Nearly everyone can recall playing Monopoly as a child, and for many, the game served as their first exposure to handling different denominations of cash. It was exhilarating to have someone land on your Park Place property, complete with hotel, and in turn receive a fistful of $50s and $100s.

A new generation of players might never get the chance to experience this, however, as Hasbro Gaming just released an “Ultimate Banking” version of the popular board game that nixes the funny money in favor of play credit cards and an electronic scanner.

You could argue it’s just a game, but Monopoly has always had a reputation for being a reflection of capitalism as it operates in the “real” world (which is why it was banned in communist states such as the Soviet Union). The cashless version of the game is no exception, as it comes at a time when calls to limit—or in some cases eliminate—the use of cash are intensifying. And to be clear, “cash” here means cash in your pocket, not cash in the bank.

Just last week, former treasury secretary Larry Summers published an op-end in the Washington Post arguing it’s time to “kill the $100 bill,” the reason being that it’s preferred by those involved in money-laundering, corruption and other illegal activity. (One million dollars denominated in $100 bills weighs 2.2 pounds, he points out, whereas the same amount in $20 bills weighs a much more cumbersome 50 pounds.) The European Union, he argues, should also consider getting rid of the 500-euro note, a position that’s echoed by European anti-fraud officials.

Having had the opportunity to hear Secretary Summers speak when I visited Harvard recently, I respect his opinion and believe his intentions are good. But ultimately the argument to eliminate the $100 bill is based on the presupposition that anyone using such a note is a drug trafficker or money launderer. This seems to go against one of the main tents of common law, namely, that we’re innocent until proven guilty.

The risks far outweigh the benefits when you consider where this anti-cash sentiment is leading us—a cashless society. As I discussed back in December regarding Sweden’s own trend toward a cashless economy, every transaction could be monitored, not to mention taxed and charged a fee. Accounts could be frozen, which, in a cashless world, would leave you with nothing.

I’ve experienced the inconvenience that sometimes comes with electronic transactions, as I’m sure many of you have.

Occasionally my credit card couldn’t be read for one reason or another, and if you’re not carrying cash, what do you do? When I’m traveling, domestically or abroad, I always carry cash with me, and $100 bills are much more convenient than a pound of $20s.

Capital controls are nothing new, but they would be much easier to impose. In Colombia, a tax is levied on every transaction, whether it is a direct deposit from your employer, transfer of funds between accounts or a purchase. Since 2003, Venezuela’s government has significantly regulated the amount of money citizens can take with them on trips abroad, in effect blocking access to foreign travel.

Currently the limit is $2,000, but for travelers headed to the U.S., it drops to $700. This, along with a labyrinthine exchange rate (there are three), has only created a black market currency exchange.

And since credit cards in Venezuela are issued by state-run banks, there’s no stopping the government from restricting payment on any goods or services, or from any vendor, it wishes.

Colombia and Venezuela are extreme cases, and there’s no reason to expect the same would ever happen in the U.S. At the same time, scrapping the $100 bill would further debase Americans’ economic liberty.

Gold Shines on Stellar Consumer Price Index (CPI) Reading

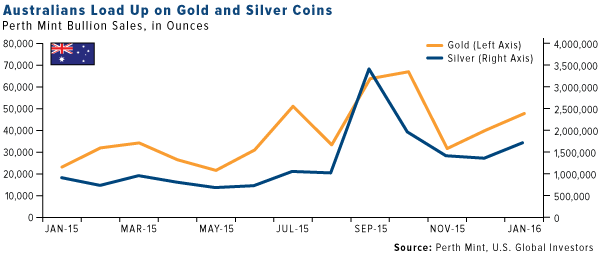

These concerns might be part of the reason why gold and silver coin sales are doing so well right now. The U.S. Mint began selling out of its popular American Eagle coins late last year, and demand is exceeding the mint’s weekly allocation of 1 million ounces. In Australia—where four out of five respondents to a recent poll said the country would be cash-free by 2022—gold coin sales surged 106 percent in January 2016 from a year earlier; silver coin sales, 151 percent.

Buying gold in times of uncertainty and instability is not just tradition—it’s rational behavior. The yellow metal has a long history of acting as an effective store of value.

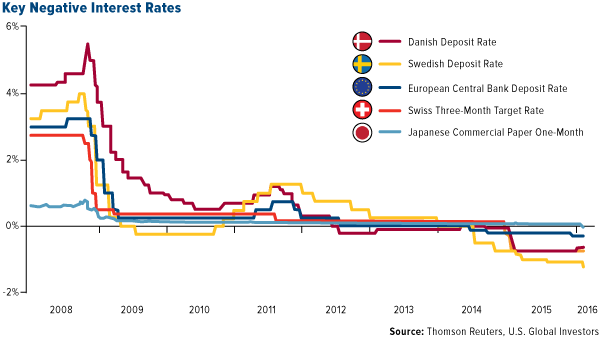

This is especially the case with nominal interest rates turning negative around the globe. More than a fifth of the world’s GDP is now produced in countries with subzero rates, and Federal Reserve Chair Janet Yellen recently stated that the Fed will not take such rates off the table for consideration.

Negative rates are essentially a tax on your bank deposits, intended to discourage saving. And if hard cash were no longer available to squirrel away in your mattress, gold might be the only other option.

But nominal rates aren’t the only driver. Numerous times I’ve written and spoken about gold’s relationship with real interest rates, which is what you get when you subtract headline inflation from the government bond yield. When inflation rises, real rates are pushed lower, and when they turn negative, gold becomes more attractive. Last week the Labor Department reported that core inflation in January increased 0.3 percent, its largest monthly gain since August 2011, when gold reached its all-time high of $1,900 per ounce. For the 12-month period, the consumer price index (CPI) hit an impressive 2.2 percent, its strongest showing since June 2012. Both of these readings beat analysts’ estimates and should be constructive for gold.

Also helping the metal’s appeal last week was the uncertainty surrounding whether the United Kingdom would exit the European Union. Momentum had been growing behind the “Brexit” campaign to end economic control from Brussels, with a majority of respondents to a British poll saying they were in favor of leaving the 28-member bloc. On Friday, however, Prime Minister David Cameron managed to secure a deal giving the UK “vital protections” to its economy, including never having to bail out any other EU member if it chooses not to. Gold ended the trading day up 2.3 percent to settle at $1,228.60 per ounce.

Oil Prices Aligned with Seasonality Trade

Oil was up last week with prices rising above their 50-day moving average, mostly on a production cap agreement between the world’s two largest producers, Russia and Saudi Arabia.

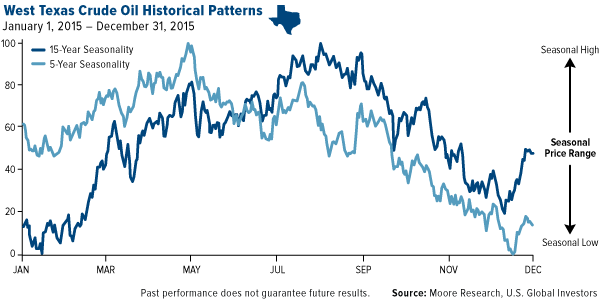

Historically, oil bottoms every February, and today it’s right on cue. We are now due for a rally until Easter at least, possibly until the beginning of summer.

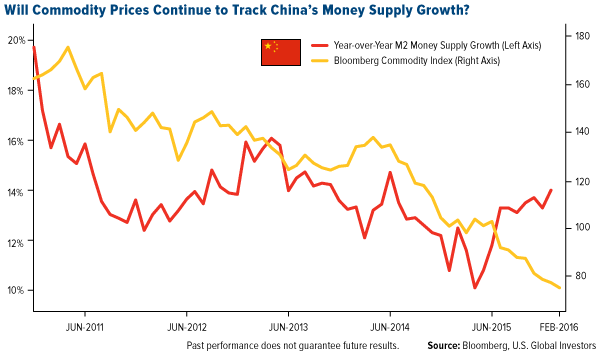

Another factor to consider is money supply. Based on our own regression analysis, there’s a high correlation between money supply growth in the seven most populous countries and commodity prices. If you look back to 2011, when oil averaged $100 per barrel and gold peaked at $1,900, money supply was strong. Since then it’s been falling, particularly in China, as you can see below. But with money supply on the upswing, we might have a good chance for a rally here.

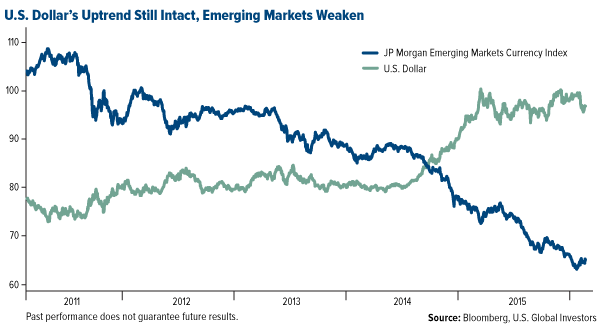

Besides continued oversupply, oil’s most significant headwind remains the U.S. dollar. As it has gained in strength, emerging market currencies have declined.

As always, it’s important to follow the smart money. Just as influential “Shark Tank” investor Mark Cuban went long on gold recently, we’ve seen big-name investors place their bets that oil prices will climb. It was widely-reported last week that billionaires Warren Buffett, George Soros and hedge fund manager David Tepper all disclosed buying shares of Kinder Morgan (N:KMI), the Houston-based oil and gas pipeline company. Buffett’s stake alone amounts to 26.5 million shares, currently valued at around $450 million.

In the meantime, low oil prices continue to give a lift to transportation stocks such as airlines, many of which reported record net profits for the fourth quarter.

DISCLAIMER: U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The consumer price index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. M2 money supply is a broad measure of money supply that includes M1 in addition to all time-related deposits, savings deposits, and non-institutional money-market funds.

The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity. The J.P. Morgan EM Currencies Index is a tradable benchmark for emerging markets currencies vs. the U.S. dollar.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2015: Hasbro Inc (O:HAS).