Monster Worldwide, Inc. (MWW) is the parent company of Monster, the global online employment solution. With a presence in approximately 55 countries globally, including key markets in North America, Europe, South America and the Asia-Pacific region, Monster offers online recruiting solutions.

This is a vol and order flow note on some news from the CEO. Here we go:

Monster Worldwide Inc. (MWW), the online recruiting service, rose as much as 12 percent after Chief Executive Officer Salvatore Iannuzzi said he’s considering “strategic alternatives” to boost shareholder value.

“Our shareholders deserve a better return,” Iannuzzi said at a Robert W. Baird & Co. conference in Boston. Before today, shares of the New York-based company had tumbled 59 percent in the past 12 months.

Iannuzzi has already embarked on a cost-cutting plan, an effort to cope with the slow economic recovery and competition from sites such as LinkedIn Corp. (LNKD) that offer cheaper ways to recruit employees. Monster said earlier this year that it would eliminate about 400 jobs, or 7 percent of its workforce, after economic turmoil in Europe caused clients to curb their use of the job-search website.

Source:Monster Worldwide Advances After CEO’s ‘Strategic’ Comment: New York Mover

Umm... OK...

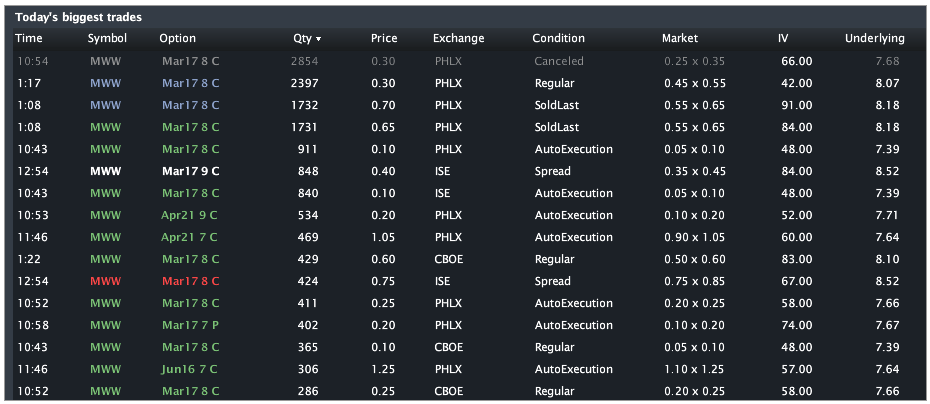

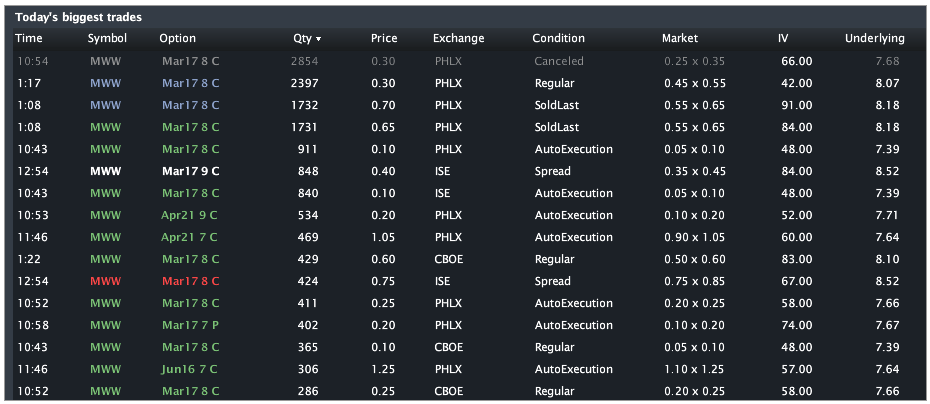

Let's start with the order flow. The company has traded over 35,000 contracts on total daily average option volume of just 1,137. Calls have traded on an 8.2:1 ratio to puts with the Mar 8 calls having traded over 17,000x. The Stats Tab and Day's biggest trades snapshots are included (below).

The Options Tab (below) illustrates that those Mar 8 calls are mostly opening (compare OI to trade size). When looking down the entire option chain for MWW, I don't see any OI larger than 4,539 (Mar 7 calls), so the size is notable for his company. The calls have traded as low as $0.05 and as high as $0.90 today. The flow is actually ambiguous as to the side, but the circumstantial evidence would point to purchases as vol his risen.

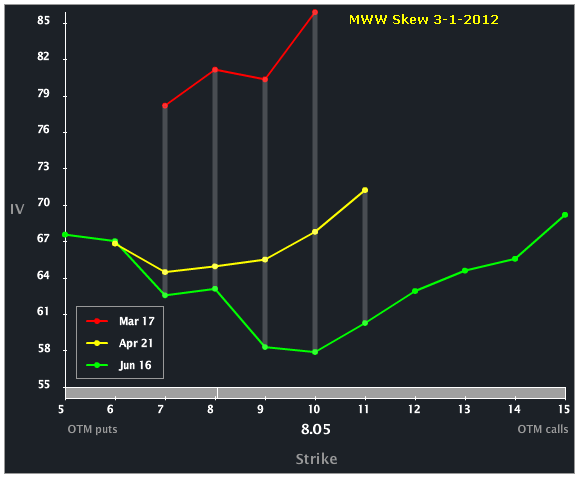

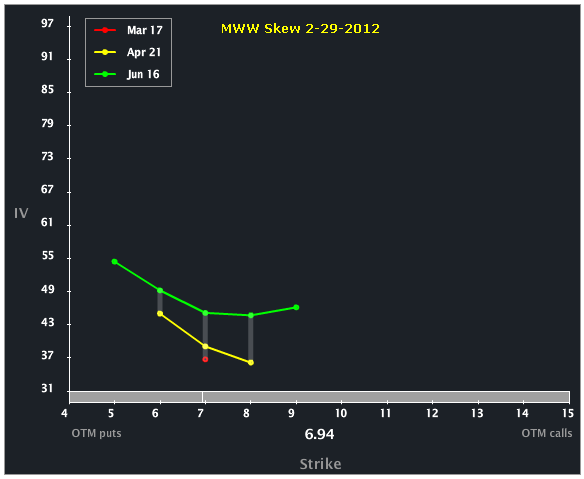

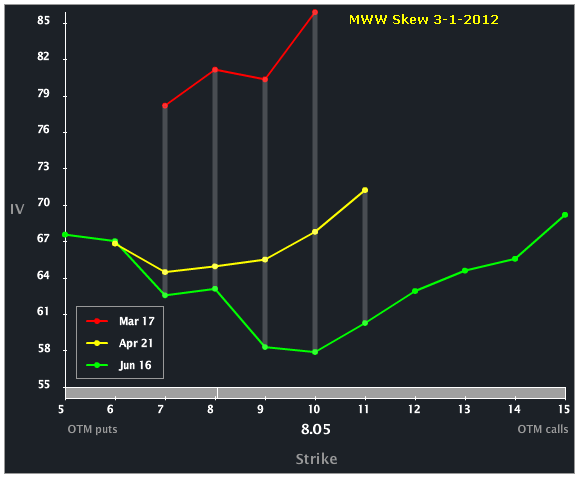

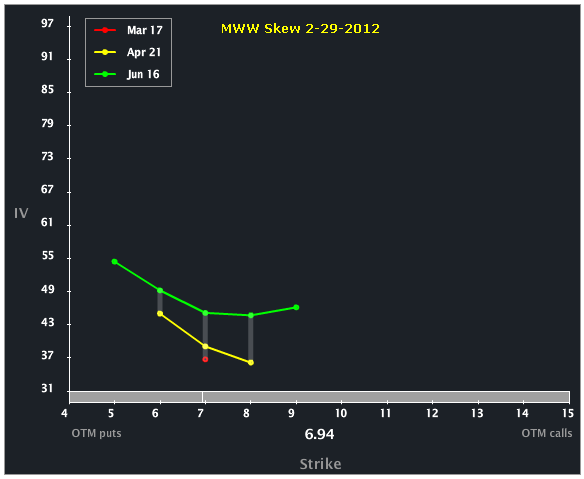

The Skew Tab snap (below) illustrates the vols by strike by month.

Check out how elevated Mar has become relative to the back two months. As a reference, I have included the skew chart from yesterday, below.

That red dot is Mar (it's just a single point b/c only one OTM options had a bid). Today, well, there are lots of them. Looking back to the Options Tab (across the top), we can see Mar vol is up 44.5 vol points while Apr and Jun are up 24.3 and 14.8 vol points, respectively. So, in English, the front is reacting the most.

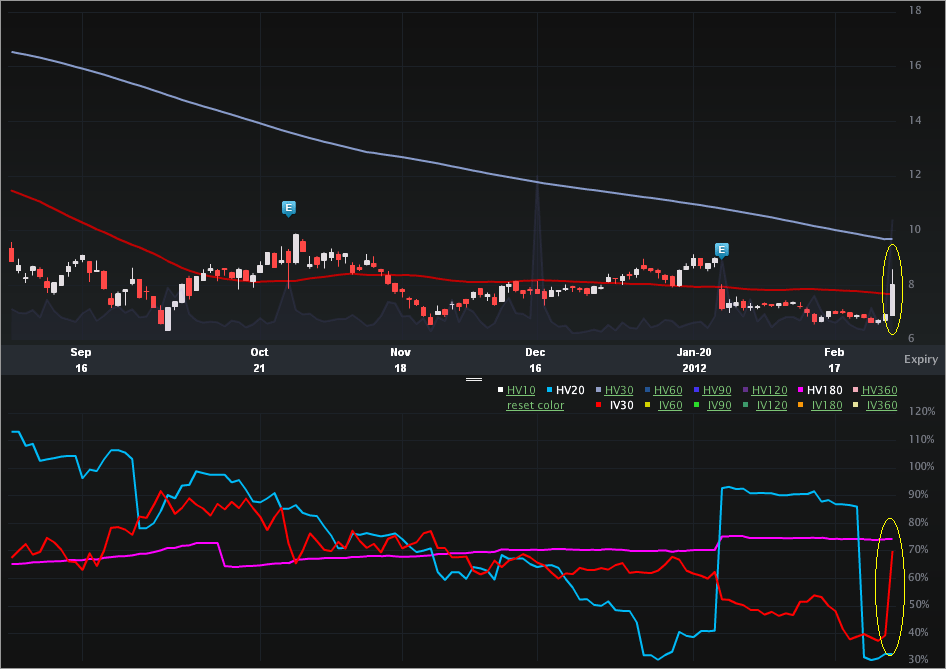

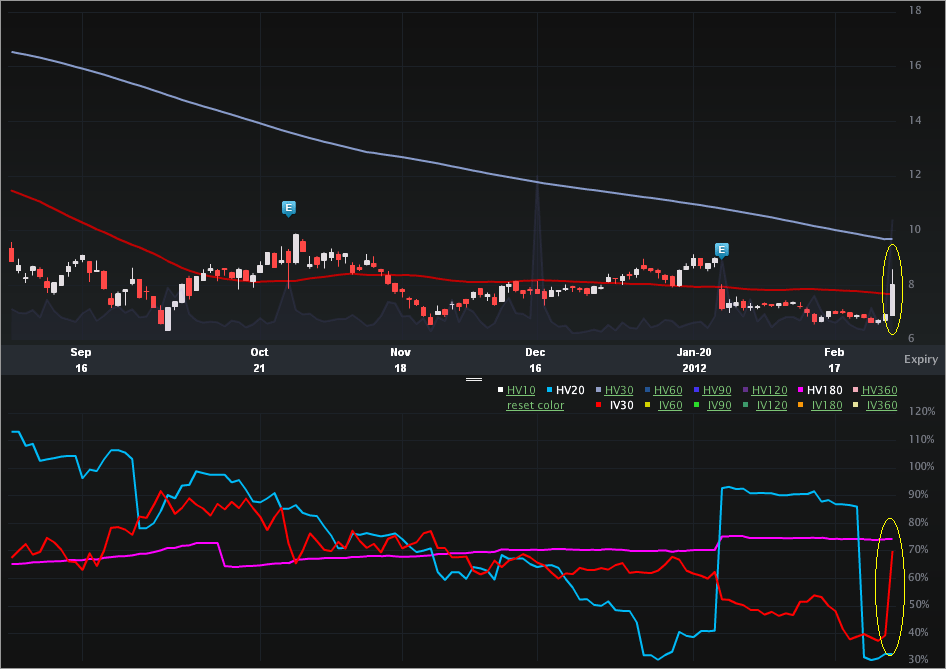

Finally, the Charts Tab (six months) is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

I've highlighted the stock pop today. As of this writing, the underlying is only up $0.71. The day range is rather large -- [$6.88, $8.59]. The vol spike is unreal. The ATM straddle was worth ~ $0.50 yesterday (on close). Today, it's worth more than $1.00.

This is trade analysis, not a recommendation.

This is a vol and order flow note on some news from the CEO. Here we go:

Monster Worldwide Inc. (MWW), the online recruiting service, rose as much as 12 percent after Chief Executive Officer Salvatore Iannuzzi said he’s considering “strategic alternatives” to boost shareholder value.

“Our shareholders deserve a better return,” Iannuzzi said at a Robert W. Baird & Co. conference in Boston. Before today, shares of the New York-based company had tumbled 59 percent in the past 12 months.

Iannuzzi has already embarked on a cost-cutting plan, an effort to cope with the slow economic recovery and competition from sites such as LinkedIn Corp. (LNKD) that offer cheaper ways to recruit employees. Monster said earlier this year that it would eliminate about 400 jobs, or 7 percent of its workforce, after economic turmoil in Europe caused clients to curb their use of the job-search website.

Source:Monster Worldwide Advances After CEO’s ‘Strategic’ Comment: New York Mover

Umm... OK...

Let's start with the order flow. The company has traded over 35,000 contracts on total daily average option volume of just 1,137. Calls have traded on an 8.2:1 ratio to puts with the Mar 8 calls having traded over 17,000x. The Stats Tab and Day's biggest trades snapshots are included (below).

The Options Tab (below) illustrates that those Mar 8 calls are mostly opening (compare OI to trade size). When looking down the entire option chain for MWW, I don't see any OI larger than 4,539 (Mar 7 calls), so the size is notable for his company. The calls have traded as low as $0.05 and as high as $0.90 today. The flow is actually ambiguous as to the side, but the circumstantial evidence would point to purchases as vol his risen.

The Skew Tab snap (below) illustrates the vols by strike by month.

Check out how elevated Mar has become relative to the back two months. As a reference, I have included the skew chart from yesterday, below.

That red dot is Mar (it's just a single point b/c only one OTM options had a bid). Today, well, there are lots of them. Looking back to the Options Tab (across the top), we can see Mar vol is up 44.5 vol points while Apr and Jun are up 24.3 and 14.8 vol points, respectively. So, in English, the front is reacting the most.

Finally, the Charts Tab (six months) is below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

I've highlighted the stock pop today. As of this writing, the underlying is only up $0.71. The day range is rather large -- [$6.88, $8.59]. The vol spike is unreal. The ATM straddle was worth ~ $0.50 yesterday (on close). Today, it's worth more than $1.00.

This is trade analysis, not a recommendation.