OPEC dumbfounded cynics overnight by agreeing to a targeted production cut that comes at the lower end of the pre-Vienna discussed ranges, delivering a production cut of ~1.2mn barrels per day to 32.5mn, effective January 1 for at least six months.

While WTI failed to bounce into the OPEC perceived Goldilocks $50-60 per barrel ranges, the cut none the less pressured US Treasury yields higher on heightened inflationary expectations and coupled with stellar US economic data lit a fire under the USD.

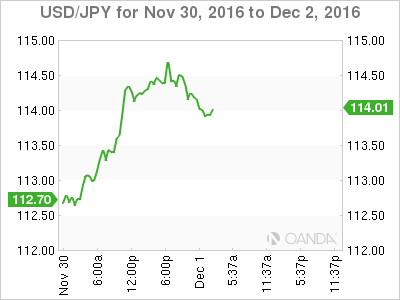

Japanese Yen

In the Currency markets, month end mayhem and extremely buoyant US economic data buttressed the US dollar with the markets favouring a long dollar play. USD/JPY rocketed to 114.50 as U.S. 10's soared to 2.37%.

Near-term oil prices will likely base after the OPEC production cut, which should provide inflationary tailwinds. With a steady stream of strong US economic data; Bond Traders will have the psychologically key 2.5 % (2015 High) in the crosshairs and this alone should provide significant winds in the sail to guide USD/JPY to 116.00. We should anticipate some near-term profit taking and I would expect the next leg higher will be more of a grind, rather than a sudden jump.

If the Bond Yield differentials were not enough to support the case for USD/JPY higher, there are reports that Japanese Life insurers and other Major Tokyo investors have been significantly increasing fully hedged US bond investments, as massive demand for the dollar is resulting in a dramatic basis widening in the currency swap market.

Key in US data overnight were the US ADP payrolls which rose greater-than-forecasted to 217k in November. On the surface this points to topside expectations that Friday’s Non-Farm Payroll will come in stronger than forecasted 180K.

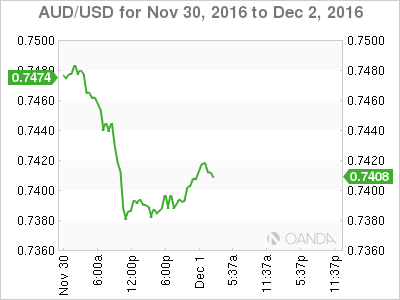

Australian Dollar

It has been a very tough session for the AUD and although a huge drop in building approvals was largely ignored, the AUD finally succumbed to a 7% drop in iron ore, against the back drop of US Yields rising, it was open season for the Aussie bears.

Once again, China’s regulators have stepped in by lowering daily trading limits and raised margin requirement to quash what is in their view, unbridled and reckless speculation.

Much of the recent price action in industrial metals has been supported by short-term Chinese Retail speculators anticipating surging demand on Trumpenomics. This trade is always a fragile house of cards, as the underbelly of this trade is over leveraged and unable to whether regulatory intervention, especially that which occurs mid-way through the game.

The surging USD yield also has the USD bull back en masse. Without the support of strong industrial commodity prices, it is not surprising to see the AUD/USD .7400 near term base give way. The Aussie desperately needs the support of industrial metals to recover lost ground amid this current strong USD rally.

CAPEX came in -4 % vs. -3 % expected, and while not providing any support to the AUD, market reaction has been muted so far. The AUD is now trading off its back foot as the currency looks for a lifeline from the USD bulls having their way.

On a positive note, the China November PMI expanded for the 4th consecutive month from 51.7 vs. 51, which should provide a respite for the Aussie dollar assault.

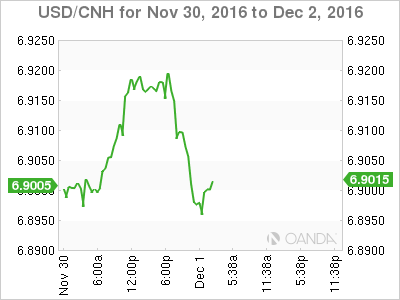

Chinese Yuan

While there is lower USD/CNY fixing offshore, USD/CNH remains very well bid at the key 6.90 level, despite expensive on shore Yuan funding. Because of the expensive cost of carry for the short Yuan trade, traders are tactically buying on dips as the USD bull trend remains intact. Yet traders are reluctant to chase higher to risk facing a wave of state-owned bank offers. Those that are astute are letting market prices come to them.

In the face of the recent wave of Yuan depreciation, regulators have stepped up capital control measures by introducing a new policy directed a kerbing Chinese investor’s portfolios and foreign direct investment( FDI) from feeding the frenzy. IN addition , SAFE has dramatically lowered the threshold for reporting security, where in the past FDI associated FX transfers of greater than USD 50 million had to be reported, the reporting limit has been cut to only USD 5 million.

US interest rate yields are moving higher, so expect the Yuan and the emerging market currency sell-off to intensify, accelerating Mainland demand for USD.

EM Asia

The local currency markets continue to sour as the US yield curve bear steepens.

The Malaysian Ringgit foreign free-for-all selling in both the Bond and Equity markets has run unabated, but there has been a brief respite as the markets digested the positives from the OPEC production cut. However, I suspect the bump in oil prices will offer little buffer to escalating local political tension and higher US yields abroad.