Is the Fed trying to wean the markets off monetary policy? Such was an interesting premise from Alastair Crooke via the Strategic Culture Foundation. To wit:

“The Fed however, may be attempting to implement a contrarian, controlled demolition of the U.S. bubble-economy through interest rate increases. The rate rises will not slay the inflation ‘dragon’ (they would need to be much higher to do that). The purpose is to break a generalised ‘dependency habit’ on free money.”

That is a powerful assessment. If true, there is an overarching impact on the economic and financial markets over the next decade. Such is critical when considering the impact on financial market returns over the previous decade.

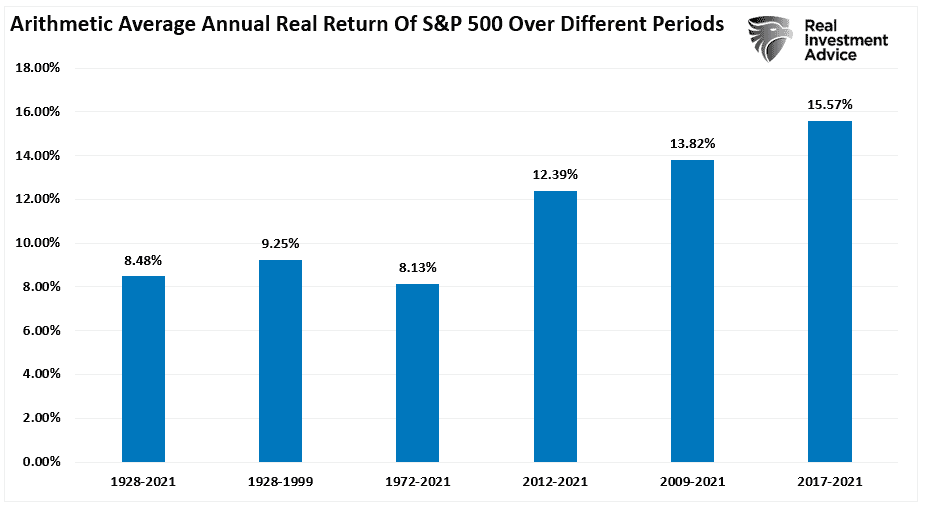

“The chart below shows the average annual inflation-adjusted total returns (dividends included) since 1928. I used the total return data from Aswath Damodaran, a Stern School of Business professor at New York University. The chart shows that from 1928 to 2021, the market returned 8.48% after inflation. However, notice that after the financial crisis in 2008, returns jumped by an average of four percentage points for the various periods.“

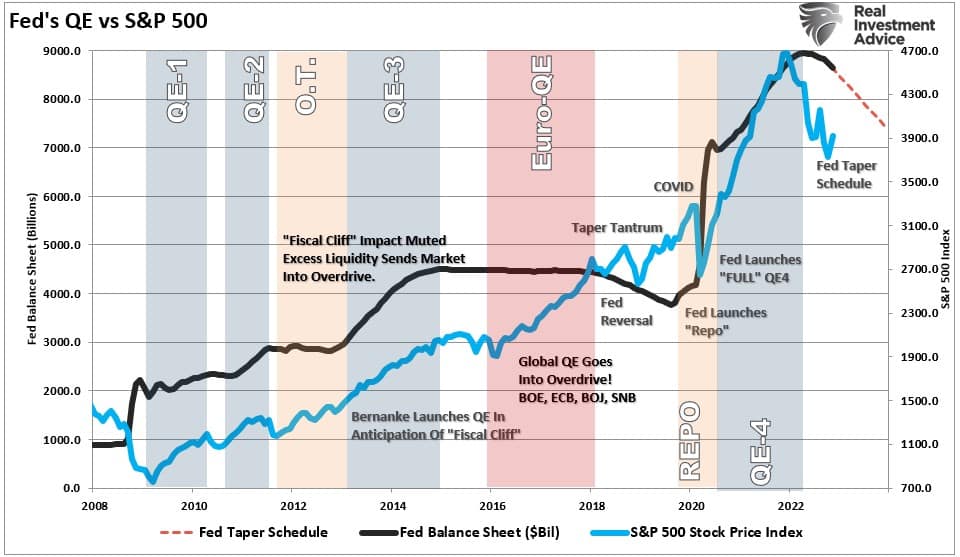

We can trace those outsized returns back to the Fed’s and the Government’s fiscal policy interventions during that period. Following the financial crisis, the Federal Reserve intervened when the market stumbled or threatened the “wealth effect.”

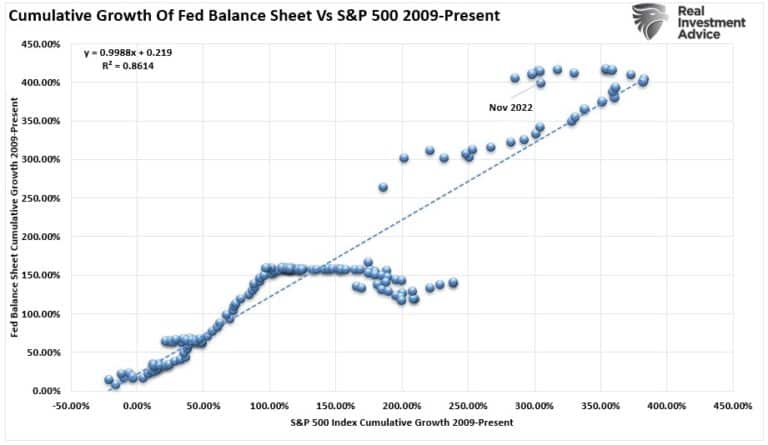

Many suggest the Federal Reserve’s monetary interventions do not affect financial markets. However, the correlation between the two is extremely high.

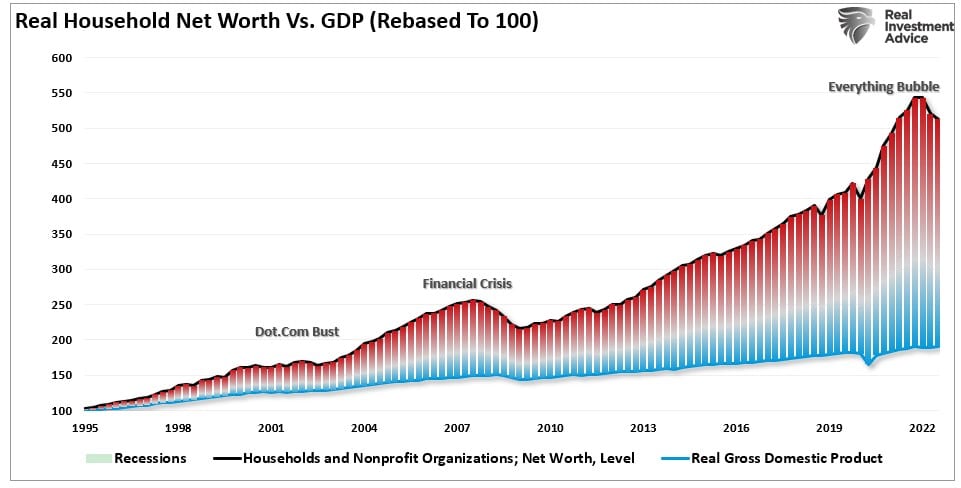

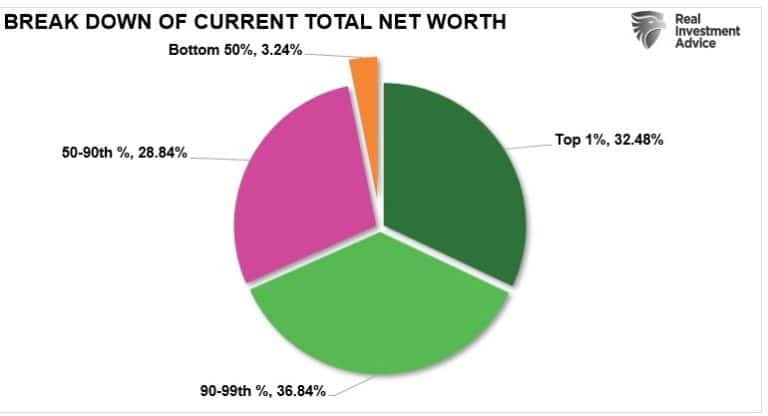

The result of more than a decade of unbridled monetary experiments led to a massive wealth gap in the U.S. Such has become front and center of the political landscape.

It isn’t just the massive expansion in household net worth since the Financial Crisis that is troublesome. The problem is nearly 70% of that household net worth became concentrated in the top 10% of income earners.

It likely was not the Fed’s intention to cause such a massive redistribution of wealth. However, it was the result of its grand monetary experiment.

Pavlov’s Great Experiment

Classical conditioning (also known as Pavlovian or respondent conditioning) refers to a learning procedure in which a potent stimulus (e.g., food) becomes paired with a previously neutral stimulus (e.g., a bell). Pavlov discovered that when he introduced the neutral stimulus, the dogs would begin to salivate in anticipation of the potent stimulus, even though it was not currently present. This learning process results from the psychological “pairing” of the stimuli.

This conditioning is what happened to investors over the last decade.

In 2010, then Fed Chairman Ben Bernanke introduced the “neutral stimulus” to the financial markets by adding a “third mandate” to the Fed’s responsibilities – the creation of the “wealth effect.”

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose, and long-term interest rates fell when investors began to anticipate this additional action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

– Ben Bernanke, Washington Post Op-Ed, November, 2010.

Importantly, for conditioning to work, the “neutral stimulus,” when introduced, must get followed by the “potent stimulus” for the “pairing” to complete. For investors, as the Fed introduced each round of “Quantitative Easing,” the “neutral stimulus,” the stock market rose, the “potent stimulus.”

Evidence Of Successful Pairing

Twelve years and 400% gains later, the “pairing” was complete. Such is why investors now move from one economic report and Fed meeting to the next in anticipation of the “ringing of the bell.”

The problem, as noted above, is that despite the massive expansion of the Fed’s balance sheet and the surge in asset prices, there was relatively little translation into broader economic prosperity.

The problem is the “transmission system” of monetary policy collapsed following the financial crisis.

Instead of the liquidity flowing through the system, it remained bottled up within institutions, and the ultra-wealthy, who had “investible wealth.” However, those programs failed to boost the bottom 90% of Americans living paycheck-to-paycheck.

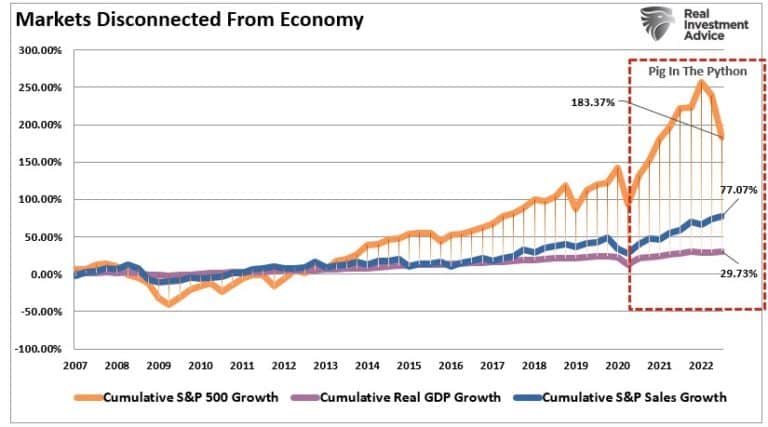

The failure of the flush of liquidity to translate into economic growth can be seen in the chart below. While the stock market returned more than 180% since the 2007 peak, that increase in asset prices was more than 6x the growth in real GDP and 2.3x the growth in corporate revenue. (I have used SALES growth in the chart below as it is not as subject to manipulation.)

Since asset prices should reflect economic and revenue growth, the deviation is evidence of a more systemic problem. Of course, the problem comes when they try to reverse the process.

The Great Unwinding

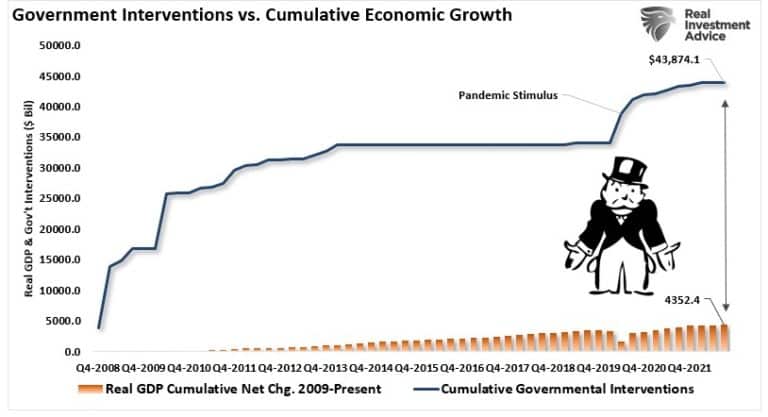

The chart below sums up the magnitude of the Fed’s current problem.

From bailing out Bear Stearns to HAMP, HARP, TARP, and a myriad of other Governmental bailouts, along with zero interest rates and a massive expansion of the Fed’s balance sheet, there was roughly $10 of monetary interventions for each $1 of economic growth.

Now, the Federal Reserve must figure out how to wean markets off of “life support” and return to organic growth. The consequence of the retraction of support should be obvious, as noted by Crooke.

“Perhaps the Fed can break the psychological dependency over time, but the task should not be underestimated. As one market strategist put it: ‘The new operating environment is entirely foreign to any investor alive today. So, we must un-anchor ourselves from a past that is ‘no longer’ – and proceed with open minds.’

This period of zero rates, zero inflation, and QE was a historical anomaly – utterly extraordinary. And it is ending (for better or worse).”

Logically, the end of Pavlov’s great “monetary experiment” can not end for the better. Once the paired stimulus gets removed from the market, forward returns must return to the basic math of economic growth plus inflation and dividends. Such was the basic math of returns from 1900 to 2008.

In a world where the Fed wants 2% inflation, economic growth should equate to 2%, and we can assume dividends remain at 2%. That math is simple:

2% GDP + 2% dividend – 2% inflation = 4% annualized returns.

Such is a far cry below the 12% returns generated over the last 12 years. But such will be the consequence of weaning the markets off years of monetary madness.

Of course, there is a positive outcome to this as well.

“If Jay Powell breaks the Fed put and takes away the unfair ability of private capital to rape and pillage the system, he will have finally addressed income inequality in America.” – Danielle DiMartino-Booth

The bottom line is that fixing the problem won’t be pain-free. Of course, breaking an addiction to any substance never is. The hope is that the withdrawal doesn’t kill the patient.