Gold:

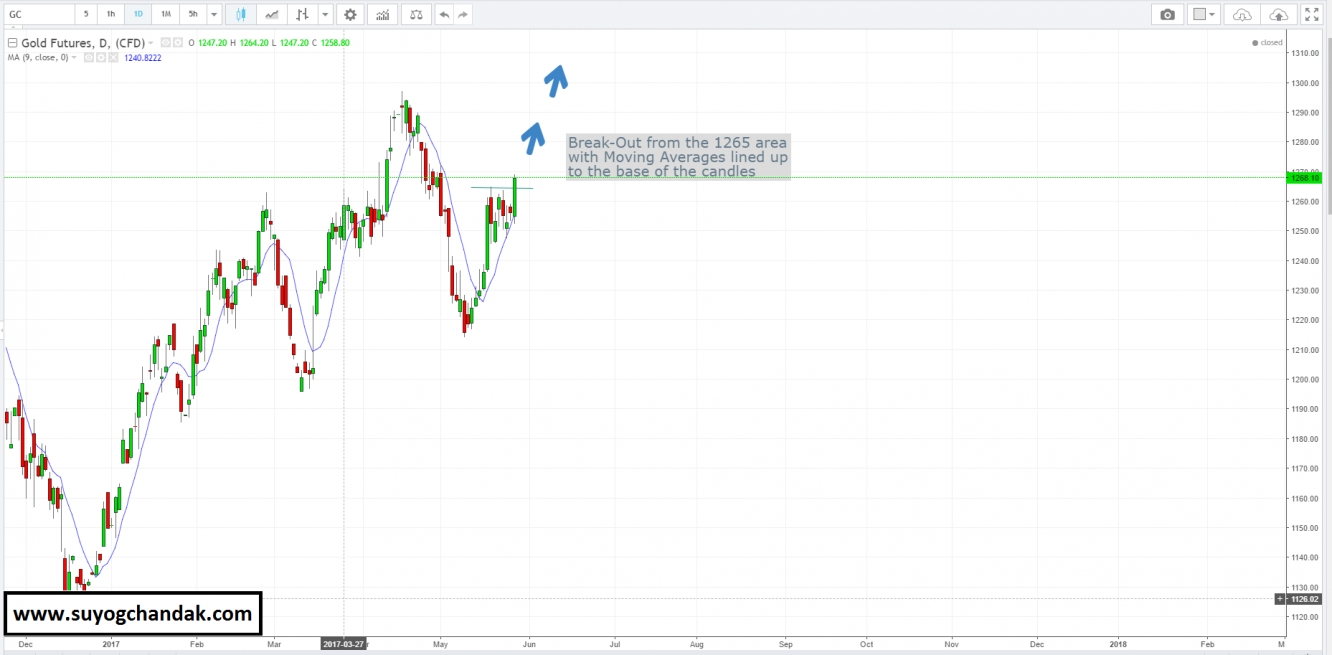

Gold, after a week and a half of consolidation has broken to the upside. The moving averages are lined up to the base of the candle which is a very strong sign of a move higher.

There was a potential Head and Shoulder building up, but it did not materialize.

On the 5 Hour chart, we can see that gold is currently in an ascending wedge, with prices potentially approaching the 1330 area.

With the all-important jobs numbers coming out at the end of the week on Friday, gold is poised for a significant move this week. The technicals point towards gold moving higher. We often see that when a commodity shows strength, the data may not matter too much. Knowing this, if we see strong Job Numbers along with a move higher in gold, we should expect significant strength in gold in the coming weeks.

Also, looking at the weekly chart, we see that for the first time in a month, gold has closed above the Moving Averages.

SILVER:

Silver has had another strong weak where it closed at highs. Silver has bounced as much as 8% from the lows 2 weeks ago. With the Jobs Numbers due this Friday, there promises to be some good price action.

On the weekly, the Moving Averages have caught up. I expect silver to go towards 17.6-17.7 where previous support might act as resistance.

Looking at the daily chart, there could be a possibility of a channel play in silver. Until it clears the channel, a longer term bullish bet may be off the cards.