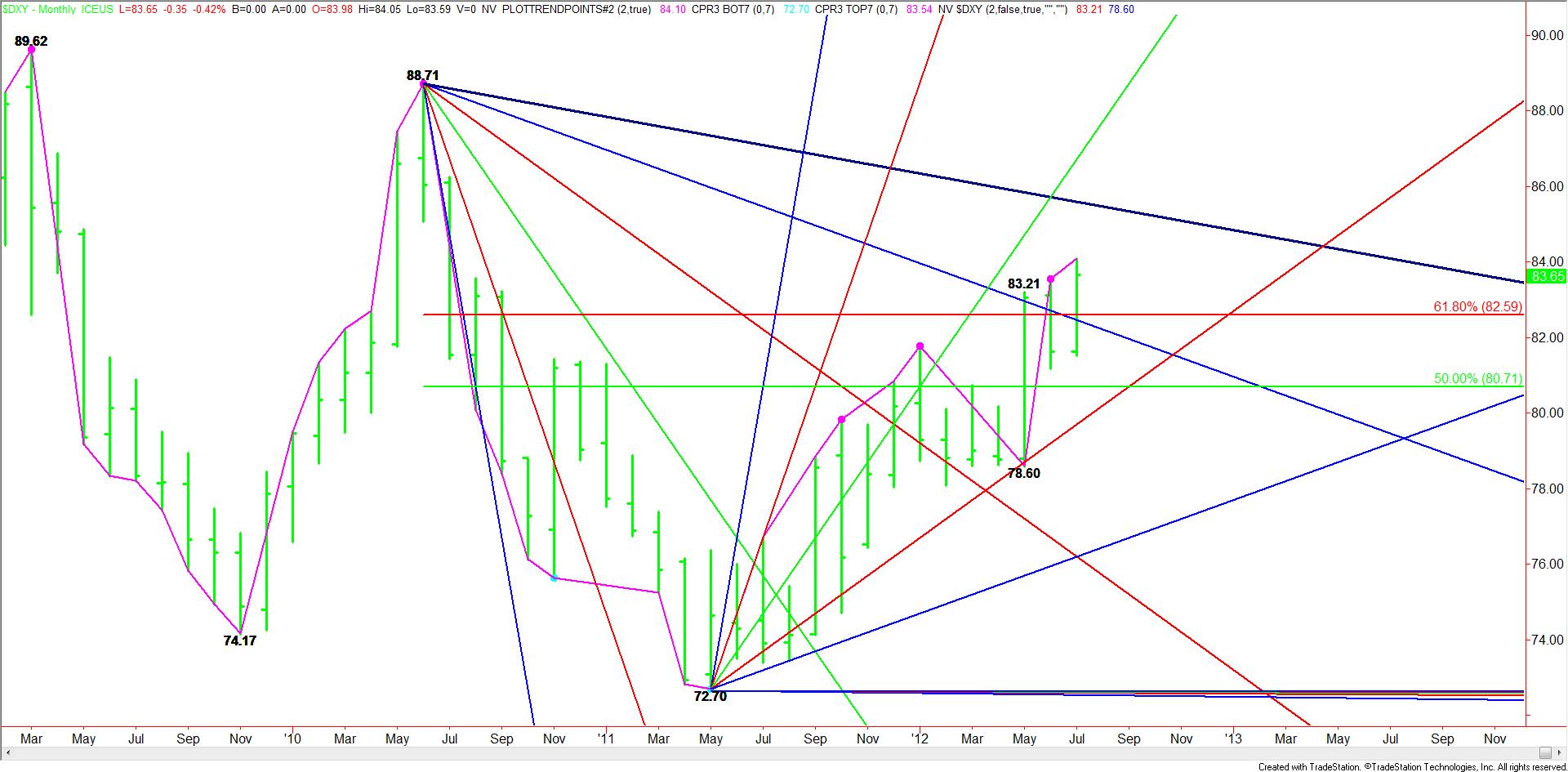

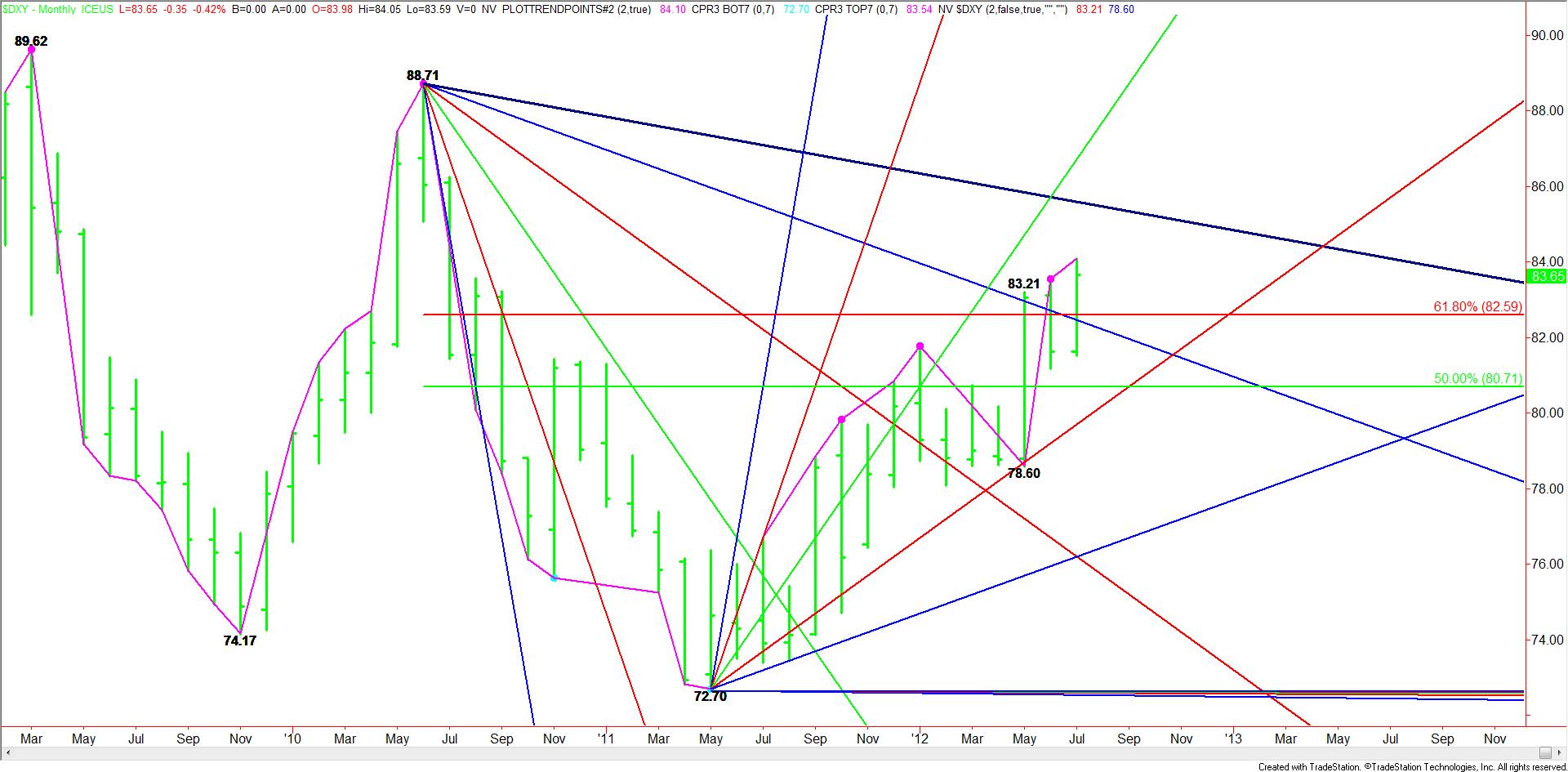

As we end July, the U.S. Dollar Cash Index is showing a sustained move to the upside after breaking through a key Fibonacci retracement level and downtrending Gann angle. The strong upside momentum into the end of the month suggests that this trend is likely to continue in August as long as investors remain willing to shed risky assets and move into the safety of the Greenback.

Based on the main range of 88.71 to 72.70, a key retracement zone was formed at 80.71 to 82.59. After toying with this zone for a couple of months, the index finally broke through the upper level with conviction, setting up the market for further upside action.

Besides breaking through the Fibonacci level, the Dollar Index also took out a downtrending Gann angle that stopped two previous breakout attempts. This angle is at 82.46 this month. Based on the current upside momentum, the market still has time to test another downtrending Gann angle from the 88.71 top at 85.59.

Besides breaking through the Fibonacci level, the Dollar Index also took out a downtrending Gann angle that stopped two previous breakout attempts. This angle is at 82.46 this month. Based on the current upside momentum, the market still has time to test another downtrending Gann angle from the 88.71 top at 85.59.

On the downside, the first sign of weakness will be a break back under the Fibonacci level. The next potential support is the 50% price level at 80.71. Finally, an uptrending Gann angle at 79.70 will likely be a buying opportunity.

With the trend clearly defined, look for the U.S. Dollar Cash Index to continue its strong surge. As long as there are problems in Europe and investors are looking for safety, the Greenback’s trend should remain intact. Any surprise stimulus move by the Fed could stop the rally in its track, but until that happens, the trend is your friend.

Based on the main range of 88.71 to 72.70, a key retracement zone was formed at 80.71 to 82.59. After toying with this zone for a couple of months, the index finally broke through the upper level with conviction, setting up the market for further upside action.

Besides breaking through the Fibonacci level, the Dollar Index also took out a downtrending Gann angle that stopped two previous breakout attempts. This angle is at 82.46 this month. Based on the current upside momentum, the market still has time to test another downtrending Gann angle from the 88.71 top at 85.59.

Besides breaking through the Fibonacci level, the Dollar Index also took out a downtrending Gann angle that stopped two previous breakout attempts. This angle is at 82.46 this month. Based on the current upside momentum, the market still has time to test another downtrending Gann angle from the 88.71 top at 85.59. On the downside, the first sign of weakness will be a break back under the Fibonacci level. The next potential support is the 50% price level at 80.71. Finally, an uptrending Gann angle at 79.70 will likely be a buying opportunity.

With the trend clearly defined, look for the U.S. Dollar Cash Index to continue its strong surge. As long as there are problems in Europe and investors are looking for safety, the Greenback’s trend should remain intact. Any surprise stimulus move by the Fed could stop the rally in its track, but until that happens, the trend is your friend.