Cautious investors wary of the fragile global economic fundamentals, have been trampled by the bull run in recent weeks. The “risk-on” drive was motivated not by the earnings season which has been rather average, but instead by the deal in the US on the fiscal cliff, liquidity injections by central banks including the Fed and growing belief that things cannot get any worse in Europe. But there is ample room for investor enthusiasm to tone down over the coming weeks, not just because of another soft earnings season, but mostly due to an extension of disappointing economic data, particularly in advanced economies.

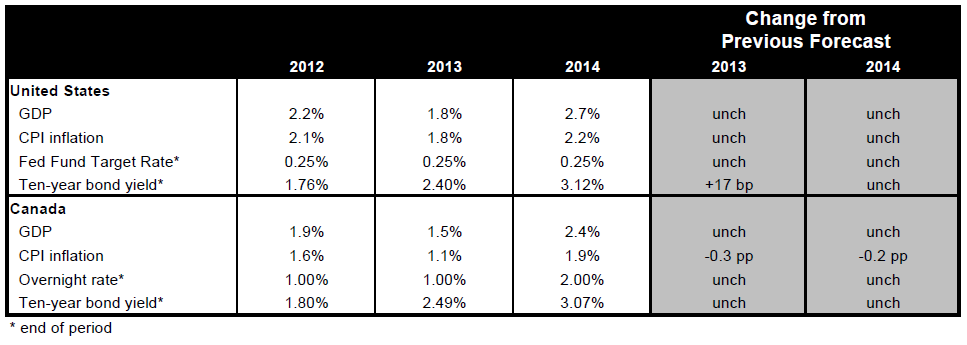

After arguably hindering US growth in Q4 last year, fickle fiscal policy now threatens to derail 2013 growth. The automatic spending cuts, due to take effect on March 1st, will weaken an economy that was hammered by a tax hike dispatched by Congress last January. Our call for 1.8% US growth this year, assuming roughly half of the sequester goes ahead, may be revised depending on the final verdict by Congress.

GDP data for Q4 wasn’t available at the time of writing, but monthly reports suggest Canada ended 2012 on a rather poor note. If, as we expect, annualized growth comes in below 1%, and assuming Q3 is left unrevised, Canada just saw the worst two-quarter stretch since the 2009 recession. That not only casts doubts about the Labour Force Survey’s boom-like employment results (161,000 increase in the second half of 2012), but also raises concerns about the economy’s underlying strength. Indeed, if economic growth is struggling at less than 1%, what happens when housing and government, two major sources of drag expected this year, start creating significant headwinds? We are comfortable with our below-consensus call for 2013 Canadian growth of just 1.5%.

World: Bull run seems premature

Cautious investors wary of the fragile global economic fundamentals have been trampled by the bull run in recent weeks. The “risk-on” drive was motivated not by the earnings season which has been rather average, but instead by the deal in the US on the fiscal cliff, liquidity injections by central banks including the Fed and growing belief that things cannot get any worse in Europe. But there is ample room for investor enthusiasm to tone down over the coming weeks, not just because of yet another soft earnings season, but mostly because of an extension of disappointing economic data particularly in advanced economies.

Markets have done quite well in recent months on balance, not because of the earnings season which has been rather average but instead by the deal in the US on the fiscal cliff, and belief that things cannot get any worse in Europe. Central bank action has also helped fuel the buying frenzy with the Fed and the Bank of Japan in particular providing even more liquidity to financial markets. The “risk-on” mood has certainly encouraged speculators to turn bullish on the euro with a return to net long positions for the first time in over a year.

The increased optimism about Europe stems from diminished concerns about sovereign debt (as evidenced by declining default probabilities), thanks largely to the ECB’s decision last summer to accept its responsibility of lender of last resort. That has not only helped sovereigns, but also relieved holders of those government bonds. Banks, for instance, reported an improvement in funding conditions as a direct result of easing of the sovereign debt crisis in the ECB’s latest Bank Lending Survey. Some banks are even repaying their LTRO loans to the ECB earlier than expected. That said, European banks remain cautious given the massive challenges ahead. The same bank lending survey showed that despite better funding conditions, banks are tightening lending standards because they’re worried about economic activity and the housing market in particular.

That’s a valid concern given that, outside of Germany, the European housing market is struggling. And things are likely to get worse before they get better, particularly in countries like Spain whose pre-recession housing boom made the US bubble look rather insignificant. All told, we wouldn’t be surprised to see European house prices decline a lot more, meaning that banks will likely have to book more bad debts over the coming months and even years.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monthly Economic Monitor

Published 02/28/2013, 07:03 AM

Updated 05/14/2017, 06:45 AM

Monthly Economic Monitor

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.