Mining stocks are down, so are precious metals and so are equities. But it shouldn’t be worrying at all. Those who spread concern over these claim that housing, financials and the dollar has bottomed. We disagree and believe gold (GLD), silver (SLV) and the undervalued gold (GDXJ), silver (SIL), uranium (URA) and rare earth miners (REMX) may be bottoming and a reversal may occur in 2013.

Precious metals, uranium and rare earths have corrected for most of 2011 and 2012 as the Fed has successfully boosted the toxic housing sectors and US debt while keeping a lid on precious metals and commodities. A good job has been done to misdirect investors off of the long-term supercycle in real assets, discredit precious metals and natural resources and create an illusion of a recovery.

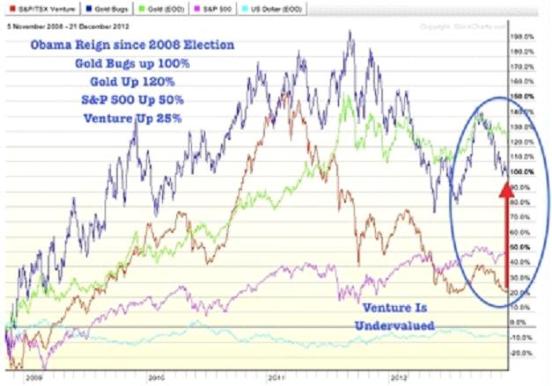

This decline in the mining sector may have been exacerbated by marginal rate hikes in gold and silver, the Fukushima Disaster and obfuscation from the Fed that they would not announce further QE every time gold and silver were about to breakout into new highs. Gold and silver have been basing and rangebound for many months. We expect that 2013 could mimic early 2009 when the miners bottomed and outperformed the general equity market. The first two years of Obama’s first term were exceptionally good for the small miners and precious metals.

Now we hear the voices of the Precious Metal Cassandra’s and the prophets of doom as they inform us that the gold and silver rally is devoid of lasting power. We disagree. The Fiscal Cliff and the economic cancer of debt continues to metastasize.

Gold and silver bullion appears to be bouncing off of strong support, while the U.S. dollar is forming a bearish head and shoulders pattern. The elites of the west possess all they need for the wives, children and grandchildren to live in splendor. They are trying to solve fiscal malignancies with fiat dollars, which is destroying savers who are getting negative returns at the local bank.

Hard asset investors have been swimming against the tide for over 22 months. Many have already thrown in the towel. Typical bears last about 18 months. We are already way overdue for a reversal and this may be exactly the wrong time to get caught up with the summer soldiers and sunshine patriots who flee from crisis exactly at the wrong time. Smart investors must fight the short term currents that favors toxic US bonds, financials and housing.

In conclusion, what does all this mean? As time goes by the only true repositories of wealth exists in the natural resource area as it has since the days of Athens and Rome. Oddly enough after millennia we have come full circle, the same countries and the world’s greatest empires are going broke.

History may not repeat, but it recurs. Monitor a potential breakout in gold and silver in 2013. Critical minerals such as rare earths, graphite, ferro alloys, tungsten, antimony and uranium may be slowly forming a bottom from which up moves occur. The junior miners and the Venture are extremely undervalued compared to the S&P500 and the gold price. Get ready for the downtrend to turn in 2013.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monitor A Potential Breakout In Gold And Silver In 2013: Gold Stocks

Published 12/30/2012, 02:07 AM

Updated 05/14/2017, 06:45 AM

Monitor A Potential Breakout In Gold And Silver In 2013: Gold Stocks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.