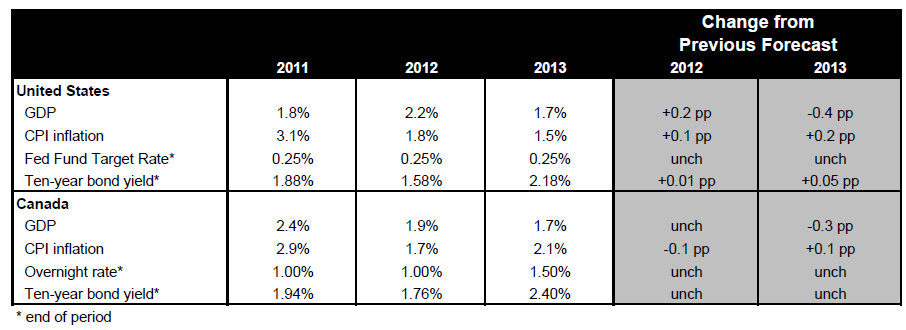

- Investor fears have subsided recently, notably with regard to the eurozone crisis. The ECB has managed to ease financial pressure on the government of Spain, but much remains to be done to equip the zone to get out of the woods and stay out. Though the GDP contraction in Q2 wasn’t as bad as feared, the worst isn’t over in the zone. The eurozone economy is likely to deteriorate further in Q3 if the PMI data for the quarter is any guide. Economic doldrums are not confined to Europe at this point. The great majority of countries are having difficulties.

- Various indicators of manufacturing activity, including weak orders, suggest an extension of sub-2% US growth into Q3. Beyond that, there’s little relief in sight, with America getting closer to the edge of the fiscal cliff. The related uncertainties will crimp the economy in the second half of the year. Moreover, the new Congress elected in November may not be able to act in time to save Q1 from the effect of automatic tax hikes and spending cuts.

- Soft U.S. growth has meant similar sluggishness in Canada. The second half of the year isn’t looking any better. US woes will limit trade’s contribution to GDP growth this year and next. Domestic demand will also be constrained not just by government, but also by a moderation in housing that’s likely to worsen as the full impacts of the new mortgage rules are felt. Labour market weakness will add to the burden for consumers. All told, growth should remain tepid at best over the next little while, leaving the output gap open for much longer than what the Bank of Canada is currently anticipating.

World: Waiting for a rebound

Investor fears have subsided recently, notably with regard to the eurozone crisis. The ECB has managed to ease financial pressure on the government of Spain, but much remains to be done to equip the zone to get out of the woods and stay out. Though the GDP contraction in Q2 wasn’t as bad as feared, the worst isn’t over in the zone. The eurozone economy is likely to deteriorate further in Q3 if the PMI data for the quarter is any guide. Economic doldrums are not confined to Europe at this point. The great majority of countries are having difficulties.

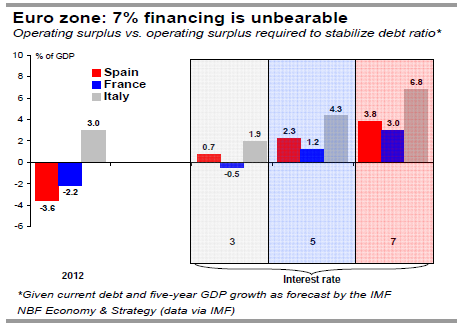

In July Spain’s cost of borrowing again topped 7% for 10-year money. Not only are the country’s banks in difficulty but its regional governments might also need central government support. In such circumstances governments typically prefer short-term financing, but Spain’s 2-year rate reached a record 6.76% in July.

Given the country’s current debt and its IMF-forecast five-year growth, we calculate that even if Spain paid an effective rate of only 3% (roughly the yield of French debt since the beginning of the year), it would have to move its current operating deficit of 3.6% of GDP to an operating surplus of 0.7% just to stabilize its debt-to-GDP ratio – a daunting task. A borrowing cost of 7% would raise the required surplus to 3.8% of GDP, in other words an adjustment of the primary balance amounting to 7.4% of GDP or a 21% increase in government revenue. An impossible task.

To Read the Entire Report Please Click on the pdf File Below.