• In October, the US Manufacturing ISM index disappointed slightly, falling from 51.6 to 50.8. However, the details were overall positive, with a considerable increase in the new orders component from 49.6 to 52.4. At the same time, the inventories index showed a considerable fall, providing a good rebound in the new orders-inventories balance, signalling some strengthening ahead.

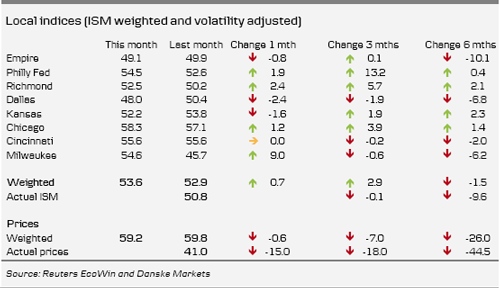

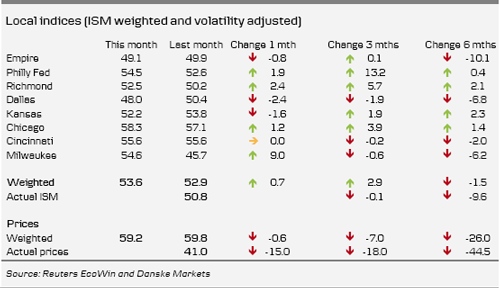

• Local surveys sent somewhat mixed signals in November but the overall picture was positive. In particular, the Chicago figures were a positive surprise, increasing from 58.4 to 62.6, indicating that the region, which is dominated by heavy industry, is showing good growth momentum. The Philadelphia Fed figures did not look as strong on the headline but the ISM-weighted figure continued to grow as a result of some strong details in employment and nventories. Hence, the overall picture points towards a strong reading tomorrow.

• On Thursday we expect to see an increase in the ISM to 52.0, as the underlying growth in the US manufacturing sector seems to have found its footing. The main source of downside risk continues to stem from Europe, where PMIs show no signs of improvement – giving the worst readings in over two years.

• In the coming months we expect the ISM to improve gradually, though at a modest pace. This goes hand in hand with our expectation of a reasonable rebound in GDP in H2 compared with the depressed H1 levels. However, the manufacturing sector still faces major headwinds; hence, we do not expect to see readings above 55 until well into 2012.

• Local surveys sent somewhat mixed signals in November but the overall picture was positive. In particular, the Chicago figures were a positive surprise, increasing from 58.4 to 62.6, indicating that the region, which is dominated by heavy industry, is showing good growth momentum. The Philadelphia Fed figures did not look as strong on the headline but the ISM-weighted figure continued to grow as a result of some strong details in employment and nventories. Hence, the overall picture points towards a strong reading tomorrow.

• On Thursday we expect to see an increase in the ISM to 52.0, as the underlying growth in the US manufacturing sector seems to have found its footing. The main source of downside risk continues to stem from Europe, where PMIs show no signs of improvement – giving the worst readings in over two years.

• In the coming months we expect the ISM to improve gradually, though at a modest pace. This goes hand in hand with our expectation of a reasonable rebound in GDP in H2 compared with the depressed H1 levels. However, the manufacturing sector still faces major headwinds; hence, we do not expect to see readings above 55 until well into 2012.