Welcome to our rolling coverage of today’s BoE Monetary Policy Meeting (12.00 GMT). Previews, live coverage and reaction below…

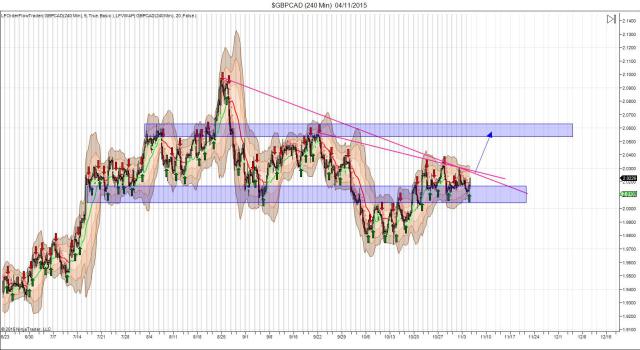

Hawkish BOE – BUY GBP/CAD

- If the BOE deliver a hawkish statement on Thursday, expect GBP to start trading higher once more on the crosses.

- GBP/CAD has potentially completed its correction of the broad uptrend its been in since late 2012, and this could prove to be the catalyst for a return to higher ground

- Look to buy a break of the potential bull-flag trend line resistance, targeting a move up into key near-term resistance at around 2.05/06

Dovish BOE – SELL GBP/JPY

- If the BOE’s “super-Thursday” leaves markets unenthusiastic about the likely proximity of an upward adjustment in UK rates, expect sterling to unwind against the Japanese yen.

- GBP/JPY has come up against some pretty key near-term resistance, which capped the initial rebound higher from the September lows against the 50% retracement from the August highs.

- A reversal beneath the local rising trend line opens up a retest of key horizontal support at around mid 184 as the initial target.

9.50 (GMT) Expectations for the meeting

Alongside the statement and the following press-conference, of particular importance will be the BOE’s inflation report, which could see the Bank citing lowered short-term inflation forecasts as downward energy price pressures persist.

Points to look out for

- Slack in the economy – How much slack does the MPC see in the UK economy?

- Rate language – any change to the phrase “ the decision as to when to start such process of adjustment will likely come into sharper relief around the turn of the year”

- Growth forecasts – Look for any changes to the growth forecast, particularly to the end of the forecast horizon

- Inflation – watch for any changes to the 2-3 year forward CPI forecast – August forecasts saw CPI breaching 2% between Q2 and Q3 2017

- Oil prices – How do the MPC see the path of oil prices over the next year. August saw forecasts of 15% lower for 2015 and 10% lower for 2016/17

It seems reasonable to expect a fairly well balanced statement with the BOE acknowledging the current and likely near-term weakness of the UK’s inflationary environment whilst paving the way for an early to mid 2016 rate rise.

9.30 (GMT) What’s happened since the last meeting?

Despite the immediate selling pressure applied to GBP, price recovered quickly to trade higher over October. Data since the last meeting has been largely positive though a few key prints displayed weakness.

- September CPI dropped back into negative territory printing -0.1%

- GDP QoQ fell to 0.5% from 0.7% prior

- Unemployment rate fell to 5.4% from 5.5% (though data referenced the three months prior to August)

- Retail sales data showed considerable strength posting 5.9% against 3.2% previous

- Net lending continued to increase posting 3.6bln against 3.4bln previous

- Public Sector Net Borrowing for September fell to .6bln from 10.8bln previous

- Average weekly earnings for the three months prior to August increased to 3.0% from 2,9%

- Manufacturing PMIs (October) unexpectedly jumped to 55.5 from 51.8

9.00 (GMT) Welcome to our day’s rolling coverage

Here are the key details for the day:

- Bank of England Monetary Policy Committee Decisions, Minutes and Forecasts, November

- Thursday November 5th, 12.00GMT

- Current rate 0.5%, expected unchanged