- Fed Chairman Powell, in his address to Congress this week, has confirmed that easing is coming

- In June, ECB President Draghi provided similar hints

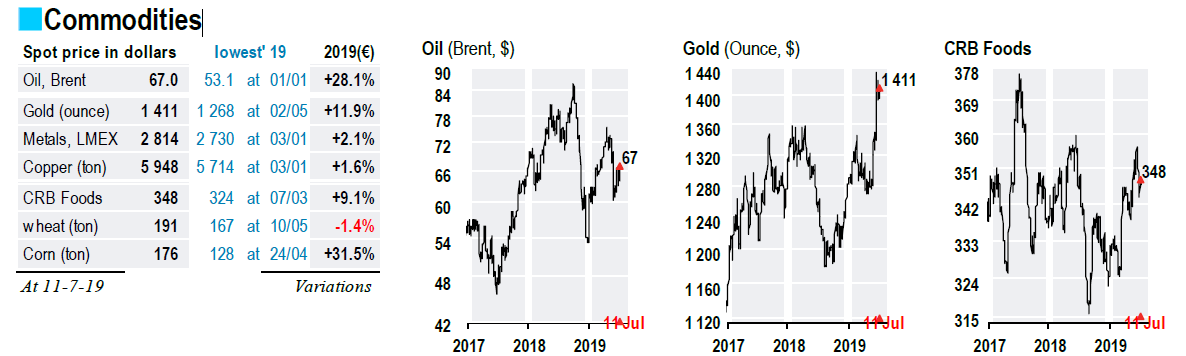

- This comes on the back of growing concerns regarding global growth and ultimately facing too low a level of inflation

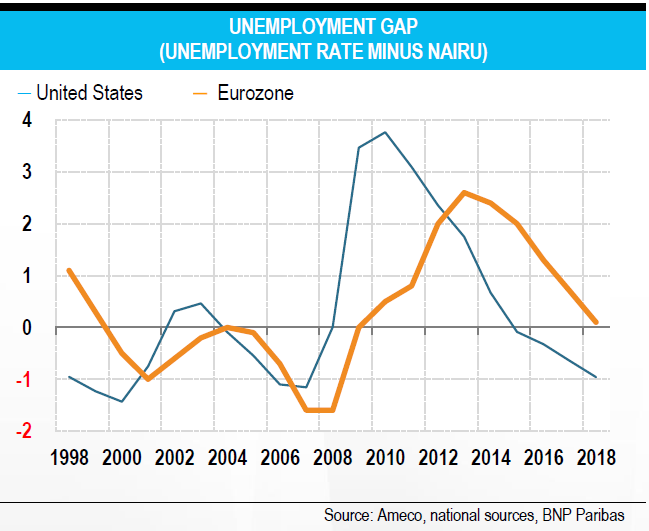

- Risks may be mounting, but, on the other hand, the unemployment rate is close to the natural rate

- There are reasons to assume that monetary easing under full employment would be less effective than when the economy is marred in recession. Monetary easing could also raise concerns about financial stability, which, if unaddressed, could weigh on the ability of monetary policy to successfully boost inflation.

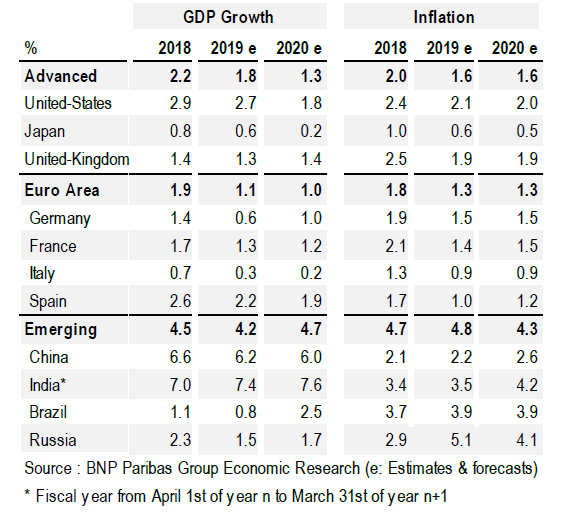

- Growth picked-up by early 19 but this was partly due to one-off factors (inventories). The trend in private domestic demand is more subdued. The housing market is softening, corporate investment should slow, as well as exports. Core inflation remains well under control and has eased a bit.

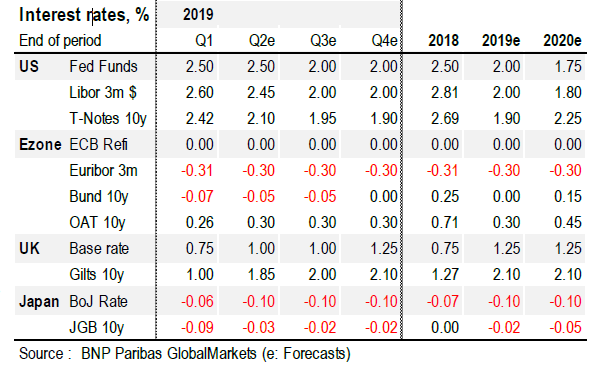

- Regarding the more cautious message delivered by the Fed’s president. J. Powell (about trade tensions), we believe the Fed Funds target rate will be cut by 2 quarter points in Q3, coming back to 1.75-2%

- Economic growth continues to slow. Activity rebounded in March 2019 but weakened again afterwards. The recent flare-up in trade tensions with the US has again darkened export prospects.

- The central bank is easing liquidity and credit conditions, though the reduction in financial-instability risks via regulatory tightening should remain a priority. Fiscal policy has also turned expansionary through increased infrastructure spending and a rising number of household/corporate tax cuts.

- In the short term, exports and private domestic investment should continue to decelerate. Tax measures should support consumer spending.

- Despite a stronger than expected growth in the 1st quarter of 2019, the economic slowdown is continuing in the eurozone, especially in Germany, due to international environment uncertainties and a slowdown of exports to China.

- Capacity constraints also play a role and activity in the manufacturing sector continues to decline.

- Inflation is now expected to decrease while core CPI is hardly moving. The activity slowdown also implies that the pick-up in core inflation should be slower than expected until recently.

- Monetary policy remains cautious and proactive, the ECB announcing the launch of another round of longer-term refinancing operations (TLTRO) for eurozone banks.

- Growth is slowing although the economy should show some resilience.

- Households’ consumption should get a boost from the tax cuts and the jobs recovery but inflation reduces purchasing power gains. Business investment dynamics remain favourable. The global backdrop is less supportive. A slight rise in core inflation is appearing but remains to be confirmed.

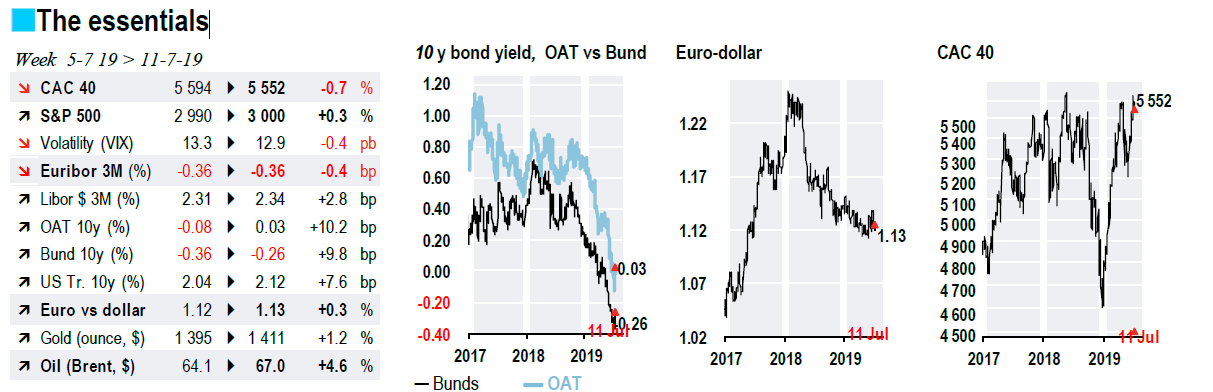

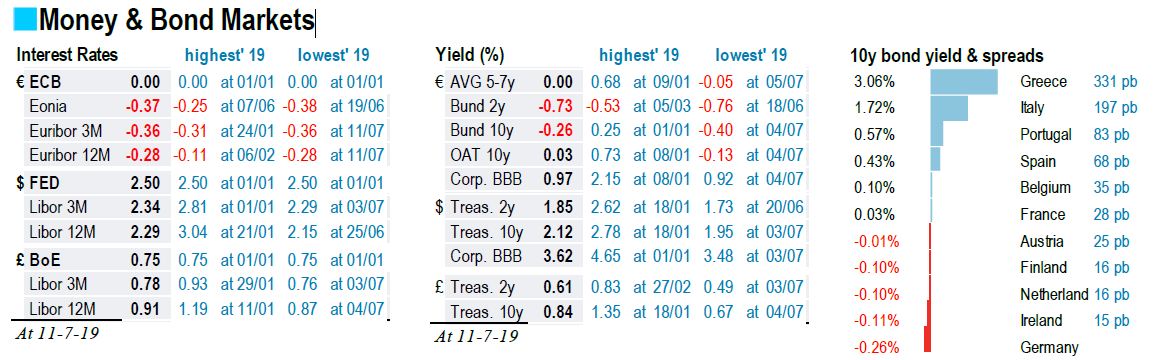

- In the US, we expect the Fed to cut rates twice in the second semester in reaction to a slowing economy, subdued inflation and heightened uncertainty. Bond markets are already pricing in rate cuts, which is why we expect that the decline of the 10 year treasury yield will only be moderate.

- The combination of slower growth and subdued core inflation leads us to expect that ECB official rates will remain unchanged this year and next. 10 year Bund yields are expected to rise only marginally to 0.00% by the end of this year. We forecast a yield of 0.15% by the end of 2020.

- No change expected in Japan.

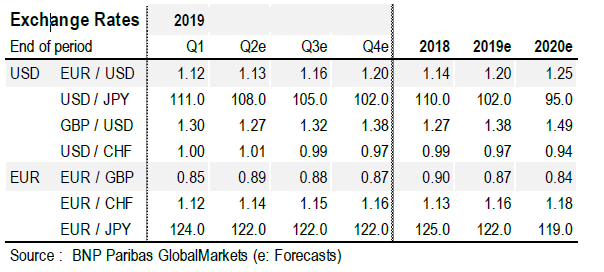

- We expect the euro to strengthen versus the dollar considering that the latter is expensive on valuation grounds and that the Fed will ease its policy

Speaking in Sintra last month, Mario Draghi has hinted at an easing of monetary policy: inflation is too low compared to target, which is an issue, all the more so considering that risks to growth are tilted to the downside. Jerome Powell, in his testimony to Congress this week, has done the same: uncertainties about trade tensions and concerns about global economic prospects weigh on the outlook for the US and could lead—on a more enduring basis—to weaker than expected inflation. Yet, the prevailing level of activity compared to potential remains high: in the US, the unemployment gap (the difference between the unemployment and NAIRU, the non-accelerating inflation rate of unemployment) is negative and in the eurozone unemployment is in line with NAIRU. This complicates one’s assessment of the likely ramifications associated with a new cycle of monetary easing.

Traditionally, policy accommodation starts when an economy slows down significantly. It tends (i) to gather pace during a recession and (ii) to continue well into a recovery, until it becomes clear that the economy is capable of “standing on its own two feet“ so to speak. During these phases, several stylised facts can be observed: mounting recession fears cause a decline in equity markets and a rise in corporate bond yields. It also makes access to financing, both via capital markets and banks, more difficult. Inevitably, confidence and activity both drop. Interest rate cuts then seek to restore confidence which in turn boosts risk appetite. Subsequently, equity and corporate bond markets rebound and access to credit improves. Growth ultimately picks up, signalling the start of a recovery.

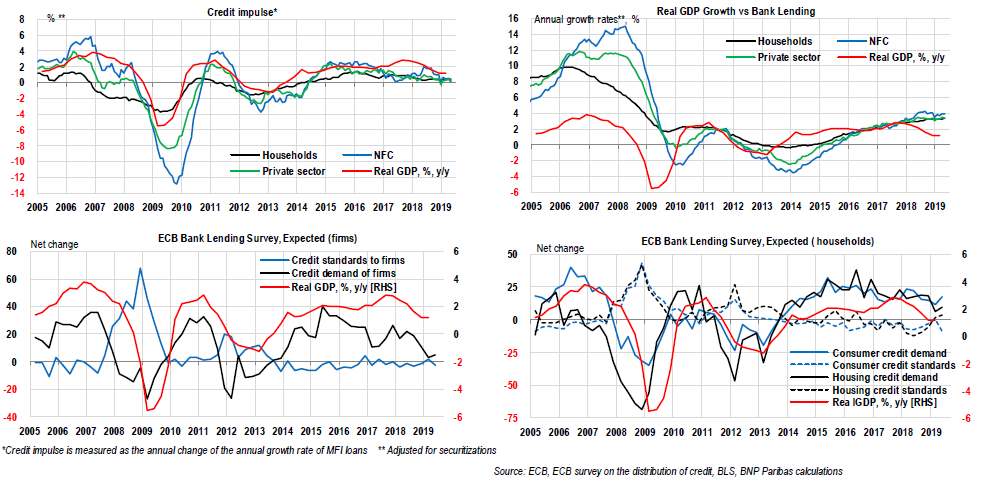

At the current juncture, these transmission channels will likely be less strong, which would imply less of a boost to growth and inflation: equity indices are at a high level, corporate bond spreads are rather tight, bank lending surveys point towards a normal credit environment. When liquidity is abundant, adding more of it will have less of an effect on the real economy than if access to credit is severely constrained, like in a recession. Clearly, the prospect of more easing has supported the stock market (the S&P500 has set a new record) and the property market should benefit from ever lower interest rates.

However, easing policy in a full employment economy so as to chase the inflation target, raises questions about financial stability. The recently published annual report of the Bank for International Settlements summarises the dilemma very neatly: “the price stability mandate sets the stage. This naturally induces central banks to maintain policy accommodation, or to ease further, when inflation is below target, even when the economy appears to be close to estimates of potential.” 1 But “it constrains the policy options when such a policy could have unwelcome effects on the financial side of the economy longer-term, such as by encouraging excessive risktaking.” The latest Financial Stability Review of the ECB 2 makes similar points. Although household indebtedness has stabilised for the euro area as a whole at 58% of GDP, which is slightly below the debt overhang threshold, it remains a source of concern in certain areas. Moreover, “in some countries, the combination of house price rises and strong new lending and/or household indebtedness warrants closer monitoring”, although “macroprudential policy actions, such as extra capital buffer requirements or controls on loosening borrower terms, can help mitigate possible risks to financial stability at the country level.” This means that, at least in certain countries and sectors, tighter macroprudential rules might very well neutralise the impact of more policy easing, thereby complicating the convergence of inflation to the ECB’s target.

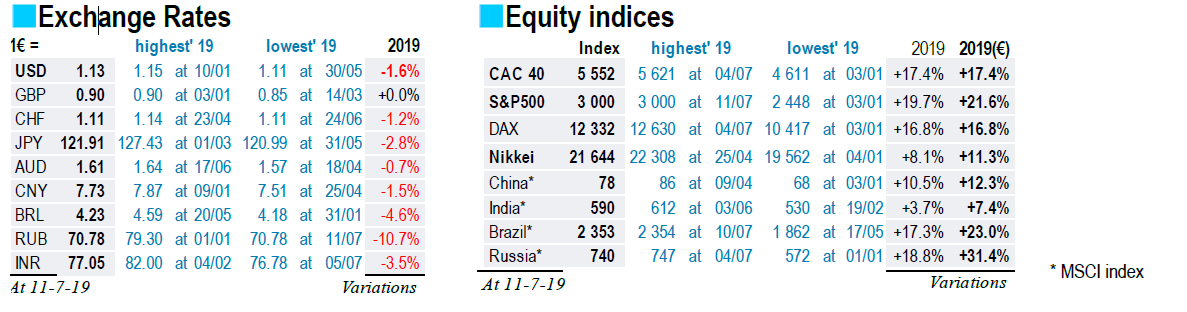

Markets overview

Pulse

Eurozone: Credit pulse

The credit impulse picked up very slightly in May 2019 in the euro area for households whereas it declined for non-financial corporations. The annual growth of loans to private non-financial sector stabilized at around 3.3%. Demand for credit is expected to rise in the third quarter of 2019 across all loan categories, stimulated by the easing of financing conditions, except for home loans, for which lending conditions are expected to tighten slightly.

Indicators preview

Next week, China's second quarter GDP numbers will be eagerly awaited considering the signs of further slowdown in recent data. The US will publish regional business surveys (Empire State, Philadelphia) as well as University of Michigan sentiment which will provide an early glimpse for July. Several data on the housing activity and market (NAHB index, permits, starts), retail sales and industrial activity will improve our reading of how the US has been doing in June. In this respect, the Beige Book of the Fed is also particularly interesting when looking for comments on how companies assess the impact of tariffs increases and the uncertainty on that matter. In the eurozone, we will have data on trade, inflation and car registrations.

Economic scenario

UNITED STATES

CHINA

EUROZONE

FRANCE

INTEREST RATES AND FX RATES

By William DE VIJLDER