In FY13, Monitise made significant progress in expanding its service offering, signing up customers for m-commerce services and adding new sales channels. The company continues to invest to drive revenue growth – although this has pushed out our EBITDA break-even forecast by a year, in the longer term the investment should generate a larger number of deals that lead to highly profitable user-generated revenues.

FY13 results in line; contract momentum maintained

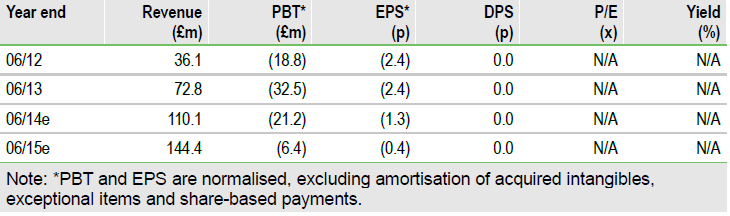

Monitise reported FY13 results that were substantially in line with expectations: revenues +102% y-o-y (vs our +100%), GMs of 75.8% (vs our 70.1%), EBITDA of -£19.3m (vs our -£20.1m) and adjusted net loss of £32.8m (vs our £34.6m). The steady flow of contract wins over recent months highlights the company’s progress in widening its service offering from m-banking to m-commerce, and the recent partnership deal with IBM strengthens the company’s indirect sales channel. The acquisition of mobile app design agency, Grapple, extends the company’s product offering from its unseen back-end functionality to consumer-facing user experience design, enabling the company to offer a more complete service to customers and providing it with an entry point into a new customer base.

Changes to forecasts

The company expects to grow revenues at least 50% in FY14 and to maintain GMs above 70%. We have revised down our user-generated revenue forecasts (lower transaction revenues partially compensated for by licence revenues) and increased our opex forecast (to reflect the cost of supporting the growing number of opportunities), resulting in EBITDA of -£6.7m for FY14 (down from +£4.4m). We introduce an FY15 revenue forecast of £144.4m (+31% y-o-y) and EBITDA of £9.4m (6.5% margin), with the potential for partners to drive revenue upside. We forecast net cash of £42.0m by the end of FY14 and £15.7m by the end of FY15.

Valuation: Reflects long-term growth potential

Monitise trades on an EV/sales multiple of 8.1x FY14e and 6.4x FY15e. In the absence of profitability metrics to support the valuation (we forecast EBITDA break-even in FY15), share price appreciation will depend on Monitise achieving its stated targets. Future milestones include Visa Europe’s and Visa Inc’s customers adopting their services, direct sales progress in the US, leverage from sales partners such as IBM, service launches in Asia Pacific and evidence of adoption of m-commerce services. The planned move in CY14 to the London Stock Exchange’s main market should provide support to the share price.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Monitise Capitalising On The Mobile Money Opportunity

Published 09/12/2013, 10:12 AM

Updated 07/09/2023, 06:31 AM

Monitise Capitalising On The Mobile Money Opportunity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.