Shares of Monster Beverage Corporation (NASDAQ:MNST) were down 4.1% in after hours trading after the company missed second-quarter 2017 earnings expectations. Results were affected by unfavorable currency exchange rates and production shortage of Java Monster and Muscle Monster products. The company maintained the strategic alignment of its distribution system with Coca-Cola system bottlers in the quarter.

Adjusted earnings of 39 cents per share missed the Zacks Consensus Estimate of 40 cents by 2.5%. Earnings however increased 28.6% year over year on higher sales.

Sales Detail

Net sales of $907.1 million beat the Zacks Consensus Estimate of $906.6 million by a narrow margin. The figure improved 9.6% year over year.

Foreign currency had an unfavorable impact of $8.2 million on quarterly net sales. Net sales outside the U.S. increased 23.8% to $247.9 million in the quarter on a year-over-year basis.

Quarterly Segment Details

Monster Energy Drinks: Net sales at the segment were $815.3 million, up 9.7% year over year.

Strategic Brands: This segment includes brands acquired from Coca-Cola. Net sales at the segment rose 10.6% to $85.6 million in the quarter.

Other: Net sales for the company's Other segment, which includes some products of American Fruits & Flavors sold to independent third parties, were $6.2 million in the quarter under review, down 6.1% year over year.

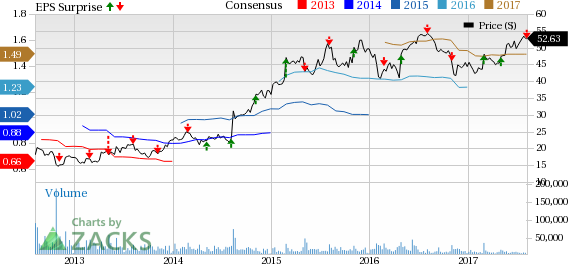

Monster Beverage Corporation Price, Consensus and EPS Surprise

Inside the Headline Numbers

Second-quarter 2017 gross margin rose 170 basis points (bps) to 64.3%.

Operating expenses increased 1.8% year over year to $233.5 million. Operating income in the quarter was $350.0 million, up 21.3% year over year.

Selling expenses, as a percentage of net sales, were 12.6%, higher than 11.2% in the second quarter of 2016.

Effective tax rate for the quarter was 35.9%, compared with 36.1% in the prior-year quarter.

Financials

Monster Beverage ended the quarter with cash and cash equivalent of $777.7 million as of Jun 30, 2017, compared with $377.6 million as of Dec 31, 2016.

Monster Beverage carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

The Coca-Cola Company (NYSE:KO) reported better-than-expected results in second-quarter 2017. Adjusted earnings were 59 cents per share, surpassing the Zacks Consensus Estimate of 57 cents by 3.5%.

PepsiCo, Inc. (NYSE:PEP) reported better-than-expected results results in second-quarter 2017 (ending Jun 17), with both earnings and revenues beating the Zacks Consensus Estimate. PepsiCo’s second-quarter core earnings per share of $1.50 beat the Zacks Consensus Estimate of $1.40 by 7.1%.

Dr Pepper Snapple Group Inc.’s (NYSE:DPS) adjusted second-quarter 2017 earnings per share of $1.25 missed the Zacks Consensus Estimate of $1.28 by 2.3%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Dr Pepper Snapple Group, Inc (DPS): Free Stock Analysis Report

Pepsico, Inc. (PEP): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Original post

Zacks Investment Research